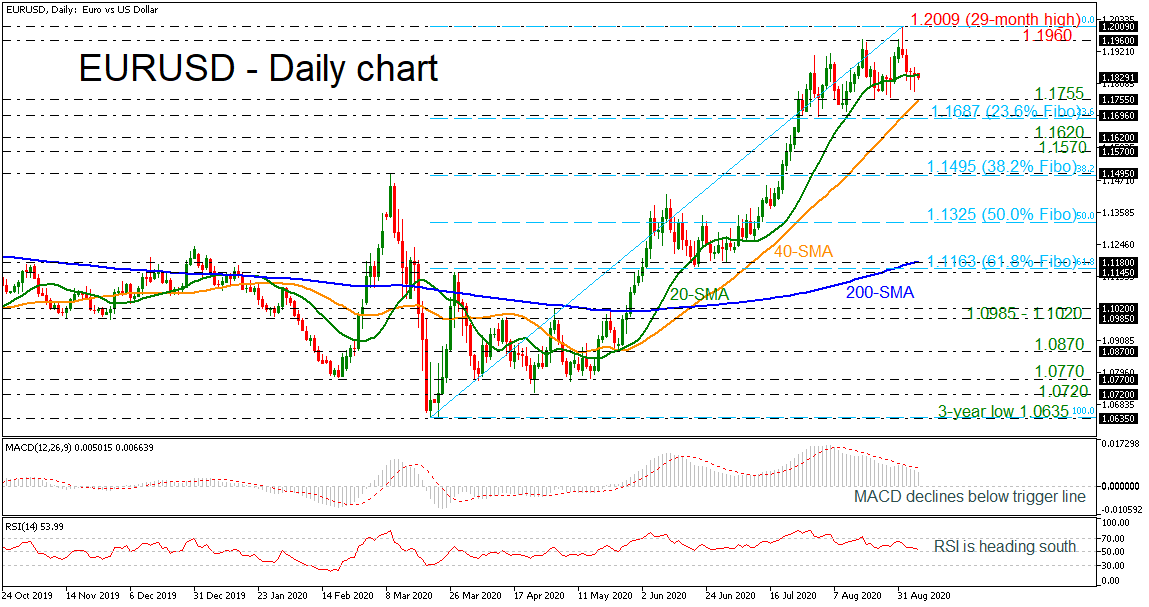

EURUSD is edging lower after the spike towards the 29-month high of 1.2009 on September 1. The four consecutive red days drove the market below the 20-period simple moving average (SMA) and the technical indicators are confirming a bearish retracement. The MACD continues to hold below the trigger line in the positive zone, while the RSI is ready to touch the neutral threshold of 50.

EURUSD is edging lower after the spike towards the 29-month high of 1.2009 on September 1. The four consecutive red days drove the market below the 20-period simple moving average (SMA) and the technical indicators are confirming a bearish retracement. The MACD continues to hold below the trigger line in the positive zone, while the RSI is ready to touch the neutral threshold of 50.

The next target to the downside is the 1.1755 support level, which overlaps with the 40-period SMA. At this stage, the market would likely see a bearish correction towards the 23.6% Fibonacci retracement of the up leg from 1.0635 to 1.2009 at 1.1687 and put in place a lower low. Breaching this level too, the 1.1620 and the 1.1570 supports could come in focus.

On the other hand, upside moves are likely to find resistance at 1.1960. Rising above this area would help shift the focus to the upside again towards the 29-month peak of 1.2009. Above that level, the February 28 inside swing low at 1.2180 is coming into the spotlight next.

Summarizing, in the short- to medium-term timeframes, the bullish phase remains in play especially if prices continue to trade above the 50.0% Fibonacci.

Origin: XM