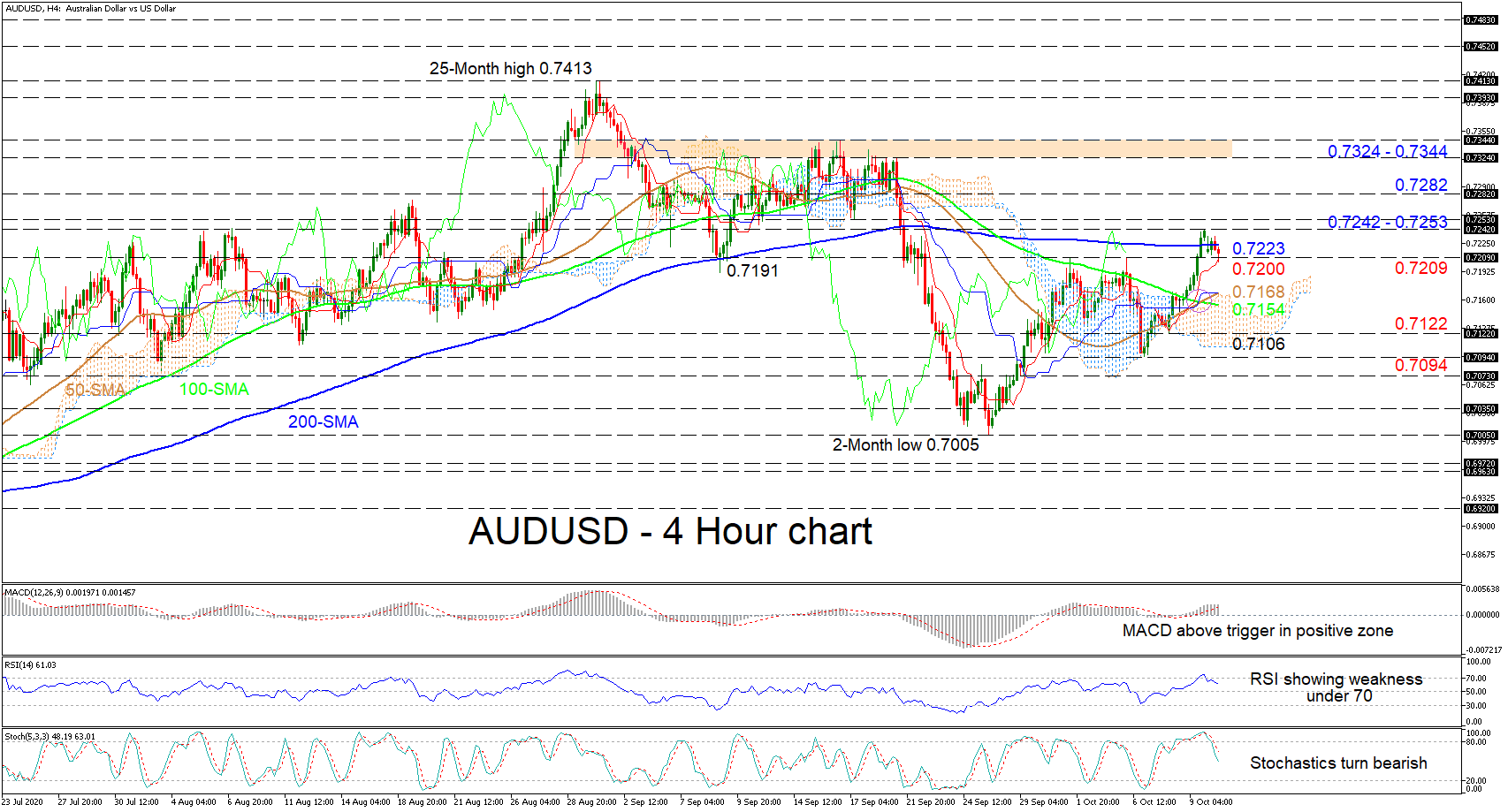

AUDUSD appears muted by the 200-period simple moving average (SMA) after having shot upwards from the 0.7094 level, above the Ichimoku cloud and the SMAs. The stalled blue Kijun-sen line at 0.7168 and the short-term oscillators back a weakening picture, while the rising red Tenkan-sen line and the 50-period SMA’s recent bullish crossover of the 100-period SMA endorse strength in the pair.

AUDUSD appears muted by the 200-period simple moving average (SMA) after having shot upwards from the 0.7094 level, above the Ichimoku cloud and the SMAs. The stalled blue Kijun-sen line at 0.7168 and the short-term oscillators back a weakening picture, while the rising red Tenkan-sen line and the 50-period SMA’s recent bullish crossover of the 100-period SMA endorse strength in the pair.

The MACD, in the positive region, is flattening above its red trigger line reflecting a slight drawback in positive momentum. The stochastic oscillator has turned strongly bearish, while the falling RSI deteriorates in the bullish area.

By returning below the 200-period SMA, immediate support may arise from the 0.7209 inside swing highs and the red Tenkan-sen line residing at the 0.7200 handle. Falling beneath these, the 50-period SMA and blue Kijun-sen line may next provide some limitations to the downside, which currently stand at the cloud’s upper boundary at 0.7168. If the bears push deeper, the 100-period SMA around 0.7154 may come into play ahead of the 0.7122 low. Additional declines could then challenge the floor of the cloud at 0.7106 before facing the 0.7094 trough.

If buyers resurface, first heavy constraints may develop from the hovering 200-period SMA at 0.7223, ahead of the capping resistance section from 0.7242 to 0.7253. Conquering these serious obstacles, the pair may jump towards the 0.7282 barrier before persisting buyers target the 0.7324 to 0.7344 zone of tops.

In brief, it seems that the pair may continue to edge sideways preserving a neutral-to-bullish tone. A dive below 0.7094 may ignite downside corrections, while a push above 0.7253 may produce optimism in the pair.

Origin: XM