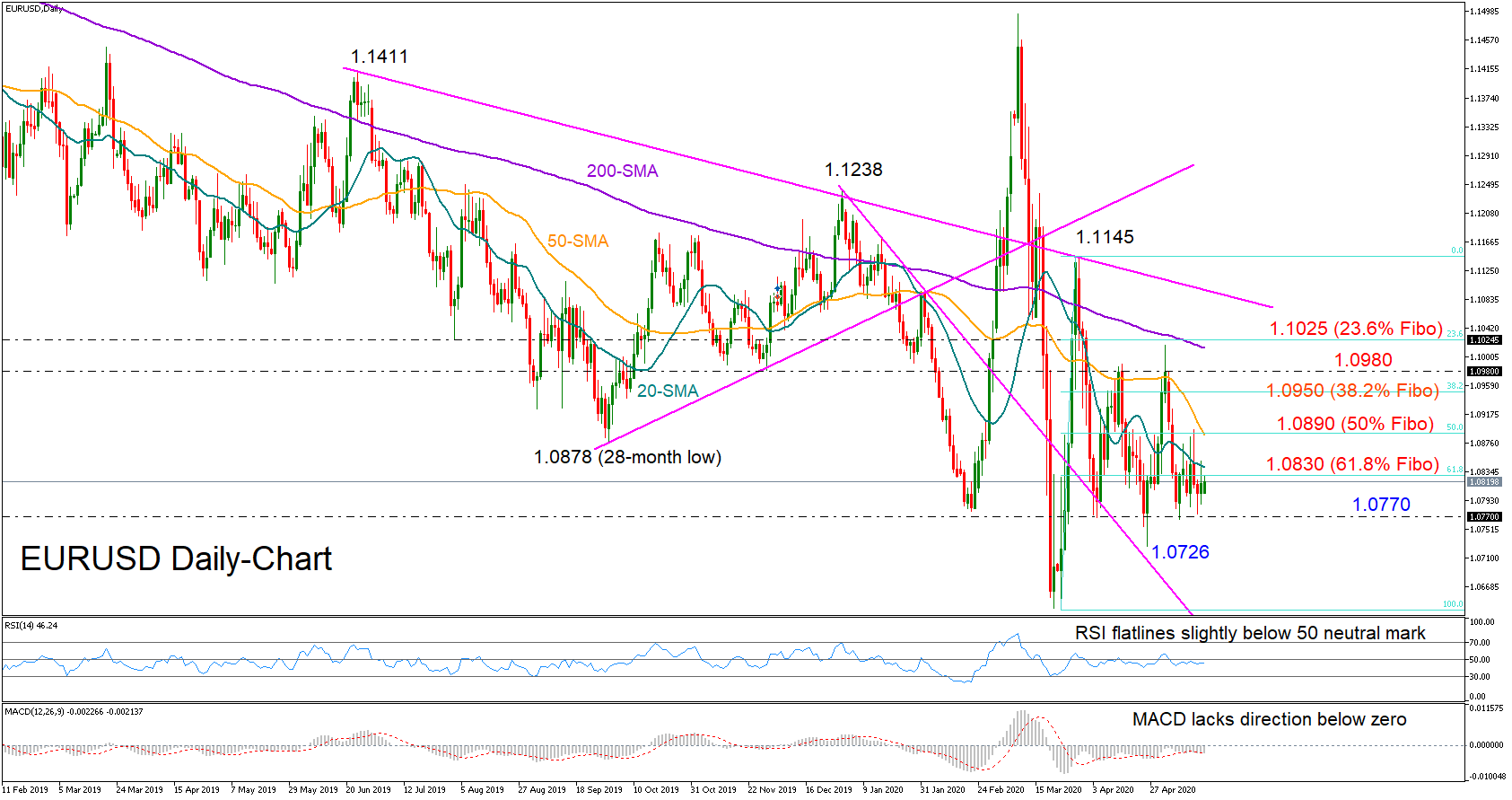

EURUSD has been in a tighter range the past week, maintaining its two-month old trendless style within the 1.0770 and 1.0890 borders while also being unable to sustain strength above the 20-day simple moving average (SMA).

EURUSD has been in a tighter range the past week, maintaining its two-month old trendless style within the 1.0770 and 1.0890 borders while also being unable to sustain strength above the 20-day simple moving average (SMA).

With the RSI and the MACD showing no sign of improvement in the bearish area, there is little optimism for a meaningful rally.

Still, some buyers could return to the market if the pair manages to clear the 20-day SMA currently approaching the 61.8% Fibonacci retracement of the upleg with a low at 1.0635 and a high at 1.1145. A rally above the 50-day SMA and the 50% Fibonacci of 1.0890 may prove more valuable as such a move would open the way towards the 1.0950-1.0980 restrictive area, a break of which could subsequently allow the retest of the 200-day SMA and the 23.6% Fibonacci of 1.1025.

On the downside, sellers are waiting to take control below the 1.0770 base. Should this happen, the spotlight will turn to April’s low of 1.0726, where any violation could bring the three-year trough of 1.0635 back into view. Lower, it would be more interesting to see if the descending trendline stretched from the 1.1238 high can act as a tough support, stopping the two-year old downtrend from extending to fresh bottoms.

In short, EURUSD is expected to attract positive traction above its 20- and 50-day SMAs, while a drop below the 1.0770 base could trigger a new bearish wave. Otherwise, the pair is likely to keep its neutral status.

Origin: XM