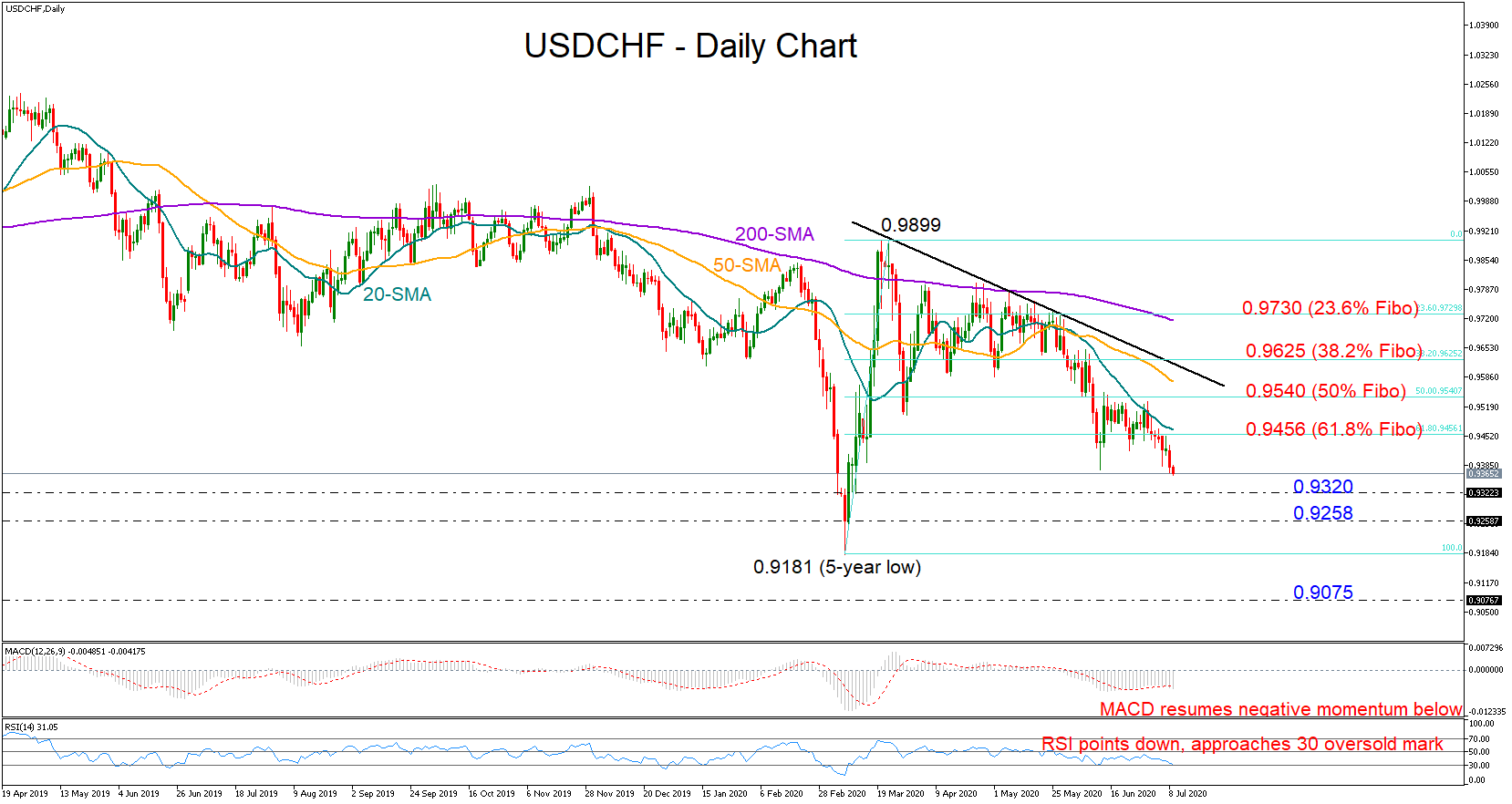

USDCHF resumed negative momentum this week after failing to climb above the 61.8% Fibonacci retracement level of the March rally that started from the 0.9181 bottom.

USDCHF resumed negative momentum this week after failing to climb above the 61.8% Fibonacci retracement level of the March rally that started from the 0.9181 bottom.

On the downside there is no key support in sight until 0.9320, hence the sell-off may continue for a bit, with the RSI and the MACD endorsing that bearish view as the former has yet to find a bottom in the oversold area and the latter is strengthening southward again.

A break below 0.9320 would expose the market to the 0.9255 support area, which the price failed to successfully breach in March. Another step lower could see the retest of the almost five-year low of 0.9181, where any violation would put the pair back in a downtrend. In this case, the decline could next stall near 0.9070 – an important barrier during the 2014-2015 period.

On the flip side, an upside reversal should overcome some obstacles before reaching the descending trendline. The 61.8% Fibonacci of 0.9456 and the restrictive 20-day simple moving average (SMA) could first come on the radar ahead of the 50% Fibonacci of 0.9540. Then, the bulls would have to push harder to pierce above the trendline and gear up towards the 200-day SMA and the 23.6% Fibonacci of 0.9730.

In the broader picture, a decisive close above the previous high of 0.9899 could eliminate downside risks and raise buying confidence.

Summarizing, USDCHF is expected to lose some ground in the short-term, with traders likely looking for support near 0.9320.

Origin: XM