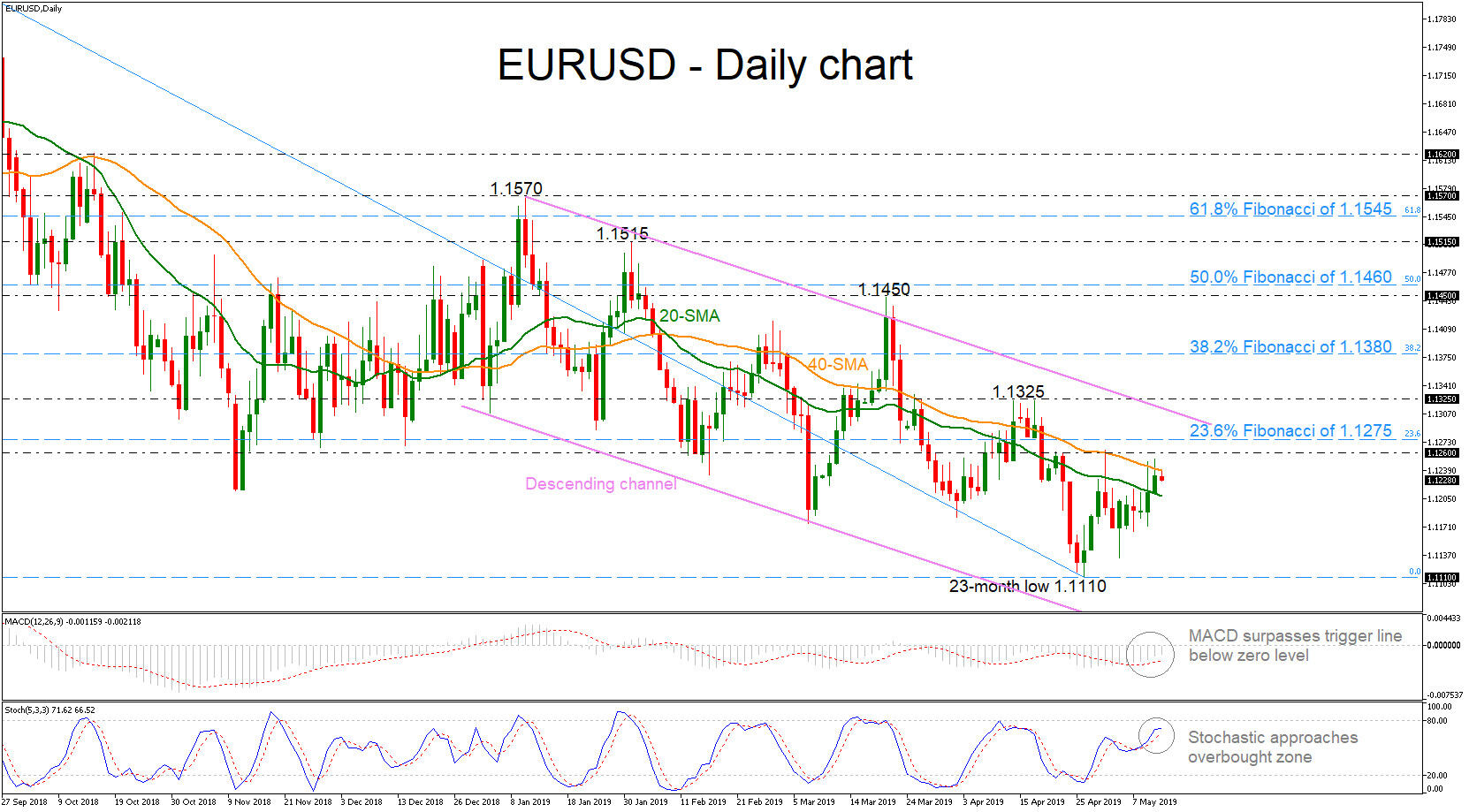

EURUSD has reversed back up again after finding support at the 23-month low of 1.1110, achieved on April 26. The price is hovering within the 20- and 40-simple moving averages (SMAs) in the daily timeframe, remaining within the four-month descending channel. Momentum indicators are pointing to positive bias in the short term with the MACD just above the trigger line in the negative territory and the stochastic oscillator approaching the overbought zone.

EURUSD has reversed back up again after finding support at the 23-month low of 1.1110, achieved on April 26. The price is hovering within the 20- and 40-simple moving averages (SMAs) in the daily timeframe, remaining within the four-month descending channel. Momentum indicators are pointing to positive bias in the short term with the MACD just above the trigger line in the negative territory and the stochastic oscillator approaching the overbought zone.

Further gains should see the May 1 high around 1.1260 acting as a major resistance before flirting with the 23.6% Fibonacci retracement level of the dowleg from 1.1815 to 1.1110 near 1.1275. A break above this level could open the way towards the 1.1325 resistance and the downtrend line, while a successful jump above these lines could switch the bearish outlook to neutral.

In the event of a downside reversal, the 20-SMA currently at 1.1207 is coming into focus ahead of the 23-month trough of 1.1110. A drop below this hurdle would reinforce the bearish structure in the medium-term, hitting the 1.0900 psychological level, identified by the peak on March 2017.

In brief, EURUSD traders should wait for a jump above the 40-day average to continue the short-term positive orders. Only a clear violation of the downward sloping channel around 1.1325 could open the door for a switch to a longer-term bullish bias.

Origin: XM