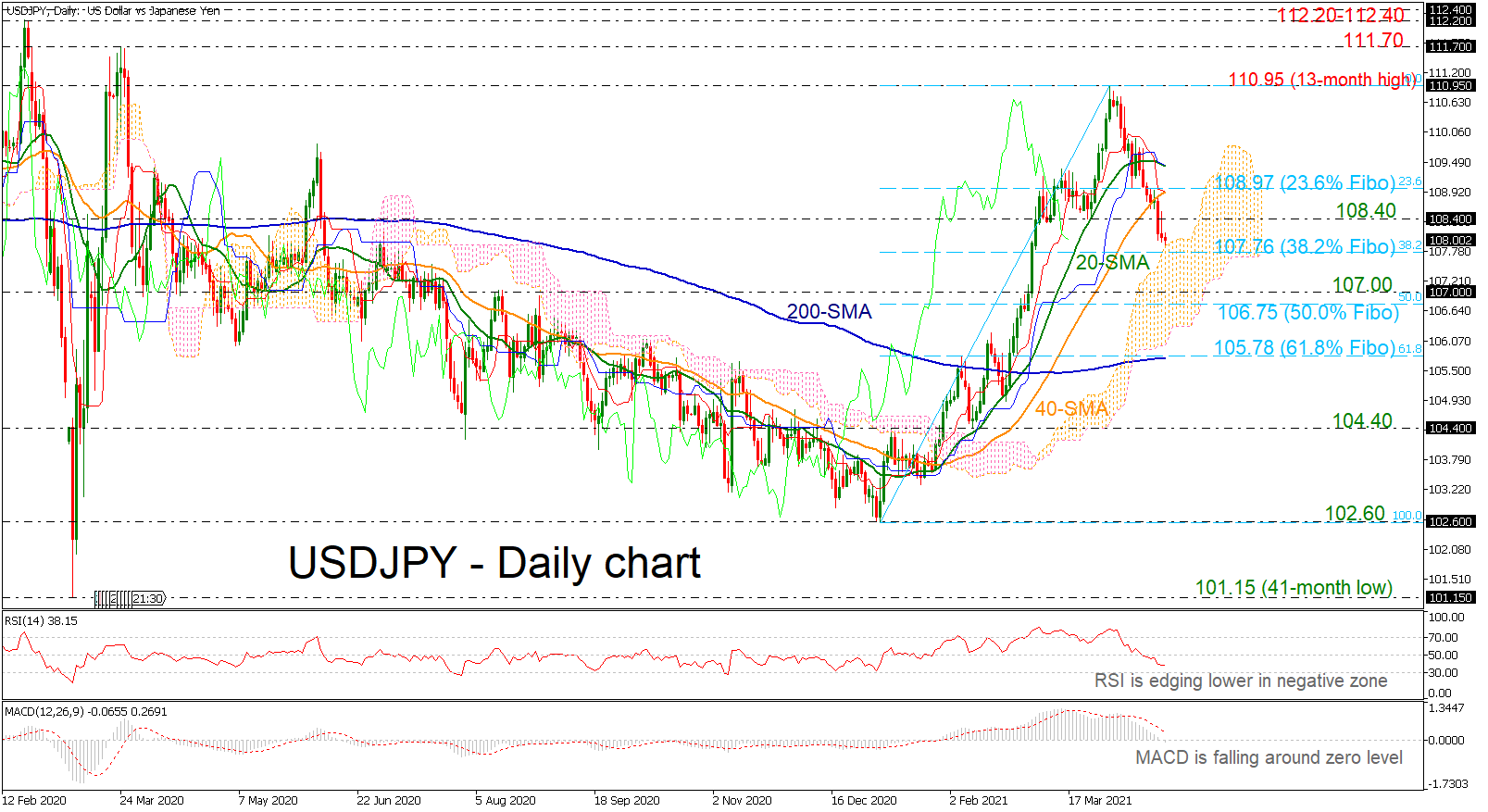

USDJPY is edging sharply lower, creating consecutive red days after the pullback from the 13-month high of 110.95. The price looks to be creating a bearish correction of the upward rally from 102.60.

USDJPY is edging sharply lower, creating consecutive red days after the pullback from the 13-month high of 110.95. The price looks to be creating a bearish correction of the upward rally from 102.60.

From the technical perspective, the RSI is retreating in the negative territory, while the MACD is weakening its momentum below its trigger line and near the zero level. The 20-day simple moving average (SMA) is turning lower, while the price is standing below the short-term SMAs.

Immediate support could come from the 38.2% Fibonacci retracement level of the upleg 102.60-110.95 at 107.76, inside the Ichimoku cloud. More losses could meet the 107.00 psychological level ahead of the 106.75 barrier, which is the 50.0% Fibonacci. Underneath these obstacles, the 200-day SMA around the 61.8% Fibonacci at 105.78 could come into the spotlight.

On the other hand, if the bulls take the control, immediate resistance could be faced from 108.40 and the 23.6% Fibonacci of 108.97. Beyond this, the 20-day SMA at 109.40 could come next before jumping to the 13-month peak of 110.95.

To sum up, USDJPY is retreating in the near term, however, the broader outlook is still positive as it holds above the 200-day SMA.

Origin: XM