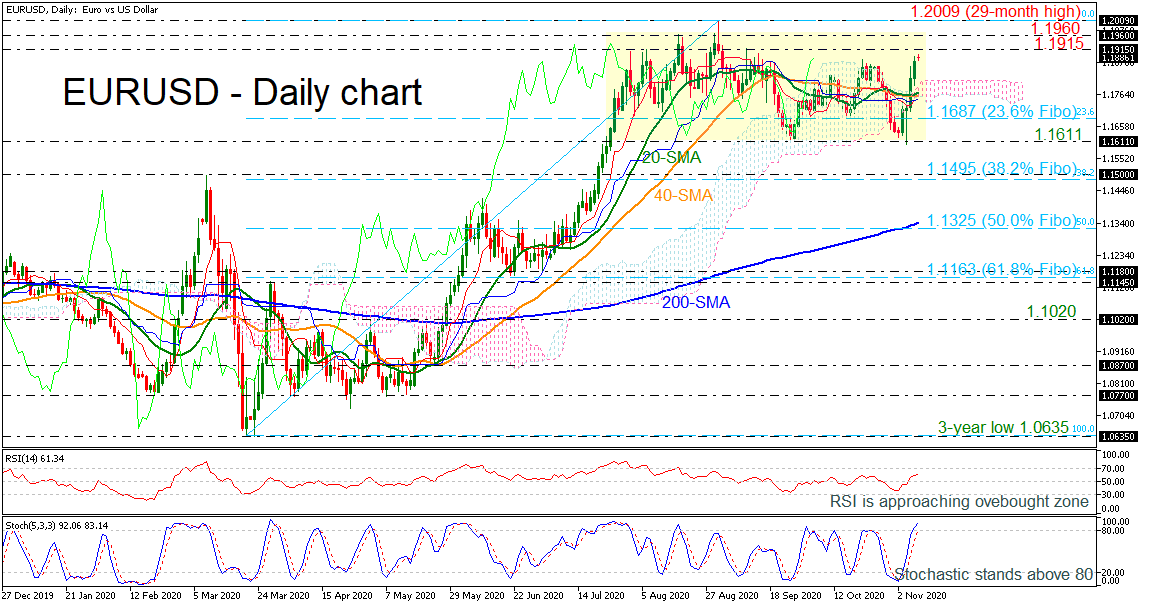

EURUSD is rallying above the previous high of 1.1880, creating four straight bullish days after the bounce off the 1.1611 support level. The price also jumped above the 20- and 40-period simple moving averages (SMAs) and the Ichimoku cloud, signaling some more buying interest.

EURUSD is rallying above the previous high of 1.1880, creating four straight bullish days after the bounce off the 1.1611 support level. The price also jumped above the 20- and 40-period simple moving averages (SMAs) and the Ichimoku cloud, signaling some more buying interest.

Technically, the RSI is confirming the positive outlook as it approaches the overbought territory, while the stochastic is holding above the 80 level suggesting a retracement in the short-term.

If the market picks up more speed, the 1.1915 barrier could offer nearby resistance ahead of the 1.1960 level. A significant close above the latter would break the 29-month high of 1.2009 before meeting the 1.2160 inside swing low, taken from February 2018, raising chances for further increases.

Should prices decline, immediate support could be found around the SMAs at 1.1770. Then a leg below that level, the pair could meet the 23.6% Fibonacci retracement level of the up leg from 1.0635 to 1.2009 at 1.1687. Steeper declines could rest around 1.1611 before the focus shifts to the 38.2% Fibonacci of 1.1495.

In the medium-term, the outlook may continue to remain neutral since prices have been holding within the 1.1611-1.1960 region over the last three months. A jump above the 29-month peak of 1.2009 may change the recent bias back to bullish.

Origin: XM