Trump U-turns on relief package but uncertainty about deal lingers

Trump U-turns on relief package but uncertainty about deal lingers

Talks between the White House and the Democrats on a new virus relief bill have restarted after President Trump reversed his decision from just two days earlier to end them. Trump had instead tried to push for standalone bills, prioritising support for airlines and $1,200 stimulus checks for all Americans. But House Speaker Nancy Pelosi’s resistance to standalone bills and the souring of the market mood might have contributed to his apparent change of heart.

Trump described the talks as “very productive” in an interview with Fox Business on Thursday. However, a deal on a new stimulus package before the November 3 election is still not guaranteed as Republicans and Democrats remain far apart on the size of the bill. Moreover, some are questioning Trump’s mental wellbeing following his contraction of the coronavirus and the experimental treatment he received that is aiding his recovery. Pelosi is even proposing changes to the US constitution to make it easier to remove a president from office if they are judged to be unfit to serve.

Adding to the chaos in Washington, Trump has said he won’t participate in the next presidential debate that is scheduled for October 15 after the commission that organizes the debates changed the event to a virtual one.

Wall Street cautiously optimistic about a ‘blue wave’

The growing sense of disarray about the election and Trump’s unpredictability are containing the excitement on Wall Street about a possible imminent deal. Worries about the US and global economic recovery could also be weighing slightly on equities.

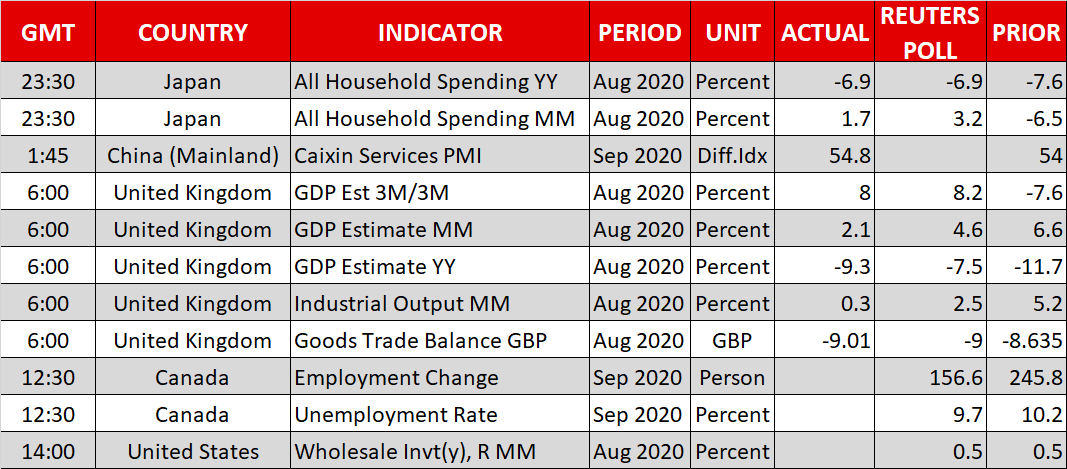

US jobless claims flatlined in yesterday’s weekly print, suggesting the rebound in the jobs market is plateauing. Meanwhile, UK GDP figures released today showed Britain’s economy grew less than expected in August, in another warning sign.

Nevertheless, all three leading indices on Wall Street posted fresh one-month highs yesterday and stock futures are indicating gains of around 0.3% today.

The underlying thinking in the markets right now is that whoever wins the US election, another round of fiscal stimulus is almost certain. Though, investors are increasingly pricing in a ‘blue wave’ sweep scenario where the Democrats take over the White House and both chambers in Congress.

Expectations that a Democratic win in November would usher in an era of higher spending on benefits, state aid and on infrastructure, not to mention greater political certainty, are countering fears about higher corporate taxes that Joe Biden has pledged.

Dollar resumes slide, loonie and kiwi shine

The safe-haven dollar and yen remained under pressure on Friday as risk appetite generally improved, though there was some support from ongoing nervousness about the election and the stimulus talks. The dollar index slipped to a 2½-week low as its major components, the euro and the loonie, advanced. The euro was making a fresh attempt at the $1.18 level, while the Canadian dollar climbed to three-week highs.

The loonie has risen sharply this week on the back of higher oil prices amid shutdowns in the Gulf of Mexico due to another hurricane in the region, and a workers’ strike in Norway causing disruptions to supply. But there was a further boost for the currency after Bank of Canada Governor Tiff Macklem signalled yesterday that negative rates were not on the cards anytime soon. The loonie’s next big move could come from employment numbers due out of Canada later today.

Another outperformer on Friday was the New Zealand dollar, which reclaimed the $0.6600 handle as it played catchup following yesterday’s dive on negative rates speculation.

Origin: XM