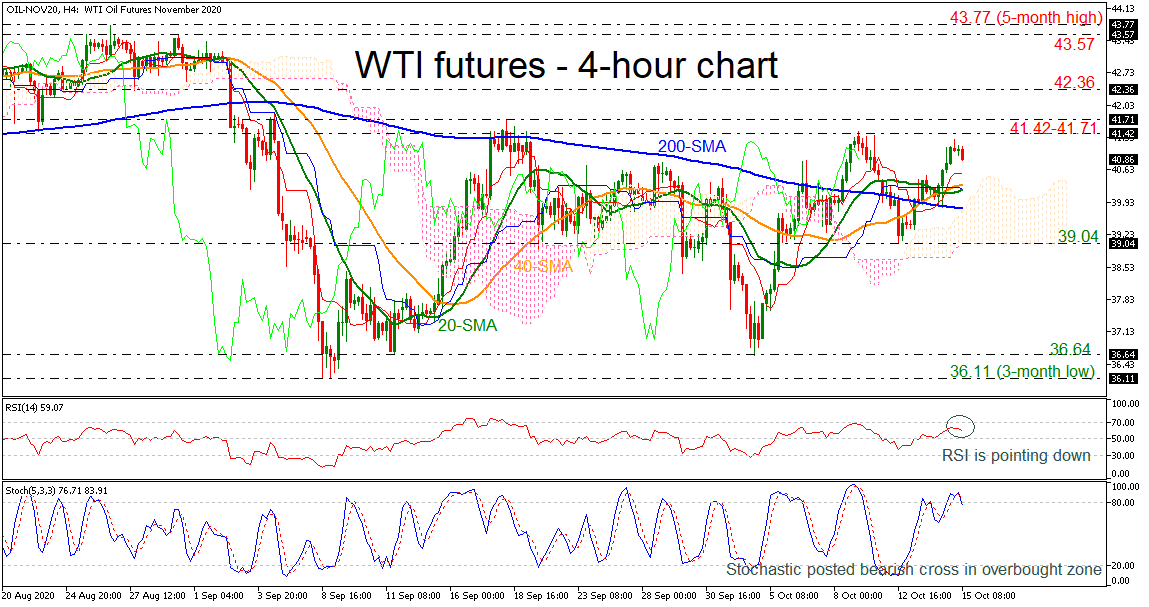

WTI crude oil futures are looking negative in the very short-term, despite the jump above the simple moving averages (SMAs) in the preceding sessions in the 4-hour chart.

WTI crude oil futures are looking negative in the very short-term, despite the jump above the simple moving averages (SMAs) in the preceding sessions in the 4-hour chart.

The stochastics are heading downwards, with the %K and %D lines posting a bearish crossover in the overbought territory, while the RSI is sloping south in the positive area. Both are suggesting that bears may take the upper hand again.

Immediate support to further losses would likely come from the 40-period SMA at 40.30 and the 200-period SMA at 39.80. If there is a successful break below this area, further support could be met around 39.04, which overlaps with the lower surface of the Ichimoku cloud. Steeper decreases could take the price until 36.64.

If, however, the commodity jumps above the 41.42-41.71 area, resistance would initially come from the 42.36 ahead of 43.57. Rising above this level, the price could meet the five-month high of 43.77, shifting the outlook back to bullish.

In the medium-term picture, the bearish outlook recently shifted to a neutral one and is likely to stay neutral as long as prices remain below 41.42-41.72.

Origin: XM