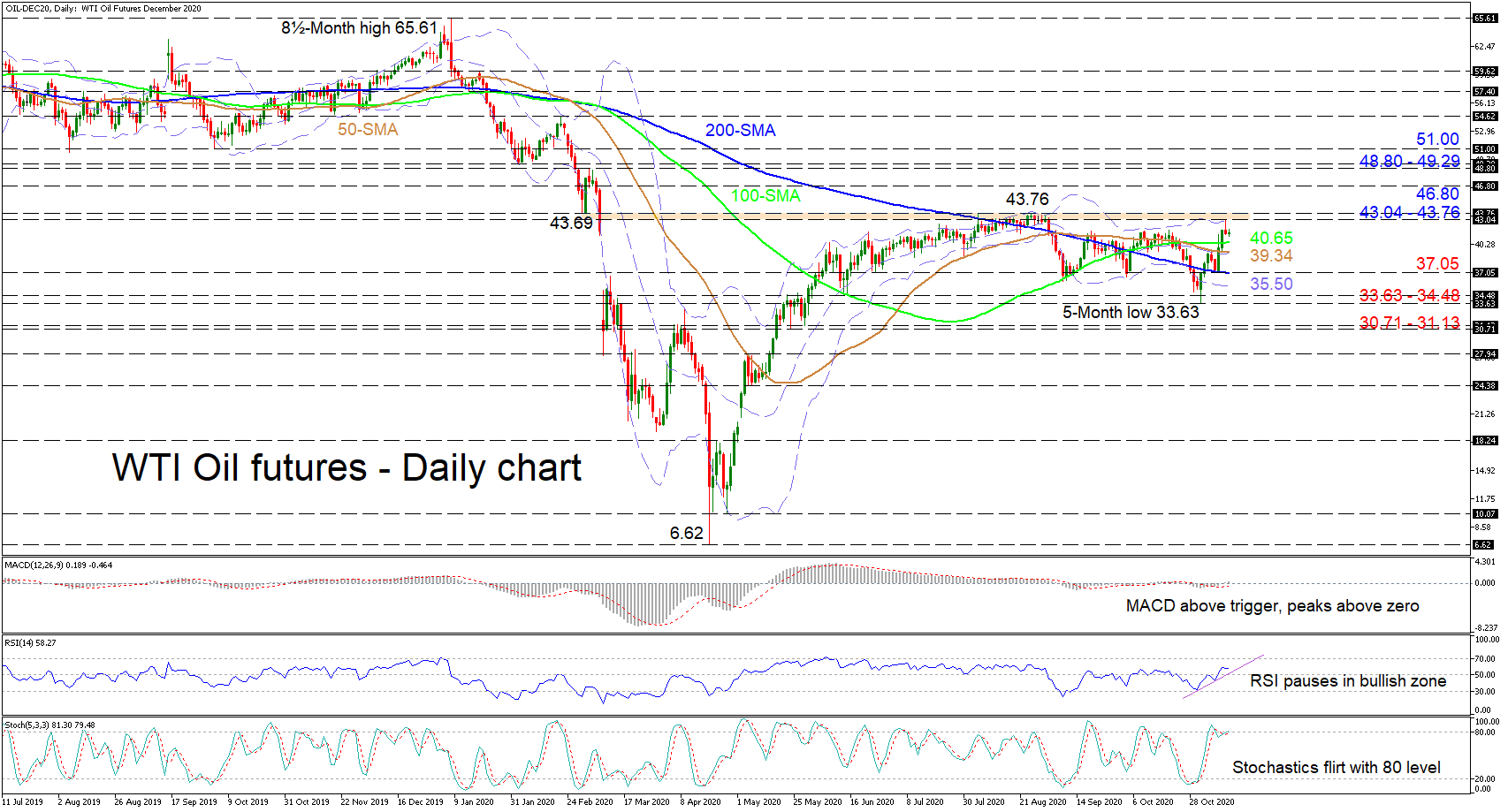

WTI oil futures appear to have returned to the vicinity of the controlling resistance levels of 43.69 and 43.76, which have together been suppressing advances for 4 months now. The commodity’s return above the simple moving averages (SMAs), from the 33.63 low, deflected off the upper Bollinger band at 43.04, just shy of the curbing level.

WTI oil futures appear to have returned to the vicinity of the controlling resistance levels of 43.69 and 43.76, which have together been suppressing advances for 4 months now. The commodity’s return above the simple moving averages (SMAs), from the 33.63 low, deflected off the upper Bollinger band at 43.04, just shy of the curbing level.

The short-term oscillators are tilting ever so slightly towards the positive picture. The MACD above its red trigger line has narrowly pierced above its neutral line, while the RSI is hovering in the bullish territory. Currently, the stochastic lines are flirting with the 80 threshold, and have yet to signal negative inclinations, with the %K line poking above 80. Nonetheless, given the price’s current location, a pullback cannot be ruled out. The Bollinger bands and directionless and flattening 50- and 100-day SMAs all continue backing the ranging structure.

To the upside, early reinforced limitations may originate from the resistance section of 43.04-43.76, where the upper Bollinger band also resides. Should this border fail to block gains from unfolding, the price may jump towards the 46.80 barrier before hitting the resistance band of 48.80-49.29. Surpassing this too, buyers may then turn their focus towards the 51.00 handle.

Steering down, initial support may develop from the 100-day SMA at 40.65 and the 50-day SMA at 39.34, merged with the mid-Bollinger band. Slipping further, the 37.05 low coupled with the 200-day SMA may attempt to redirect negative moves. However, failing to halt further fading in price may send the commodity towards the lower Bollinger band at 35.50, before aiming for the support region of 33.63-34.48. Persistent selling could then target the 30.71-31.13 support belt.

Summarizing, oil continues to command a neutral bias in the short-to-medium picture, curbed by the 43.76 ceiling and the 33.63 trough.

Origin: XM