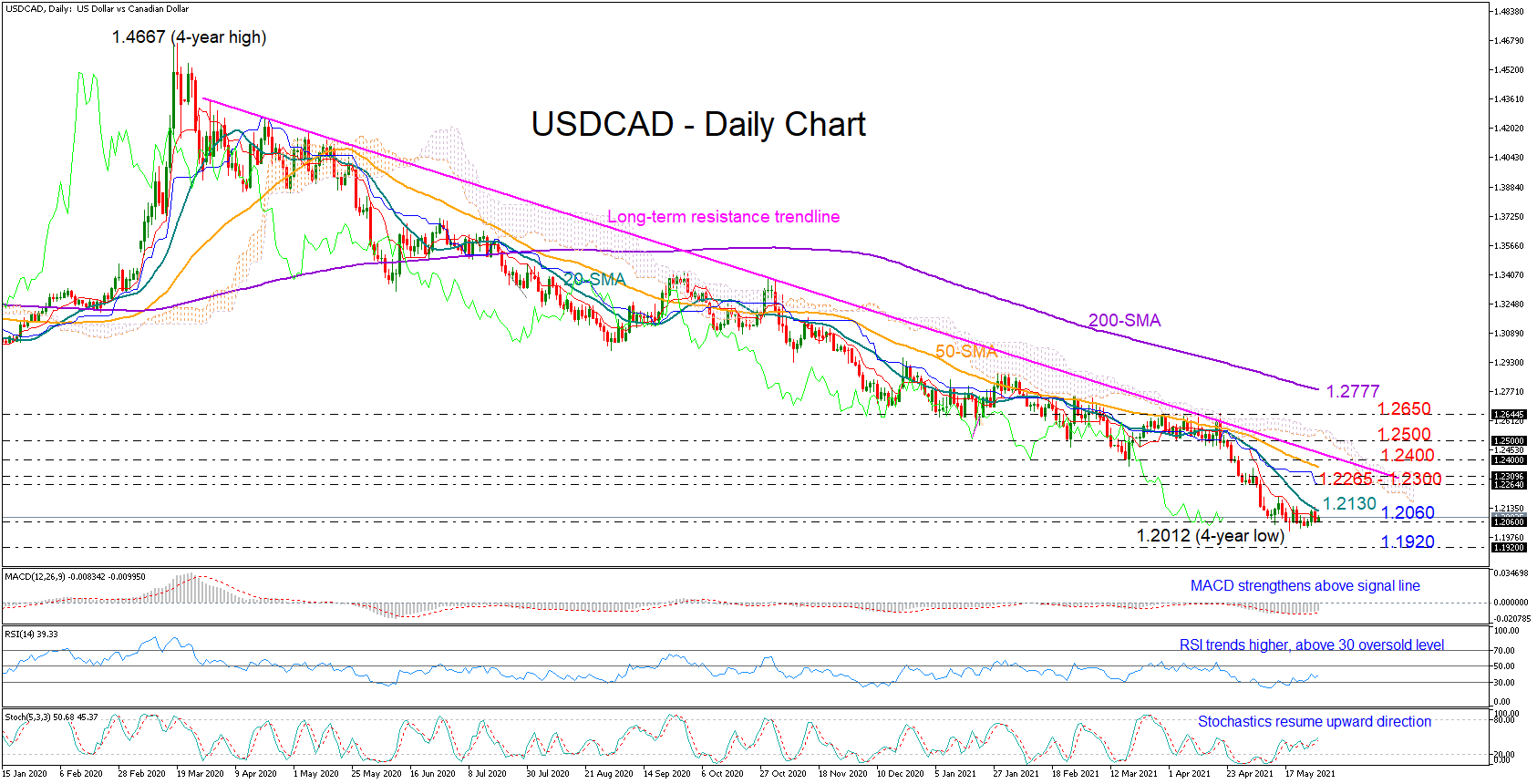

USDCAD extended its consolidation phase around the crucial 2017 low of 1.2060 for the third consecutive week, increasing speculation that the bears are losing the fight and the bulls could soon take charge.

USDCAD extended its consolidation phase around the crucial 2017 low of 1.2060 for the third consecutive week, increasing speculation that the bears are losing the fight and the bulls could soon take charge.

Indeed, the positive slope in the RSI and the Stochastics, which are sailing away from oversold waters, and the upside reversal in the MACD suggest that downside risks are fading. Still, the 20-day simple moving average (SMA) appeared quite restrictive over the past two days and unless it gives way, the bears could dominate, risking another negative extension towards the 1.1920 level taken from the low of February 2015. A steeper decline could also open the door for the 1.1800 support zone.

Nevertheless, if the bulls win the battle with the 20-day SMA currently around 1.2130, the price could accelerate towards the 1.2265 – 1.2300 congested area. Not far above, the long-term resistance trendline could be a tougher obstacle to overcome near 1.2400 and a game changer since any break higher from here, and preferably a sustainable move above the Ichimoku cloud and the 1.2500 mark, could question the strength in the broader downtrend, sparking an exciting rally towards the key 1.2650 resistance area. If the price prints a new higher high above 1.2650, the 200-day SMA currently at 1.2770 could be the next target.

In brief, although the broad picture remains bearish given the intact long-term downtrend drawn from the 1.4667 top, the lengthy range trading around the tough 1.2060 support level raises the odds for an upturn. Technically, however, a decisive close above the 20-day SMA is required for a new bullish wave to start.

Origin: XM