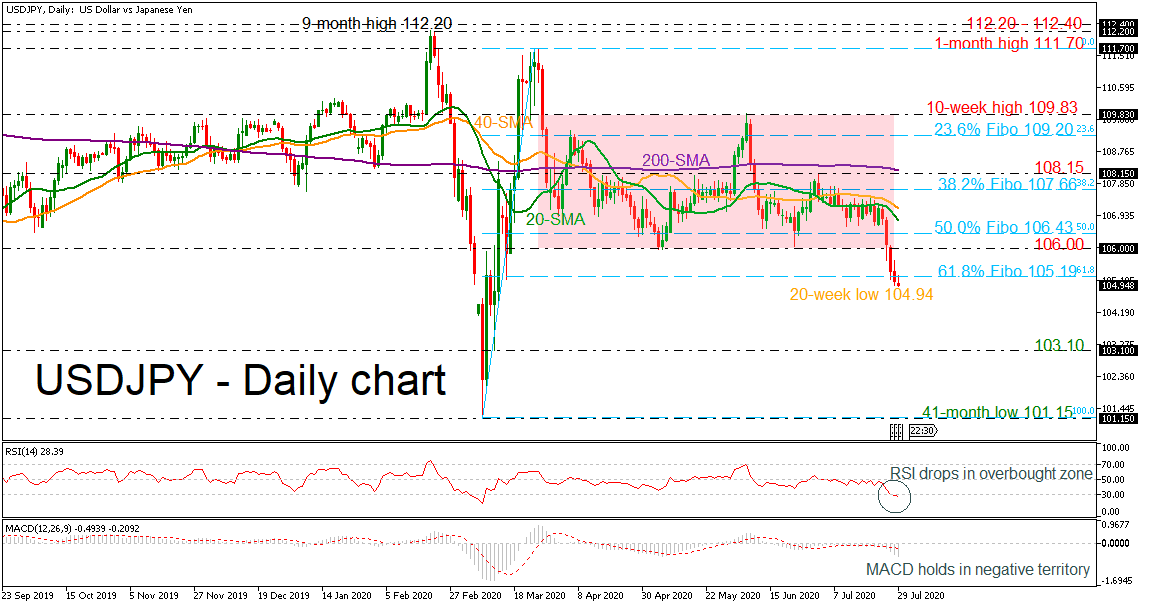

USDJPY tumbled to a fresh 20-week low of 104.94 earlier today, completing the fifth negative session in a row. The price shifted the neutral picture to bearish in the short term, declining beneath the 61.8% Fibonacci retracement level of the up leg from 101.15 to 109.83 at 105.19.

USDJPY tumbled to a fresh 20-week low of 104.94 earlier today, completing the fifth negative session in a row. The price shifted the neutral picture to bearish in the short term, declining beneath the 61.8% Fibonacci retracement level of the up leg from 101.15 to 109.83 at 105.19.

Further backing this short-term view are the downward slopes of the 20- and 40-day simple moving averages (SMAs). However, for now the technical oscillators reflect bearish signals. The MACD, in the negative area, is losing ground below its trigger line, while the RSI is hovering in oversold territory.

If sellers sink deeper, the 103.10 support level could provide the initial key constrictions for the bears. Steeper declines under the line would have to tackle a more durable support section at the 14-month trough of 101.15.

On the other hand, if buying interest picks up, early tough resistance could occur at the 106.00 psychological level, where the ceiling of the consolidation area from the preceding weeks also resides. A violation of this level may shoot the pair to challenge the 50.0% Fibonacci of 106.43 and the 20- and 40-day SMAs currently at 106.80 and 107.10 respectively. If advances endure past these obstacles, buyers may then target the 38.2% Fibonacci of 107.66.

Overall, the short-to-medium-term picture has turned negative below the 105.00 handle as the break below the trading range cemented negative worries.

Origin: XM