Tepid recovery in stock markets

Tepid recovery in stock markets

After a sharp two-day sell-off on Wall Street, it was a relatively calmer start to the day on Thursday with Asian shares looking mixed and US and European stock futures turning green. Last week’s bear market rally came to an abrupt end as investors found it difficult to ignore the ever-gloomier virus headlines. Even President Trump has been sounding a more sombre tone lately and on Tuesday, he bluntly warned Americans that the next two weeks will be “very tough”.

Market anxiety was heightened this week from a surge in the number of COVID-19 infections in the United States, which passed 200,000 cases yesterday. But while it may be difficult to see light at the end of the tunnel just yet, there are tentative signs that the spread may be slowing in some European hotspots such as Italy.

This was enough to brighten the mood slightly today, lifting risk assets and weighing on safe havens, though gold still managed to edge higher, highlighting the extreme cautiousness in the markets.

Until investors are able to put a price on the final cost of the economic impact from the virus pandemic, any predictions of where the bottom is for stocks will be deemed premature. Companies have been pulling their guidance rather than revising them, underscoring the level of uncertainty about the current situation, while many banks have been forced to scrap their dividend payouts.

Dollar softer ahead of US jobless claims

The improved risk tone dragged on the US dollar today, with its index off by 0.25% in early European trading. Against the yen, the greenback was marginally higher as the Japanese currency – also a safe haven – weakened versus most of its peers.

The euro, which has been underperforming this week, remained in the red, slipping to $1.0930, amid doubts as to whether EU leaders will be able to agree on a substantial support package to help virus-stricken Eurozone economies survive the crisis.

In contrast, the pound was looking perkier, climbing back above the $1.24 level, while the Australian and New Zealand dollars also rallied to gain 0.6% and 0.9% respectively.

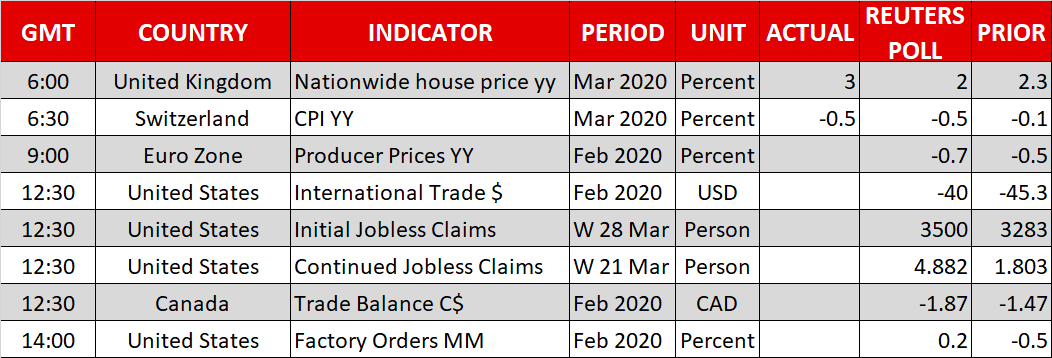

However, the positive mood may not hold for long if the latest jobless numbers out of the United States later today show another jump in weekly unemployment claims. Last week, jobless claims hit a record 3.3 million and are forecast to rise by a further 3.5 million today as the scale of the lockdown in the US expanded in late March.

Weekly jobless claims have been stealing the limelight from other data recently as they are seen more up to date and relevant during the virus crisis. It explains why there was little reaction to yesterday’s better-than-expected ISM manufacturing PMI and Friday’s nonfarm payrolls report might similarly not attract as much attention.

Oil rallies on hopes of Saudi-Russia deal

Oil was the big gainer on Thursday amid signs that Russia and Saudi Arabia are on talking terms again, with the help of President Trump. WTI and Brent Crude surged by around 9% on growing hopes that the two major producers will be able to resolve their dispute and end the price war that is crippling the global energy industry at a time when demand has plummeted due to the pandemic.

While any agreement to return production to where it was before the collapse of the OPEC/non-OPEC pact is unlikely to fully restore prices to previous levels, it should at least ease some of the pain for smaller producers, as well as remove the threat of deflation for central banks.

In another boost for oil, China has reportedly started buying the commodity to fill up its state reserves, taking advantage of the slump in prices.

Origin: XM