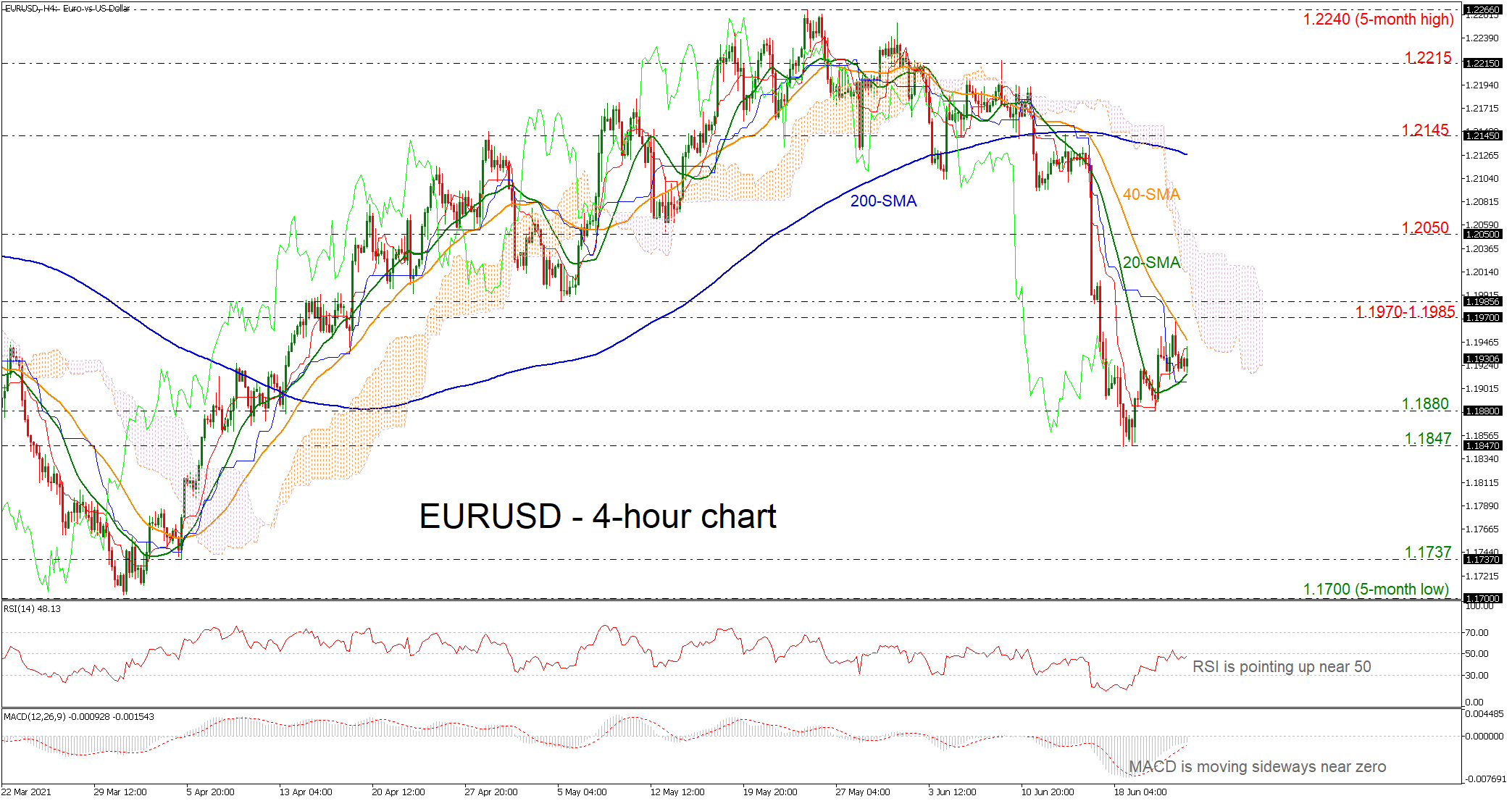

EURUSD has been in a bullish correction move over the last week after the sell-off from the five-month high of 1.2240. The pair is currently trading within the 20- and 40-period simple moving averages (SMAs) and the red Tenkan-sen line is standing above the blue Kijun-sen line, suggesting a bullish tendency in the 4-hour chart.

EURUSD has been in a bullish correction move over the last week after the sell-off from the five-month high of 1.2240. The pair is currently trading within the 20- and 40-period simple moving averages (SMAs) and the red Tenkan-sen line is standing above the blue Kijun-sen line, suggesting a bullish tendency in the 4-hour chart.

If the market rises over the 40-period SMA, it might reach the 1.1970-1.1985 resistance area before hitting the 1.2050 barrier. The 200-period SMA at 1.2127, which is much higher, could block the bullish surge ahead of 1.2145.

Otherwise, a decline below the 20-period SMA might lead to a test of the 1.1880 support and the 1.1847 hurdle, both of which were taken from the June 18 bottom. More bearish pressure might push the price to 1.1737 and the psychological level of 1.1700.

To sum up, EURUSD is bullish in the very short-term, and a jump above the 200-period SMA may switch the medium-term bias to positive as well.

Origin: XM