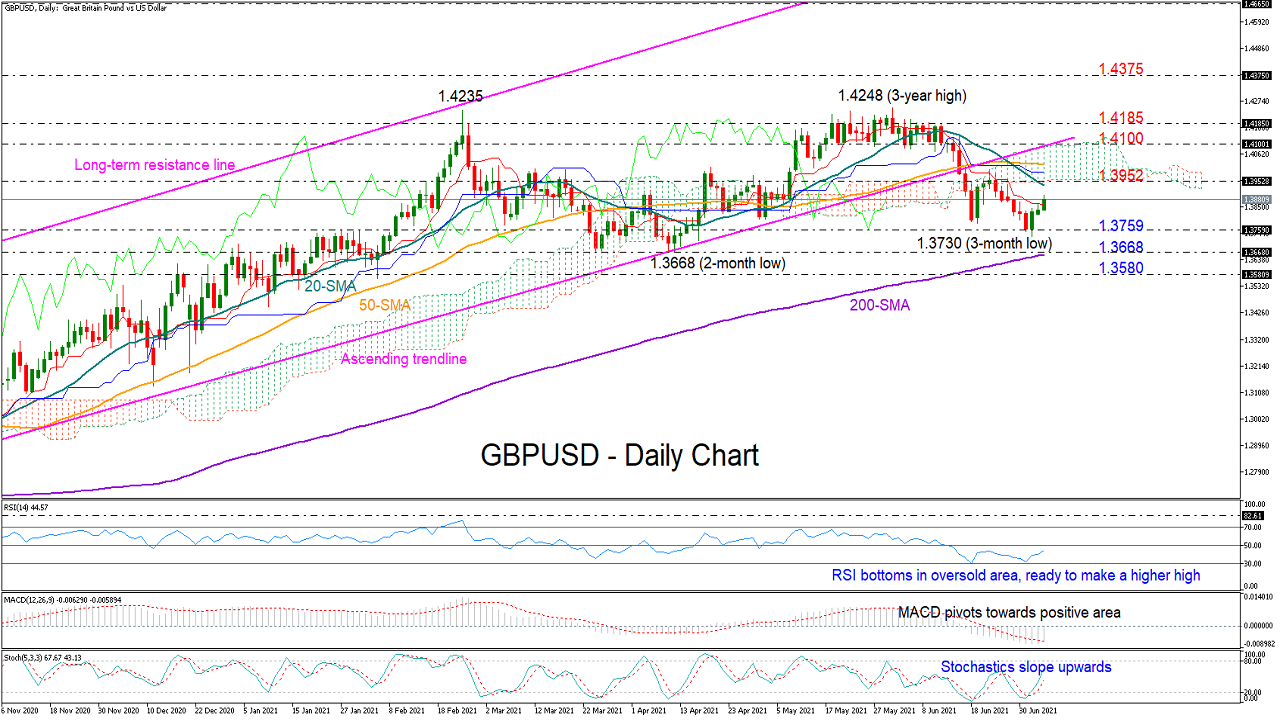

GBPUSD is gaining momentum within the 1.3800 area and above the red Tenkan-sen line, which kept the bulls under control over the past few weeks, marking its third consecutive green day.

GBPUSD is gaining momentum within the 1.3800 area and above the red Tenkan-sen line, which kept the bulls under control over the past few weeks, marking its third consecutive green day.

The technical indicators endorse the ramping positive traction in the price. The RSI has bottomed in the oversold area and is set to print a new higher high, while the Stochastics is also making its way above its 20 oversold level. Adding to the encouraging signals is the MACD, which is pivoting towards the positive zone.

However, whether the latest rebound is just a correction in the short-term downward path, which paused near an almost three-month low of 1.3730, remains to be seen. The resistance area around 1.3952, where the bottom of the Ichimoku cloud is currently located, could immediately cool any bullish attempts towards the broken ascending trendline seen at 1.4100. A decisive close above that line, and more importantly an extension beyond the 1.4185 barrier, will bring the long-term uptrend back into play. Then, a clear step above the crucial 1.4235 hurdle will be needed for an outlook upgrade towards the 2018 top of 1.4375.

In the bearish scenario, if the bulls fail to breach the 1.3952 level, the price may reverse to seek support near 1.3759. Additional declines from here could experience a tougher battle near the previous low of 1.3668 and around the 200-day simple moving average (SMA), a break of which could motivate fresh selling towards 1.3580.

Summarizing, GBPUSD may recoup some of its previous losses in the short term, though a steeper rally is required above the 1.4100 – 1.4185 area to resume its positive outlook.

Origin: XM