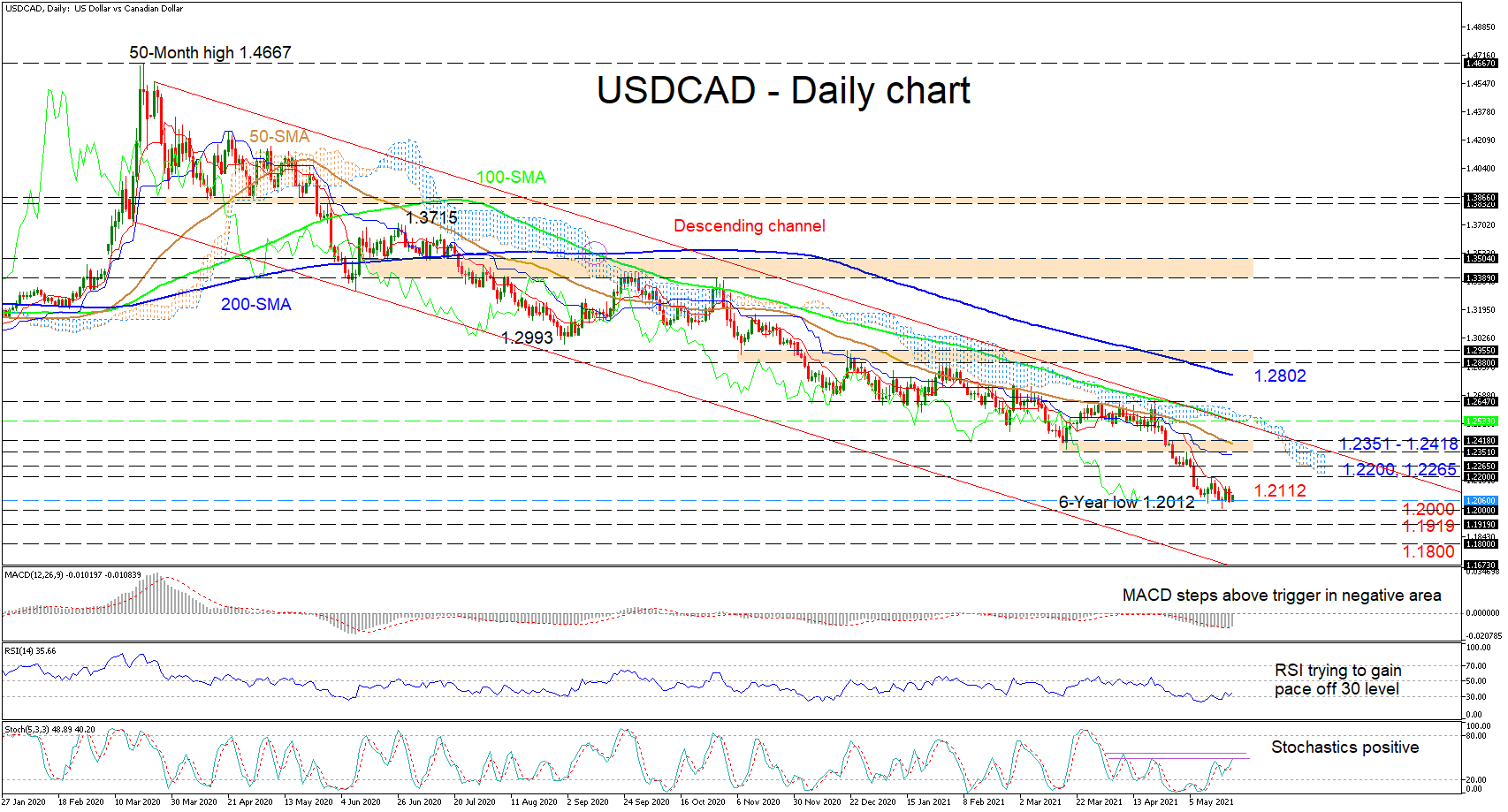

USDCAD is tiptoeing across the 1.2060 support barrier, related to the critical trough from back in September 2017, after the latest downfall ticked to a 6-year low of 1.2012. The sliding bearish simple moving averages (SMAs) are defending the negative structure, while the Ichimoku cloud continues to overshadow hopes of improvements in the pair.

USDCAD is tiptoeing across the 1.2060 support barrier, related to the critical trough from back in September 2017, after the latest downfall ticked to a 6-year low of 1.2012. The sliding bearish simple moving averages (SMAs) are defending the negative structure, while the Ichimoku cloud continues to overshadow hopes of improvements in the pair.

The current snapshot of the flattening Ichimoku lines is implying that negative momentum is taking a breather. This is also being expressed in the short-term technical indicators, which are conveying a marginal growth in buying interest. The MACD is improving past its red trigger line in the negative region, while the RSI is attempting to mould some footing off the 30 level. The positively charged stochastic oscillator is further endorsing this premise but has yet to clear the nearby resistances.

If the pair continues to respect the formed floor of 1.2060, immediate upside friction could arise from the red Tenkan-sen line at 1.2112 ahead of the 1.2200 handle, followed by the resistance border of 1.2265, linked to the February 2018 trough. Creeping higher, failure by buyers to conquer the key resistance section of 1.2351-1.2418, which is reinforced by the cloud and the bearish channel’s upper boundary, could give credence to the channel’s rule.

Should adherence to the 1.2060 level begin to evaporate, support may originate from the 6-year low at 1.2012 before the psychological hurdle of 1.2000, attempts to contest additional loss of ground in the pair. However, if the price deteriorates beyond the 1.2000 mark, durable support could develop at the 1.1919 trough, identified back in May 2015. Directing even lower, sellers may then meet the 1.1800 obstacle, in-line with the low reached in January 2015.

Concluding, USDCAD remains heavy within the commanding descending channel and appears incapable of countering negative pressures.

Origin: XM