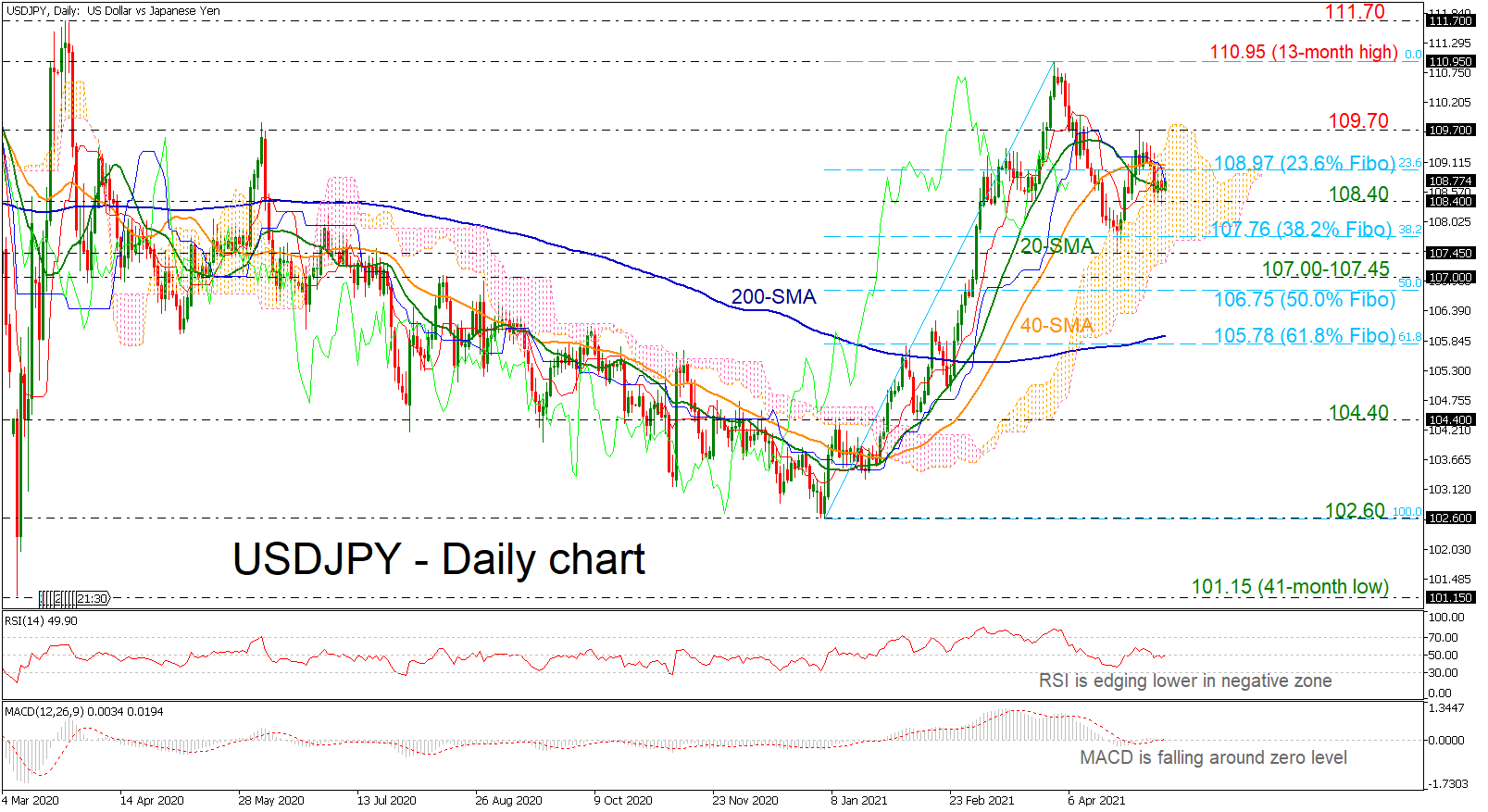

USDJPY has reversed back down again after finding resistance at the 109.70 barrier achieved on April 30. Momentum indicators are pointing to a neutral to negative bias in the short term with the RSI just below 50 and the MACD oscillator is flattening near the zero level.

USDJPY has reversed back down again after finding resistance at the 109.70 barrier achieved on April 30. Momentum indicators are pointing to a neutral to negative bias in the short term with the RSI just below 50 and the MACD oscillator is flattening near the zero level.

Further losses should see the 108.40 mark, inside the Ichimoku cloud, acting as major support. A drop lower would reinforce the bearish structure in the short-term and open the way towards the next key support of the 38.2% Fibonacci retracement level of the upward move from 102.60 to 110.95 at 107.76.

In the event of an upside reversal, the 23.6% Fibonacci at 108.97 could act as a barrier before being able to re-challenge the 109.70 hurdle. A break above this line would shift the short-term outlook to a more neutral one as it would take the pair at the 13-month high of 110.95. Further gains would lead the way towards 111.70, registered in March 20.

Overall, USDJPY needs to surpass the 111.00 handle to return into bullish mode. Currently, the price is creating a bearish correction in the near term.

Origin: XM