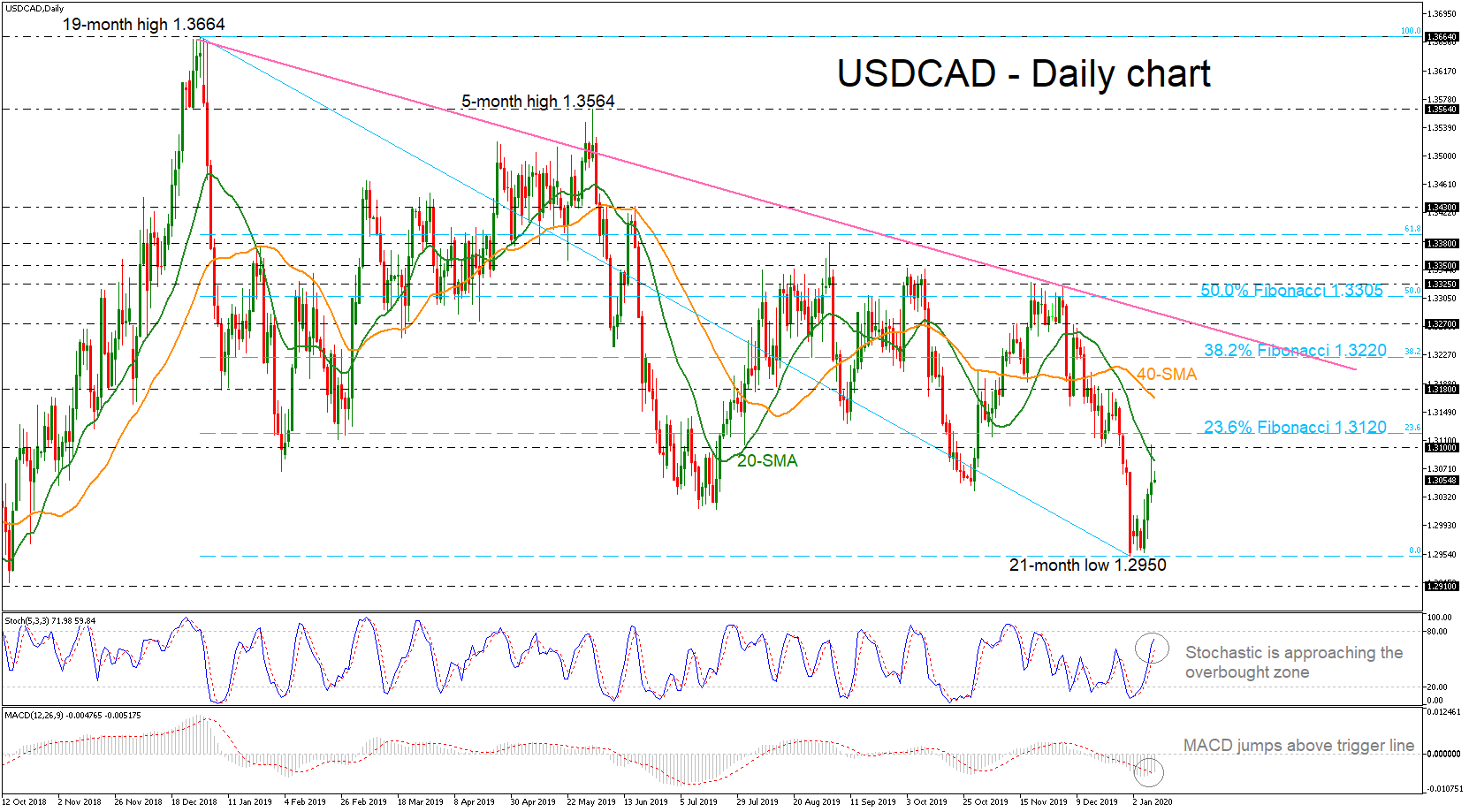

USDCAD recorded its third day of gains after a failed attempt to break significantly below the 21-month low of 1.2950 on Tuesday. In the longer-term timeframe, the pair is still moving in a bearish direction.

USDCAD recorded its third day of gains after a failed attempt to break significantly below the 21-month low of 1.2950 on Tuesday. In the longer-term timeframe, the pair is still moving in a bearish direction.

Chances for a short-term reversal are increasing as the stochastic oscillator is approaching its overbought territory. Moreover, the MACD posted a bullish crossover with its trigger line in the bearish area, suggesting a possible upside correction. However, the pair hit the 20-period simple moving average (SMA), which stands near the 1.3100 handle and ended the day below it on Thursday.

In case of a continuation of the rebound and a successful climb above 1.3100 and the 23.6% Fibonacci retracement level of the downward wave from 1.3664 to 1.2950 near 1.3120, the pair could flirt with the 40-period SMA currently at 1.3167 and the 1.3180 resistance. Another step higher could enable the pair to reach the 38.2% Fibo of 1.3220, which holds around the one-year downtrend line.

In the alternative scenario, a move lower could challenge the 1.2950 support level again. Slightly below this, the 1.2910 barrier, taken from October 2018, could attract traders’ attention before moving sharply lower until the 1.2780 zone, registered on September 2018.

All in all, the price needs a strong push higher to create further gains above 1.3100 in the very short-term.

Origin: XM