AUDUSD collected marginal gains on Wednesday and closed just around the 50-day simple moving average ((SMA) despite a volatile session within the 0.7100-0.7000 region.

AUDUSD collected marginal gains on Wednesday and closed just around the 50-day simple moving average ((SMA) despite a volatile session within the 0.7100-0.7000 region.

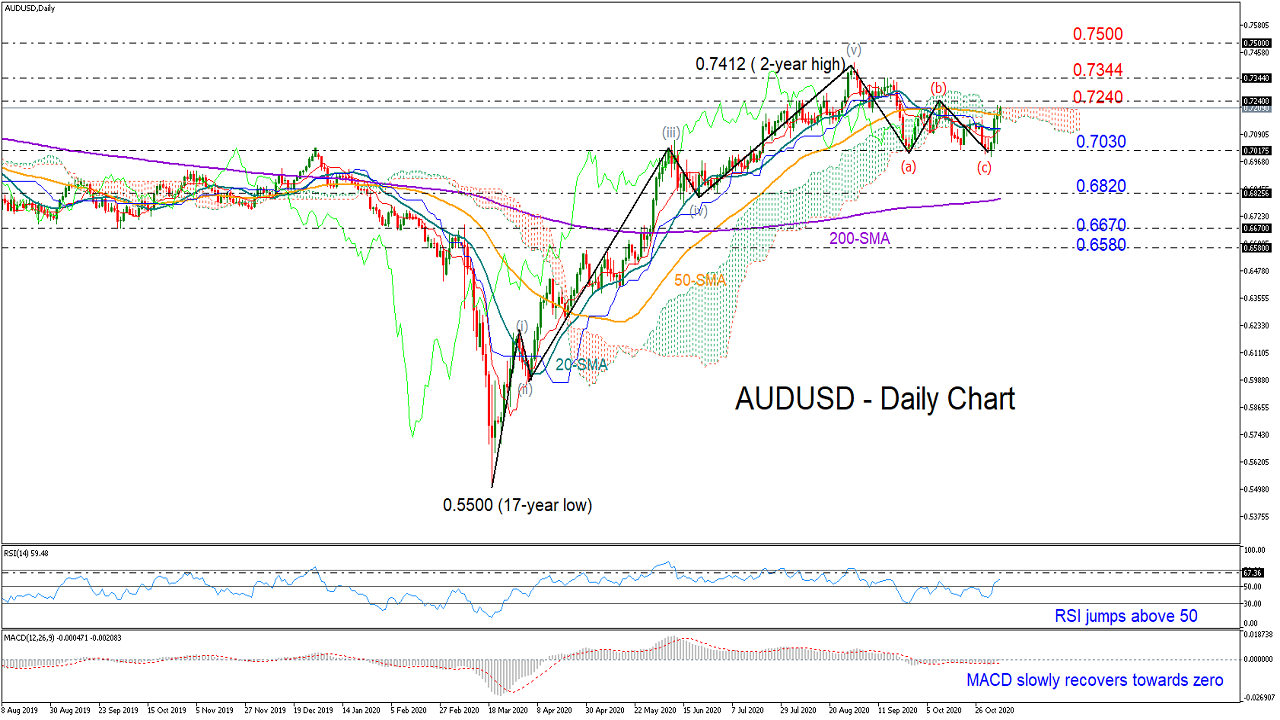

Earlier in the week, the 0.7030 support area managed to halt negative movements for the third time, increasing speculation that the downfall from the 0.7412 peak could be temporary. The recent bullish action could also reflect the end of an a-c corrective pattern and the start of a new bullish wave 1-5 according to the Elliot theory. Still, the bearish cross between the 20- and 50-day SMAs suggests that the above should be taken with a grain of salt for now.

Another upside extension seems the most likely scenario in the near term as the RSI is pointing upwards comfortably above its 50 neutral mark and the MACD continues to slowly recover towards the zero line. Yet, the size of the move should be large enough to surpass the previous high of 0.7240 and hence violate the downward pattern. If that is the case, the bulls may gear up to 0.7345, a break of which may top within the 0.7412 – 0.7500 key resistance zone.

Otherwise, if the 50-day SMA holds firm, the pair may again seek safety around the 0.7030 base. Should this prove fragile, giving credence to the latest downfall instead, the price could sink towards the 200-day SMA and the 0.6820 barrier, while a step lower may widen selling exposure towards 0.6670 and then to 0.6580.

Looking at the medium-term picture, the pair maintains an upward direction from the 0.5500 trough as long as it sustains strength above 0.7030, and thus a positive outlook.

Summarizing, AUDUSD could face additional bullish pressure in the short run, where a decisive close above 0.7240 could confirm a bullish bias and a stronger signal of a positive trend continuation.

Origin: XM