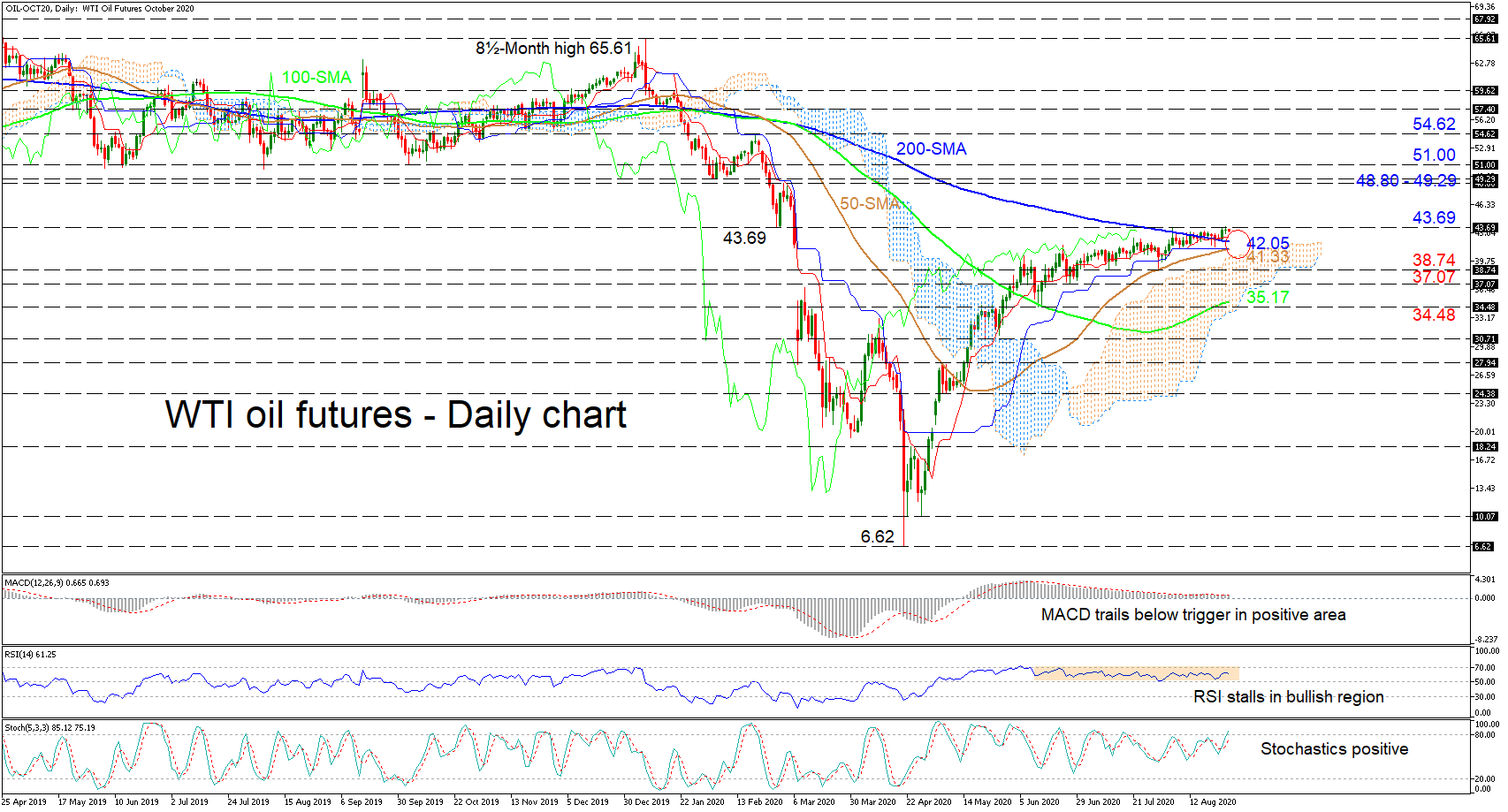

WTI oil futures are striving to overcome a critical resistance at 43.69, after having nudged over the 200-day simple moving average (SMA). Positive momentum has been gradually shrinking for approximately two-months, mirrored in the flattening out of the Ichimoku lines. Yet, the price continues to steadily crawl higher, maintaining a positive tone above the SMAs and the Ichimoku cloud.

WTI oil futures are striving to overcome a critical resistance at 43.69, after having nudged over the 200-day simple moving average (SMA). Positive momentum has been gradually shrinking for approximately two-months, mirrored in the flattening out of the Ichimoku lines. Yet, the price continues to steadily crawl higher, maintaining a positive tone above the SMAs and the Ichimoku cloud.

The short-term oscillators further reflect the anaemic positive momentum. The MACD, slightly in the positive region, continues to drag below its red trigger line, while the RSI remains stalled in the bullish section. That said, the stochastic %K line has penetrated above the 80 level, endorsing improvements in the commodity.

To the upside, immediate obstructing resistance may come from the 43.69 inside swing low from March 2. Overrunning this, the commodity may accelerate towards the 48.80 to 49.29 resistance band. If this border fails to terminate the climb, sustained buying interest may test the 51.00 handle ahead of the 54.62 peak, reached on February 20.

Otherwise, initial congested support may arise from the nearby 200- and 50-day SMAs at 42.05 and 41.33 respectively. Dipping under this zone, where the Ichimoku lines also reside, the cloud’s upper surface and the 38.74 low may test the unfolding move. Should steeper declines ignore the 37.07 barrier, the price may challenge the 100-day SMA at 35.17 and the trough of 34.48 slightly beneath.

In brief, the short-term timeframe preserves a positive tone above the SMAs and the 38.74 low. Moreover, positive sentiment could be reinforced with the approaching bullish crossover of the 200-day SMA.

Origin: XM