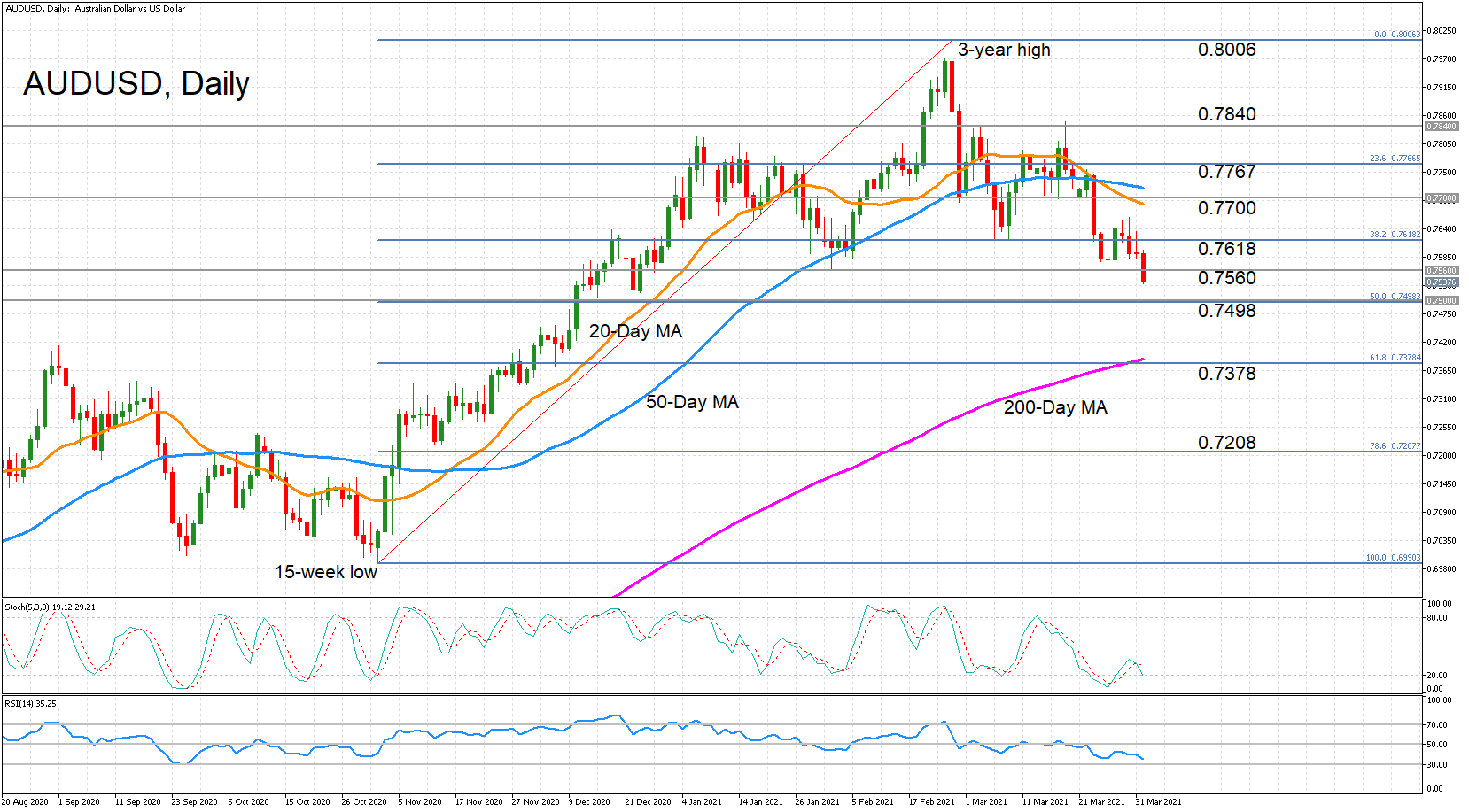

AUDUSD has broken below the key support level of 0.7560, which was successfully defended back in February and March, and is now plumbing fresh 3-month lows. The momentum indicators are pointing to increased bearish bias in the short term. The RSI is declining and heading towards the 30 oversold level, while the %K of the stochastic oscillator has crossed back below the %D line and both are falling.

AUDUSD has broken below the key support level of 0.7560, which was successfully defended back in February and March, and is now plumbing fresh 3-month lows. The momentum indicators are pointing to increased bearish bias in the short term. The RSI is declining and heading towards the 30 oversold level, while the %K of the stochastic oscillator has crossed back below the %D line and both are falling.

At this rate, it’s only a matter of time before the psychologically important 0.75 level is put to the test. The 50% Fibonacci of the November 2020-February 2021 uptrend passes just below this mark at 0.7498, adding even more significance to this support region. A drop below it would open the way for the 200-day moving average (MA), which lies just above the 61.8% Fibonacci of 0.7378.

Failure to hold above the 200-day MA would hand the bears full control as the recently turned neutral outlook in the medium term would be downgraded further, switching to bearish. Even lower, the 78.6% Fibonacci of 0.7208 could next attract attention.

However, should the negative bias ease and prices were to recoup some lost ground, the 38.2% Fibonacci of 0.7618 would be the first major obstacle on the upside. Above that, the 20-day MA, currently at 0.7688, would be important for the bulls to reclaim if they are to revive some positive momentum.

Climbing back above the 20-day MA would help alleviate the downside pressure in the near term but unless prices are able to keep above the 200-day MA, the longer-run uptrend that began in March 2020 is at risk of faltering.

Origin: XM