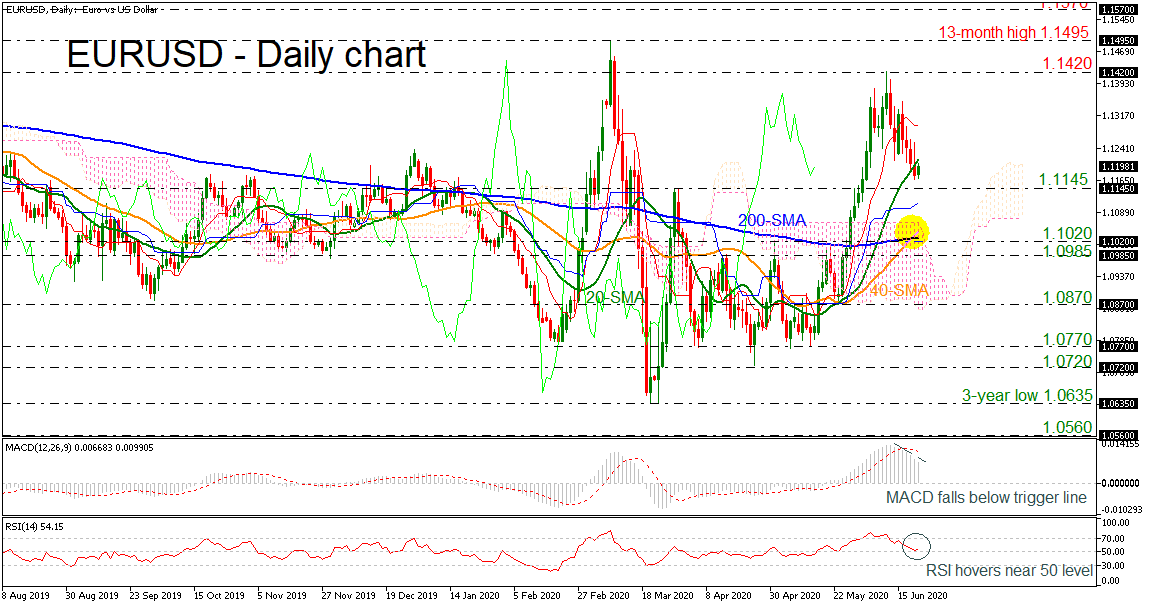

EURUSD has been in a declining move over the last two weeks after the pullback off the 1.1420 resistance level.

EURUSD has been in a declining move over the last two weeks after the pullback off the 1.1420 resistance level.

Currently, the pair is lacking direction in the medium-term, however, the 40-day simple moving average (SMA) posted a bullish cross with the 200-day SMA. The RSI is marginally sloping up near the neutral threshold of 50, while the MACD is still losing ground below its trigger line.

The price is capped by the 20-day SMA and looks ready to find support at the 1.1145 barrier. Clearing this key region, it would hit the 1.1020 support, which overlaps with the aforementioned bullish cross of the SMAs and the 1.0985 obstacle. A fall below the latter level could open the door for the 1.0870 line, which stands near the lower surface of the Ichimoku cloud and the 1.0720 – 1.0770 area, remaining in a consolidation zone. Only a drop under the three-year low of 1.0635 would shift the outlook from neutral to bearish.

On the other side, if the price runs higher, it could meet resistance at 1.1420 and the 13-month peak of 1.1495. Above that, the 1.1570 hurdle could be a crucial level for more increases changing the bias to bullish.

Summarizing, EURUSD is failing to improve the positive move from the three-year trough of 1.0635, but the RSI and the bullish cross of the SMAs are signs of optimism for more gains.

Origin: XM