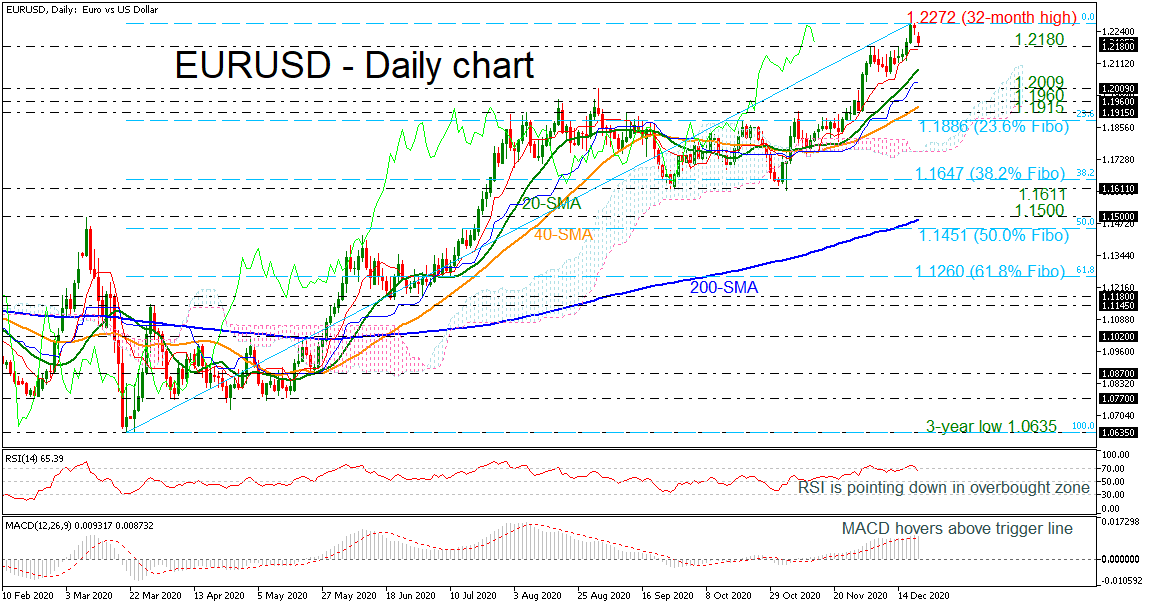

EURUSD surged to a 32-month high on Thursday, extending its bullish rally from the 1.1611 support level. Today, the market opened with a negative gap, retreating from the multi-month high.

EURUSD surged to a 32-month high on Thursday, extending its bullish rally from the 1.1611 support level. Today, the market opened with a negative gap, retreating from the multi-month high.

The positive picture in the medium term is further supported by the MACD, which is rising above its trigger line, however, the RSI is suggesting a possible pullback as the index is sloping south in the overbought territory. In trend indicators, the simple moving averages (SMAs) are following the price action.

Should prices reverse lower, immediate support could come at 1.2180 before meeting the 20-day SMA at 1.2085. Below that, the 1.1915-1.2009 area is another major support around the 40-day SMA. A drop below this region would take the pair closer to the 23.6% Fibonacci retracement level of the up leg from 1.0635 to 1.2272 at 1.1886 and significantly weaken the bullish medium-term structure. Further losses could open the way towards the 1.1611 level.

To the upside, there is immediate resistance at the 32-month peak of 1.2272, while above that, the next major resistance to watch is the 1.2410 barrier, taken from the high in April 2018. More gains could lead the price until 1.2480, registered in March 2018.

Overall, EURUSD has been in a crucial upside tendency since March and any falling move beneath the 200-day SMA may switch this outlook to neutral.

Origin: XM