Today we want to focus on the USD/CAD, and the upcoming release of Canadian inflation data. After recent data showed a negative print (MoM) in June for the first time since last December, combined with oil prices not gaining significant momentum over the month of July and rising fears of a further escalation in the trade war between the US and China, it will be interesting to see if Canadian inflation can fulfil the current projection of 0.2%.

Today we want to focus on the USD/CAD, and the upcoming release of Canadian inflation data. After recent data showed a negative print (MoM) in June for the first time since last December, combined with oil prices not gaining significant momentum over the month of July and rising fears of a further escalation in the trade war between the US and China, it will be interesting to see if Canadian inflation can fulfil the current projection of 0.2%.

In our opinion, every print below 0.2% would potentially result in rising speculation of a dovish BoC by September 4, and the central bank is openly concerned about the trade dispute between the US and China at the last July meeting.

While the latest economic indicators were on track on with Canadian inflation being on target, any disappointing print could, in combination with the global economic slowdown and increasingly dovish central banks around the globe force the BoC to join this rhetoric and result in a push lower in the CAD.

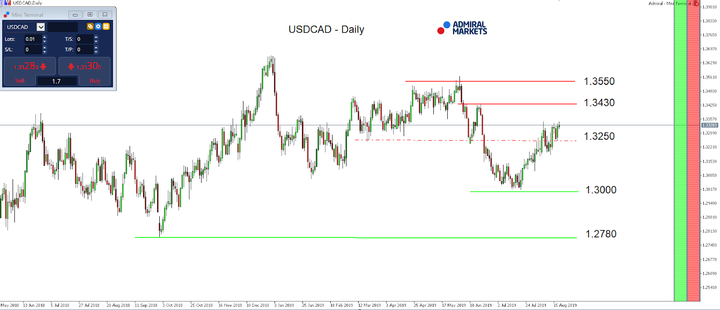

That said, a print below 0.2% (MoM) could push the USD/CAD back above 1.3300, levelling the path up to 1.3550, stop-over around 1.3420/50.

If, on the other hand, inflation comes in above expectation, the currency pair could see another test of the region around 1.3000, since market participants could await the BoC to stick to a “wait-and-see”-approach at the next meeting.

Origin: Admiral Markets