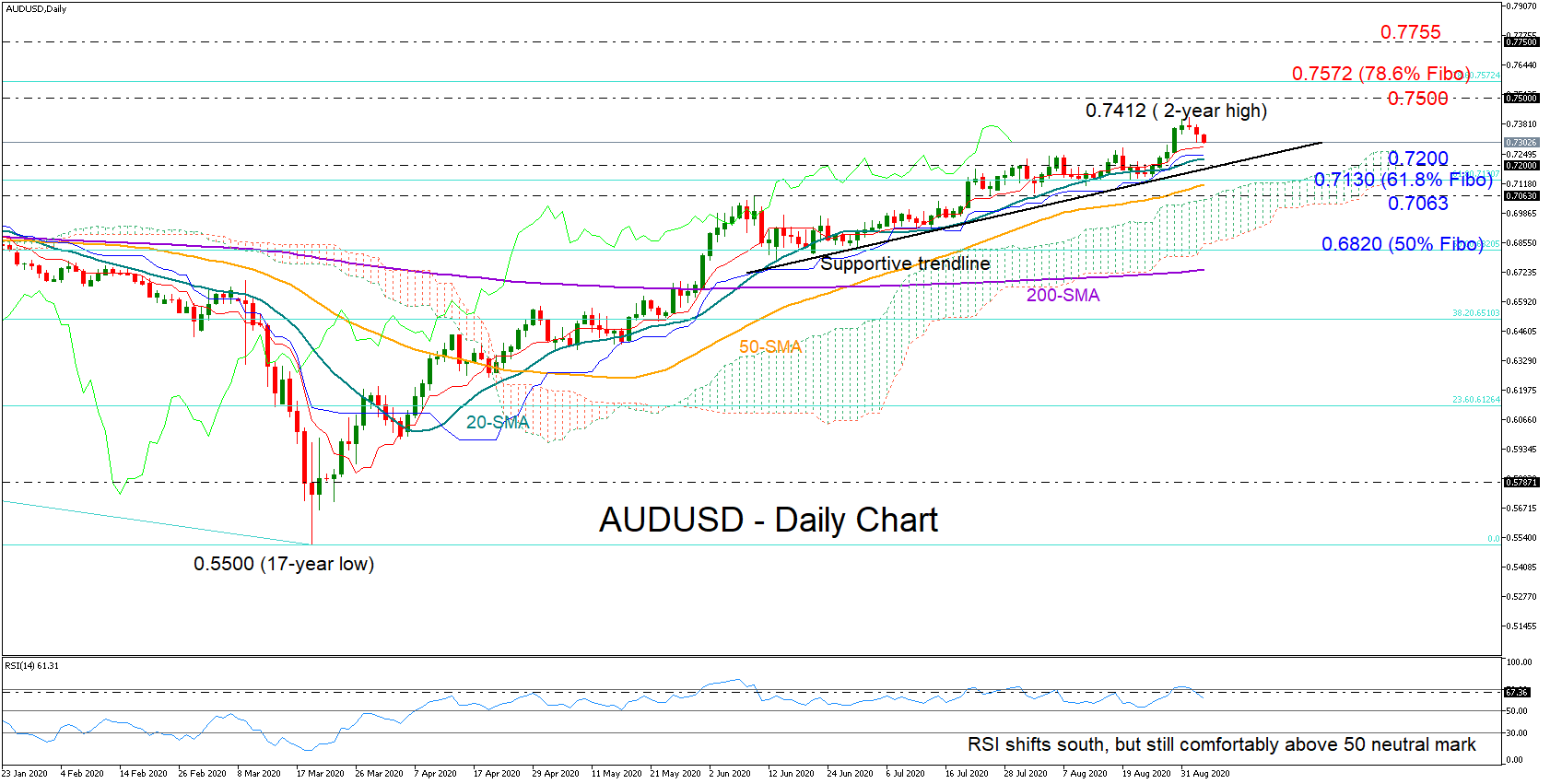

AUDUSD printed a bearish doji just after piercing the 0.7400 level on Tuesday, foreseeing the weakness in the following sessions.

AUDUSD printed a bearish doji just after piercing the 0.7400 level on Tuesday, foreseeing the weakness in the following sessions.

The bearish action, however, could be just a correction in the 5 ½-month old uptrend as the 20- and 50-day simple moving averages (SMAs) retain their upward trajectory and remain positively aligned. In Ichimoku indicators, the red Tenkan-sen also continues to hold above the blue Kijun-sen line despite flattening a bit, while the RSI has reversed south but still has some way to go to reach its 50 neutral mark.

Now whether a downside move could be concerning or not may depend on two key levels. In other words it could be a two-way process. Initially, the price should cross below the 0.7200 level, where a short-term supportive trendline and the 20-day SMA are converging. Then it should close decisively below 0.7063, violating the 61.8% Fibonacci retracement of the 0.8135-0.5500 downtrend, the 50-day SMA, and the upper surface of Ichimoku cloud on the way down.

If the above case materializes, the pair could stage a more aggressive sell-off probably towards the 50% Fibonacci of 0.6820. Such a move would make the ongoing upward pattern less credible.

Otherwise, if the pair manages to rebound somewhere above 0.7200, the focus will shift back to the two-year high of 0.7412. A clear break at this point could find resistance somewhere between 0.7500 and 0.7572 before the 0.7755 restrictive zone appears on the radar.

Note that the broken 200 SMA in the weekly chart is hovering around 0.7250 and it would be interesting to see if it could act as support this time.

Summarizing, AUDUSD is expected to stretch its bullish direction unless it drops significantly below 0.7063.

Origin: XM