Virus slowdown and stimulus talk: Music for stocks

Virus slowdown and stimulus talk: Music for stocks

Markets continue to price in an improvement in the global economy, with Wall Street rallying 7% on Monday and futures pointing to a higher open today as well, amid signs that the pandemic might have peaked in the worst-hit European countries. In fact, both Europe and the US have made clear progress lately as the growth rate of new infections has declined substantially, fueling optimism that the costly lockdowns are bearing fruit and that these economies might reopen in the coming weeks.

On top of that, stocks got a helping hand from expectations for another multi-trillion dollar US rescue package. The White House and Congressional leaders reportedly signaled to Wall Street executives that the next round of fiscal stimulus could total $1.5 trillion and be delivered by mid-May. A few hours later, House Democratic leader Nancy Pelosi told her fellow lawmakers that the new package could ‘easily’ cost more than $1 trillion.

With both political parties clearly in favor of ramping up the stimulus dose, it’s probably only a matter of when, not if, more fiscal support will arrive. That turbocharged equities as investors priced in a less severe recession for the US economy.

All told, while this rebound could continue for now, it’s still difficult to say that the worst is behind us and that rosier days lie ahead for markets. While the virus saga is clearly improving, markets seem to be underplaying the economic fallout of these lockdowns in the longer run.

Many believe things will go back to normal relatively quickly once all these economies reopen. Perhaps, but that’s looking less likely by the day. With unemployment rising so quickly, this crisis could leave its marks on consumer habits and economies for years to come, laying the foundations for a slow and potentially muted recovery. That doesn’t seem to be priced in yet.

Gold climbs as deficit hawks have left the building

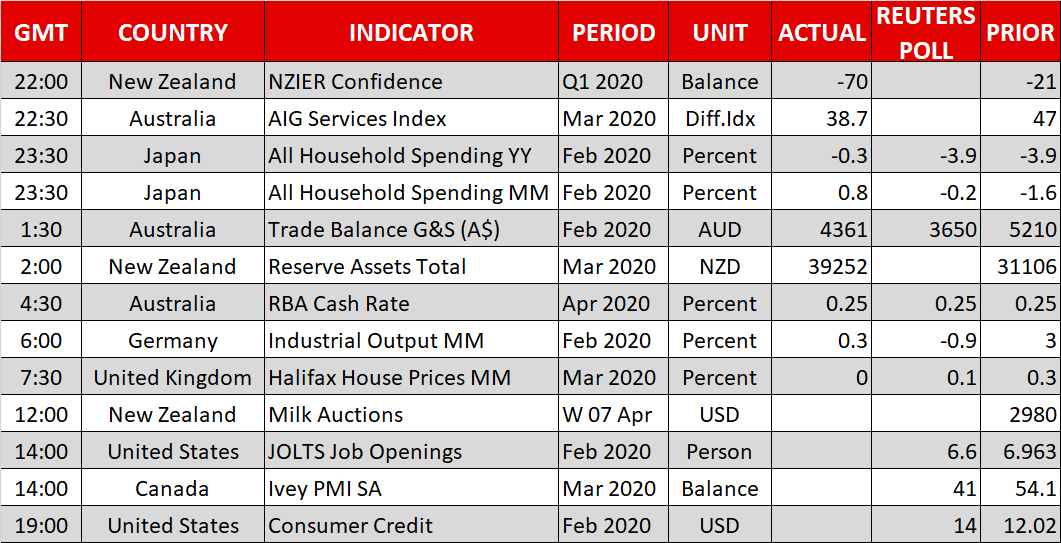

In the FX realm, the cheerful mood is translating into substantial gains for the beaten down commodity-linked currencies, namely the loonie, kiwi, and aussie. The latter got an additional lift after the RBA kept its policy unchanged earlier today and hinted at a slowdown in its QE purchases ‘if conditions improve’. Meanwhile, the dollar and yen are on the retreat, as traders trim their defensive exposure.

The odd one out from all of this was gold. Bullion posted very substantial gains, signaling 1) that some investors are using this stock rally as an opportunity to hedge their riskier bets and 2) that the explosion in government deficits has reawakened fears of debt monetization and currency debasement.

Deficits hawks have apparently left the building, and while that’s good news for short term economic growth, it’s even better news for gold prices in the long term. Coupled with rock bottom interest rates, endless QE, and an uncertain economic outlook, this looks like the elixir for bullion.

Eurogroup meeting: Time for Eurobonds?

As for today, markets will keep a close eye on the meeting of the EU finance ministers. The focus will be on the prospect of a Eurozone-wide fiscal package to help cushion the economic blow. Specifically, will they finally agree on the creation of a common debt instrument to fund this stimulus, a so-called ‘coronabond’?

This could be crucial for the euro. While it’s unlikely this will be agreed today, as Germany and the Netherlands are still opposed to the whole concept of risk sharing, the creation of a de-facto Eurobond could be a game changer. It would remove a good chunk of the institutional and political risk premium embedded in the euro.

Origin: XM