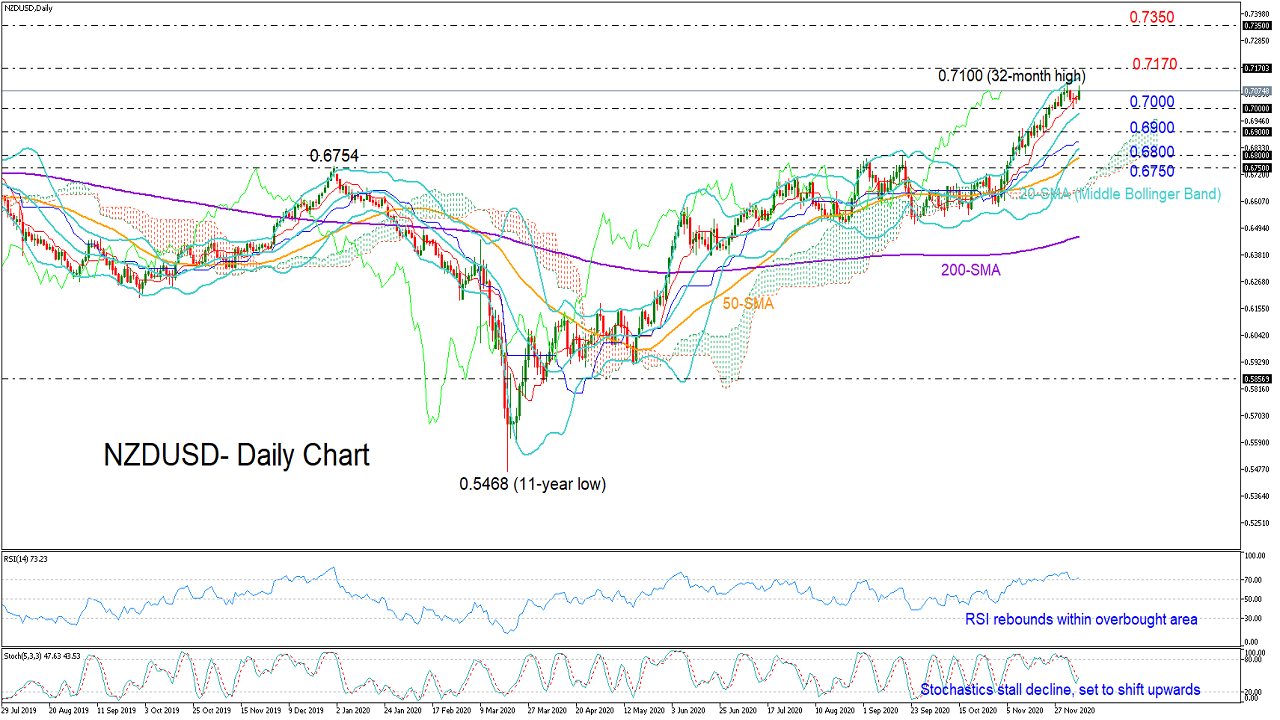

NZDUSD pivoted higher early on Wednesday and towards its 32-month top of 0.7100, refusing to abandon the 0.7000 area for the time being.

NZDUSD pivoted higher early on Wednesday and towards its 32-month top of 0.7100, refusing to abandon the 0.7000 area for the time being.

The RSI is also reluctant to exit the overbought zone, suggesting that although the market remains vulnerable to downside corrections, there is still some bullish fuel left in the tank. The upside reversal in the fast-stochastics and the fact that the price continues to fluctuate within the upper Bollinger area is also keeping the short-term bias tilted to the upside.

In the bigger picture, the upward trajectory from the 11-year low 0.5468 is well established and clearly supported by the bullish intersection of the 20- and 50-day simple moving averages (SMAs). Note that the golden cross between the 50- and 200-day SMAs is also valid.

Should the pair sustain strength above 0.7080, the uptrend could mark a new higher high around 0.7170. Beyond that, the rally may next stabilize around the key resistance area of 0.7350.

If positive momentum fades sooner than expected, traders could look for immediate support somewhere between the 0.7000 number and the 20-day SMA, which is also the middle Bollinger band. Another step lower may bring the 0.6900 level into view before a more crucial battle takes place within the 0.6800 and 0.6750 borders. A decisive close below the latter would signal the end of the current bullish phase, switching the outlook back to neutral.

Summarizing, although there is limited space for gains in the short run, NZDUSD could seek fresh highs potentially around 0.7170.

Origin: XM