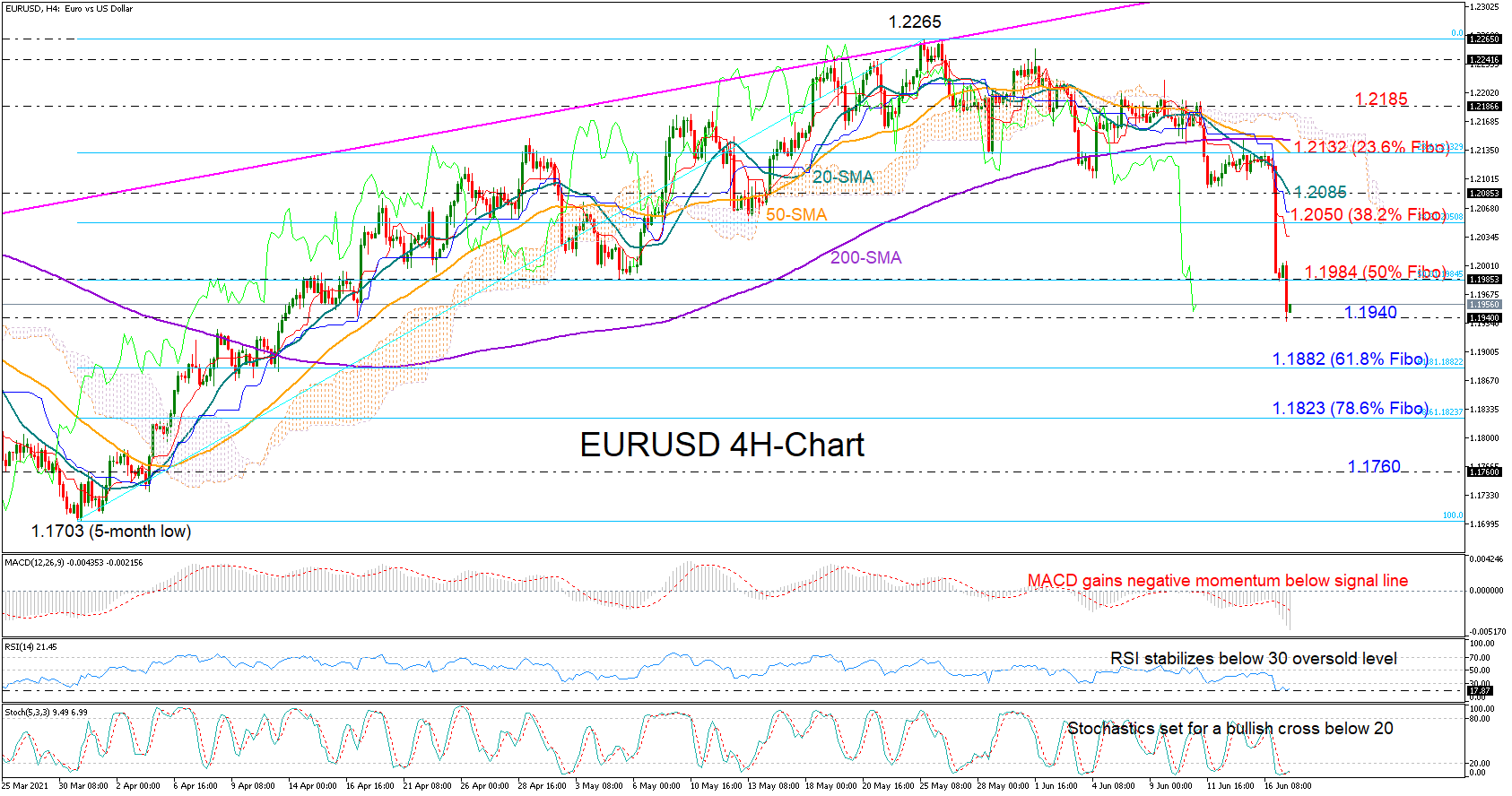

EURUSD was one of the biggest victims of the hawkish FOMC policy announcement, with the price collapsing by more than 1.30% below May’s lows in the aftermath and extending its freefall lower to 1.1940 on Friday.

EURUSD was one of the biggest victims of the hawkish FOMC policy announcement, with the price collapsing by more than 1.30% below May’s lows in the aftermath and extending its freefall lower to 1.1940 on Friday.

An upside reversal would not be a big surprise in the near term in the four-hour chart given the RSI’s deep downfall inside the oversold area. The Stochastics also look set for a bullish cross in the oversold territory, though neither of those indicators have showed a convincing upturn yet. Hence, the basic scenario is for the sellers to dominate in the short term.

Nevertheless, a decisive close below the 1.1940 restrictive area is required to pressure the price towards the 61.8% Fibonacci retracement of the 1.1703 – 1.2265 upleg at 1.1882. Slightly lower, the 78.6% Fibonacci of 1.1823 may also attract attention before the way clears towards the 1.1760 -1.1703 zone.

Alternatively, the pair will need a solid foundation to recover the FOMC damage. The 50% and 38.2% Fibonacci levels could adopt a resistance role at 1.1984 and 1.2050 respectively, while not far above, the 20-period simple moving average (SMA) could negate any bullish movements towards the crucial barrier around the 23.6% Fibonacci of 1.2132. Note that the 50- and 200-period SMAs are also in the neighborhood.

Summarizing, EURUSD is looking bearish but oversold in the short-term picture. A sustainable move below 1.1940 is expected to trigger the next bearish round.

Origin: XM