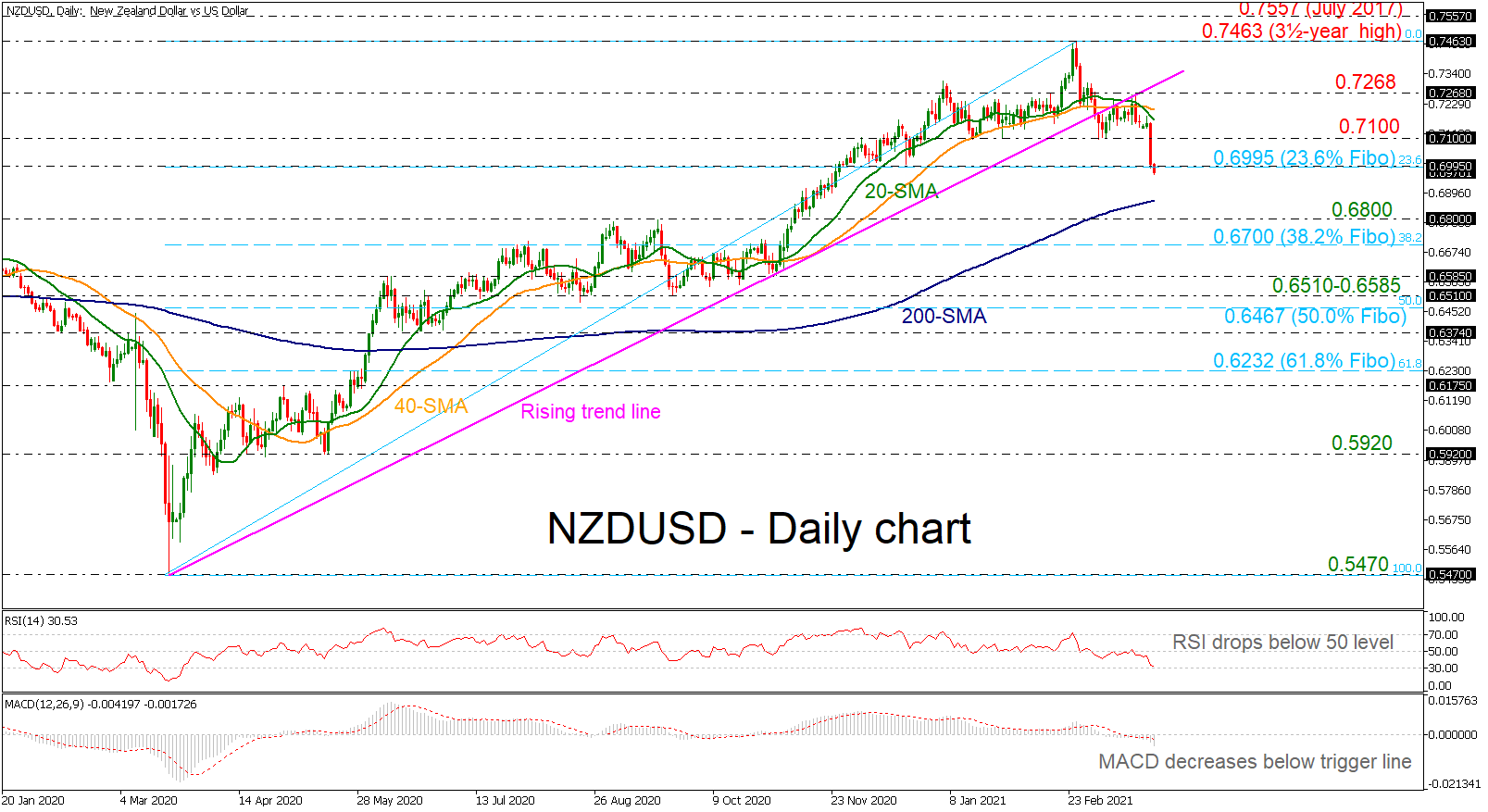

NZDUSD was sold aggressively on Tuesday after failing to climb above the 20-day simple moving average and breaking below the 0.7100 psychological level.

NZDUSD was sold aggressively on Tuesday after failing to climb above the 20-day simple moving average and breaking below the 0.7100 psychological level.

The momentum indicators are confirming the recent negative price action. The RSI is heading towards the 30 level, while the MACD is strengthening its bearish move below its trigger and zero lines.

The price is currently flirting with the 23.6% Fibonacci retracement level of the upward wave from 0.5470 to 0.7463 at 0.6995. A continuation of the drop below this line could take the price towards the 200-day simple moving average (SMA) at 0.6867 and then near the 0.6800 handle. Steeper decreases could meet the 38.2% Fibonacci level of 0.6700.

Alternatively, a climb above the 0.7100 barrier and the 20- and 40-day simple moving averages (SMAs) could drive the pair until the 0.7268 resistance. Moving higher, the three-and-a-half-year peak of 0.7463 could come next in the spotlight.

In conclusion, NZDUSD is forming a neutral-to-bearish structure in the short-term picture as it is falling below the long-term ascending line.

Origin: XM