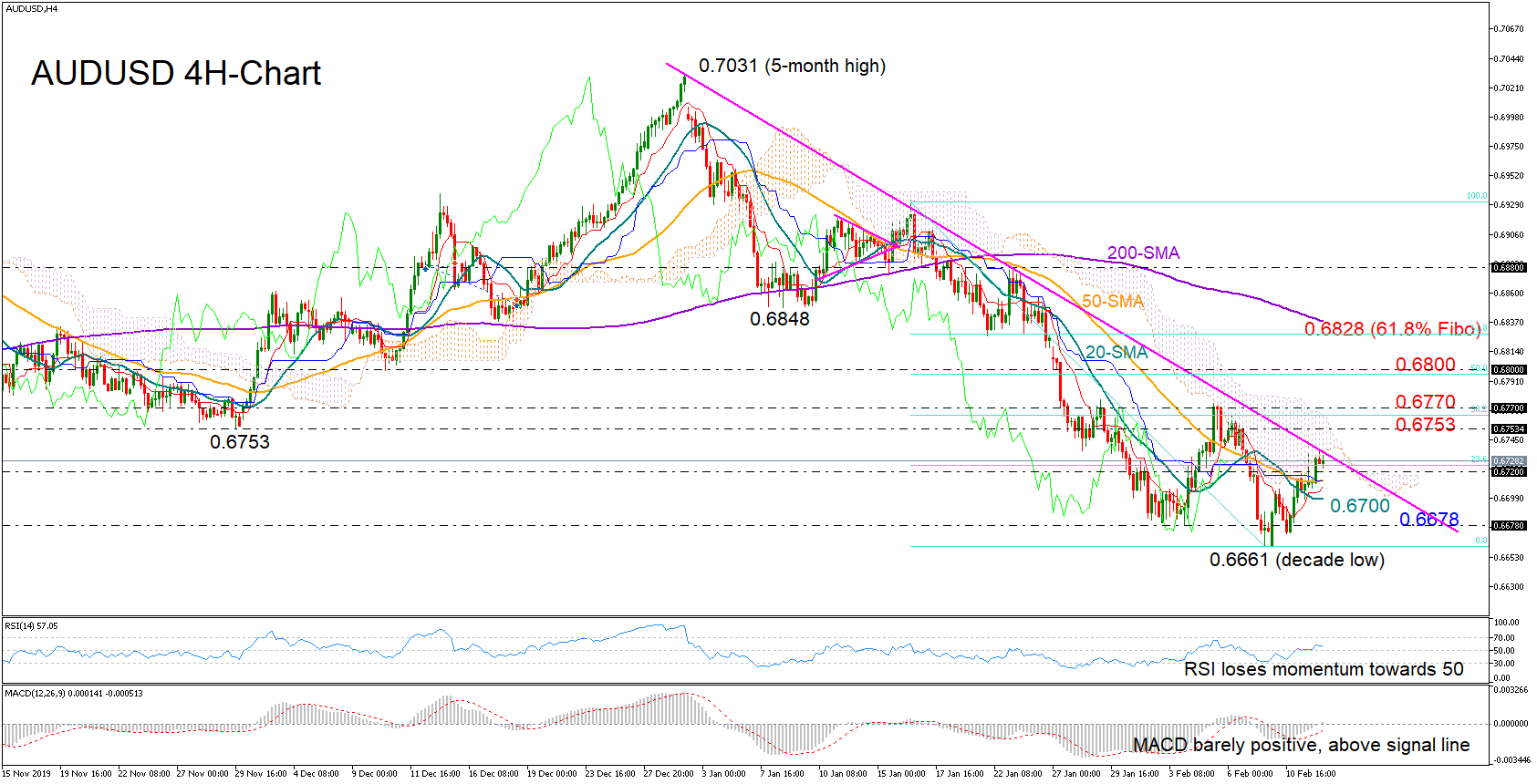

AUDUSD earlier this week escaped from a more-than-a-decade low of 0.6661 to bounce back into the 0.6700 territory.

AUDUSD earlier this week escaped from a more-than-a-decade low of 0.6661 to bounce back into the 0.6700 territory.

While the RSI and the MACD on the four-hour chart have entered bullish territory, both indicators have yet to show strong momentum above their neutral levels, bolstering the case of a neutral to-positive session in the short-term.

Besides, for the bulls to return to the game, the price should break above the resistance trendline stretched from the 0.7031 peak and pierce the bottom of the Ichimoku cloud, which also seems to be a hurdle.

In the event of a significant rally above the descending trendline, the price could initially pause within the 0.6753-0.6770 area that encapsulates the 38.2% Fibonacci of the downleg from 0.6932 to 0.6661 and the November low. Running above its previous peak, the pair could gain extra buying traction, with the focus shifting towards the 0.6800 mark which is marginally above the 50% Fibonacci. Another leg up could cement the recent rebound and push resistance up to the 61.8% Fibonacci of 0.6828.

On the flip side, sellers could take over if weakness extends below the 20-day simple moving average (SMA), opening the door for the important 0.6678-0.6661 support region. A decisive closure below that floor could set the stage for a sharper decline probably towards the 0.6500 and 0.6400 psychological levels.

Meanwhile in the bigger picture, the market continues to follow a downtrend despite its latest rebound and only a bullish run above 0.6770 would bring the bearish wave into question.

Summarizing, AUDUSD is expected to trade neutral in the short-term unless it closes significantly above the descending trendline. A sharper increase above 0.6770 is needed to raise hopes for an uptrend.

Origin: XM