- Early April saw the EUR/USD pair breach a resistance zone near 1.07, initiating an upward trend.

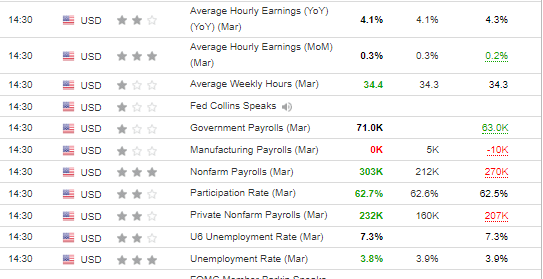

- Despite robust US labor market data last Friday, bullish momentum persisted, driving the local uptrend in the currency pair.

- Market focus now shifts to upcoming inflation data and the ECB decision, and the pair could test that level depending on the data.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool.

Last week, the EUR/USD pair broke through a crucial demand zone around the 1.07 price level, igniting the current upward trend.

Despite strong US labor market data released on Friday, the bulls continued to dominate, sustaining the local uptrend.

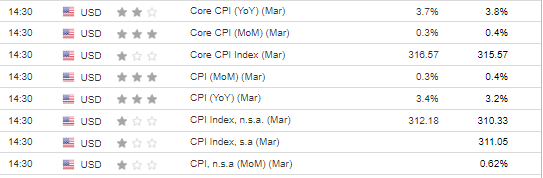

Now, the future of the currency pair hinges largely on upcoming inflation data released on Wednesday, as well as the European Central Bank’s monetary policy decision.

Meanwhile, recent robust economic indicators from the US have sparked speculation about the possibility of no interest rate cuts from the Federal Reserve this year.

Following the initial market reaction that boosted the US dollar, aligning with the overall data trend, Monday’s session saw most of the EUR/USD’s declines reversed.

It appears that the market is eagerly anticipating Wednesday’s data on inflation, which will significantly impact the short and medium-term exchange rate of the main currency pair.

Initial forecasts predict a slight rise in consumer inflation to 3.4% year-on-year. If inflation exceeds expectations, it could lead to renewed pressure on prices, potentially breaking the tested support around 1.07.

Fed Hawks Circling

Despite expectations of unchanged interest rates at Thursday’s ECB meeting, the bank’s authorities will likely continue their narrative of monitoring and analyzing incoming data from the European economy.

At the start of the year, the market was highly certain that the Federal Reserve would pivot in just a few months, potentially even in March, due to ongoing disinflation and concerns about a significant economic slowdown.

However, as the first quarter has passed, the primary question now isn’t when the pivot will occur, but whether it will happen at all this year.

Presently, the market is estimating about a 50% chance of a Fed move in June, with expectations for three cuts in the subsequent months.

Nonetheless, given the trend of continually pushing back the likelihood of a pivot by several months, it’s plausible that the first quarter of 2025 could become a viable option.

Why might the Fed delay further? Firstly, there’s no pressure from the economy for rate cuts, as both GDP readings and labor market data show no significant signs of a recession.

Additionally, disinflation has notably slowed down. Hence, to avoid a scenario akin to the 1970s, the Federal Reserve is inclined to postpone the start of the cycle for as long as possible.

EUR/USD Defends 1.07 Support

The EUR/USD, having bounced back around 1.07, is now sitting around the midpoint of the range between 1.07 and 1.10. It seems likely that this situation will persist until tomorrow’s inflation data is released.

The previously mentioned levels now serve as the main support and resistance areas, depending on whether we witness a positive or negative scenario.

If there’s a negative surprise, and it aligns with the Fed’s hawkish rhetoric, it will potentially prompt the EUR/USD to decline again.