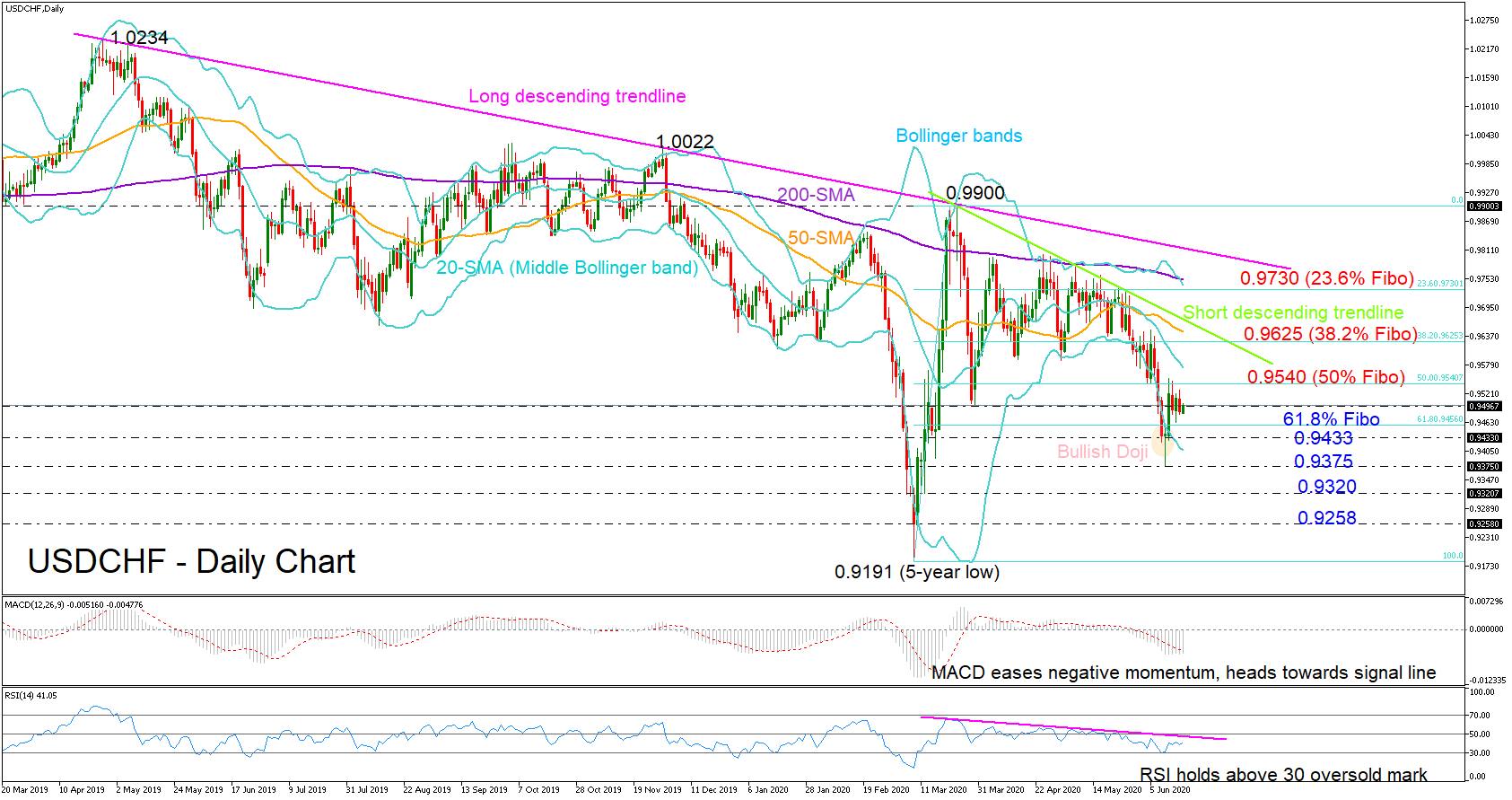

USDCHF has been consolidating inside the 0.9433-0.9550 area over the past week, not far from the 50% and 61.8% Fibonacci retracement levels of the upleg with a low at 0.9191 and a top at 0.9900.

USDCHF has been consolidating inside the 0.9433-0.9550 area over the past week, not far from the 50% and 61.8% Fibonacci retracement levels of the upleg with a low at 0.9191 and a top at 0.9900.

With the MACD easing negative momentum in the bearish area and the flat RSI refusing to return to its 30 oversold mark, the pair could see a more encouraging course in the short-term. Note that a long-legged bullish doji has been created below the lower Bollinger band before last week’s rebound, increasing optimism that the pair could change direction to the upside.

A correction higher should pierce the 50% Fibonacci of 0.9540 and more importantly the 20-day simple moving average (SMA) to see further extension towards the 38.2% Fibonacci of 0.9625. However, only a decisive close above the short-term downward-sloping trendline currently around 0.9660 could prove a more meaningful achievement, eliminating bearish risks and boosting the price towards the 23.6% Fibonacci of 0.9730 and the 200-day SMA. A longer-term descending trendline could be another key resistance on the way up.

In the negative scenario where the pair retreats below 0.9433, the bears could push for a close beneath last week’s trough of 0.9375. If they succeed, the next stop could be near 0.9320, a break of which could subsequently bring the 0.9258 support area into focus.

Summarizing, the bearish short-term bias in USDCHF seems to be weakening. A close above 0.9540 could signal additional positive moves, whereas a drop below 0.9433 may add more pressure to the market.

Origin: XM