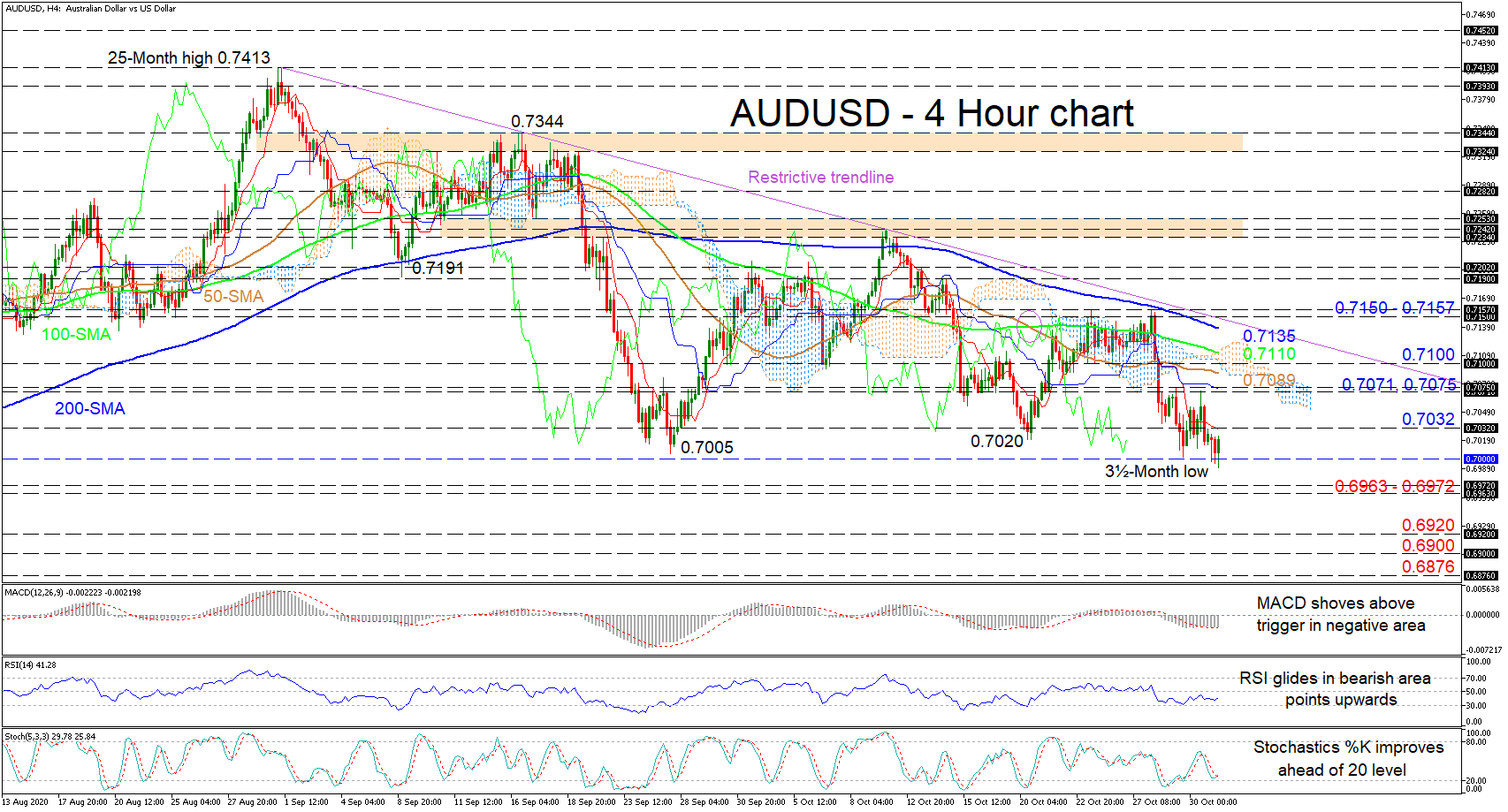

AUDUSD is currently pushing off the 0.7000 handle after the curbing 200-period simple moving average (SMA) plunged the pair underneath the 50- and 100-period SMAs, the Ichimoku cloud, and the 0.7020 and 0.7005 supporting troughs. The steady downward slopes of the SMAs and the bearish demeanour of the Ichimoku lines sponsor further fading in the pair.

AUDUSD is currently pushing off the 0.7000 handle after the curbing 200-period simple moving average (SMA) plunged the pair underneath the 50- and 100-period SMAs, the Ichimoku cloud, and the 0.7020 and 0.7005 supporting troughs. The steady downward slopes of the SMAs and the bearish demeanour of the Ichimoku lines sponsor further fading in the pair.

The short-term oscillators express conflicting signals of momentum but are leaning slightly towards the downside. The MACD, in the negative region, has marginally pushed above the red trigger line, while the RSI is barely pointing up in bearish territory. The stochastic oscillator’s negative charge seems to be faltering as the %K line is stalling ahead of the 20 mark.

If the bears slip past the tough 0.7000 level, initial support may develop from the zone of 0.6963 – 0.6972. Should further deterioration in the pair unfold, the key 0.6920 mark, which relates to multiple lows from the first half of July, may attempt to dismiss the descent. Failing to do so, the price may aim for the 0.6900 hurdle and the 0.6876 low, both around the beginning of July.

Otherwise, if buyers manage to drive the price back up, first limitations may occur at the red Tenkan-sen line at the 0.7032 high. Overtaking this, the congested peaks of 0.7071 and 0.7075, which encapsulate the blue Kijun-sen line, may provide upside hindrance towards the 50-period SMA of 0.7089, at the cloud’s lower band. Slightly overhead, the 0.7100 barrier and the adjacent 100-period SMA at 0.7110 may impede the price from challenging the 200-period SMA, presently at 0.7135 and the neighbouring restrictive trend line drawn from the 0.7413 top.

In brief, AUDUSD despite struggling to conquer the 0.7000 mark, is sustaining a negative tone beneath the MAs and the descending trend line. A break above the 0.7150 – 0.7157 section may confirm a bullish shift in the short-term picture.

Origin: XM