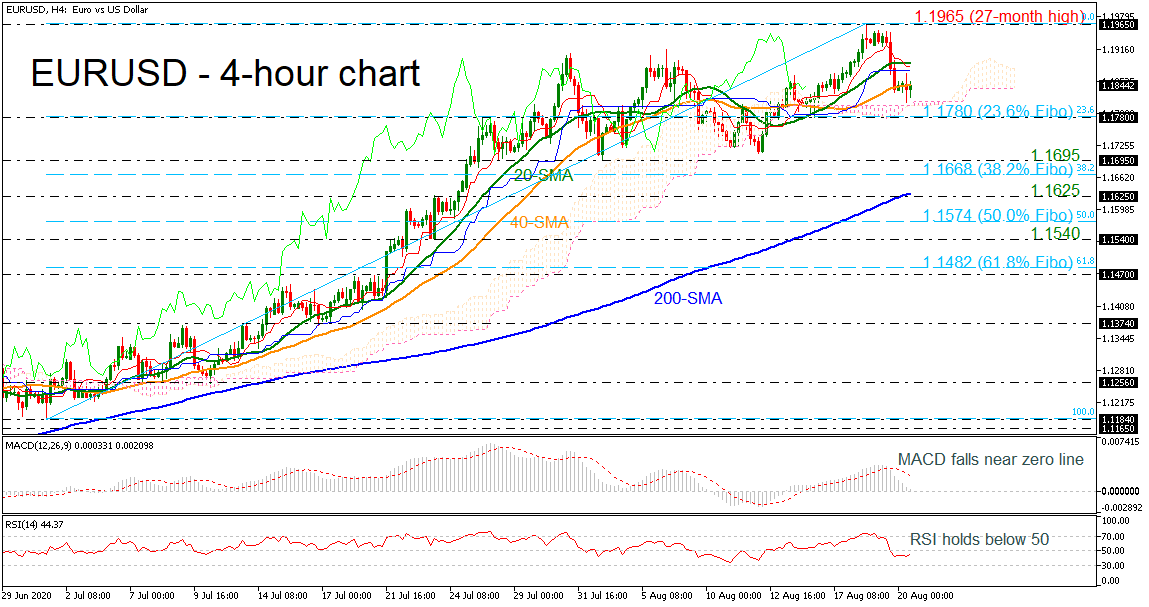

EURUSD is on course for a bearish correction after the spike on the 27-month peak of 1.1965 on Tuesday. The sell-off, especially on Wednesday, has drove the price near the 40-period simple moving average (SMA) in the 4-hour chart. The momentum indicators are supportive of the bearish picture, with the RSI remaning inside negative territory, the MACD losing ground towards the zero line.

EURUSD is on course for a bearish correction after the spike on the 27-month peak of 1.1965 on Tuesday. The sell-off, especially on Wednesday, has drove the price near the 40-period simple moving average (SMA) in the 4-hour chart. The momentum indicators are supportive of the bearish picture, with the RSI remaning inside negative territory, the MACD losing ground towards the zero line.

Immediate support is being provided by the Ichimoku cloud around 1.1811 ahead of the 23.6% Fibonacci retracement level of the up leg from 1.1184 to 1.1965 at 1.1780. However, should prices dip lower again, the next support would likely come from 1.1695 and the 38.2% Fibonacci of 1.1668. A drop below 1.1668 would challenge the 200-period SMA at 1.1625.

In case of an upward attempt, EURUSD would likely meet resistance at the 20-period SMA, currently around 1.1890. A break above the latter line would ease the downside pressure, hitting the new high of 1.1965. Breaching this peak, the next resistance is coming from 1.2160, achieved in February 2018.

In the medium term, the bullish outlook remains intact for the moment. However, should prices decline towards the 200-period SMA, this would shift the medium-term picture to a more neutral one.

Origin: XM