Trade hopes rise as US-Sino negotiations conclude

Trade hopes rise as US-Sino negotiations conclude

Trade headlines will top market interest on Tuesday as Chinese and US officials conclude their two-day meeting in Beijing. This is the first face-to-face contact after Trump and Xi Jinping agreed at the G20 summit on December 1 to a ceasefire on new tariffs until March 1 and investors are hopeful that the two sides could be in a rush to reach common ground as negative economic consequences have started to emerge, especially in China.

Optimism heightened even further on Monday after the Chinese Vice Premier, Liu He made a surprise appearance at the vice-ministerial level trade talks, a potential sign that Beijing is willing to strike a deal with the US. In the same day, the US Commerce Secretary, Wilbur Ross, stated that both governments could reach an agreement that “we can live with” encouraging markets even more that the outcome of the negotiations will be positive.

In the aftermath, the Dow Jones and S&P 500 closed with moderate gains on Monday, while on Tuesday stocks in Asia traded mixed, with Japanese equities moving in positive territory and Chinese ones in the negative despite China releasing more liquidity on Friday. This indicates that investors are not totally convinced that trade negotiations could make rapid progress, probably asking for more clues in advance of stepping up buying orders.

Moreover, the notion that the Fed may not deliver two rate hikes in the new year seems to be supporting investor sentiment during the past few months, though a lot of uncertainty remains and hence volatility is expected to continue to trouble markets until the Fed gives a clear rate guidance. FOMC meeting minutes due for release on Wednesday are next in line to impact market rate projections. Recall that the US services sector grew at a slower pace in December according to the ISM non-manufacturing survey on Monday, though it did not deteriorate as much as the manufacturing industry did.

Dollar rebounds after three days of drops, antipodeans weaken despite trade news

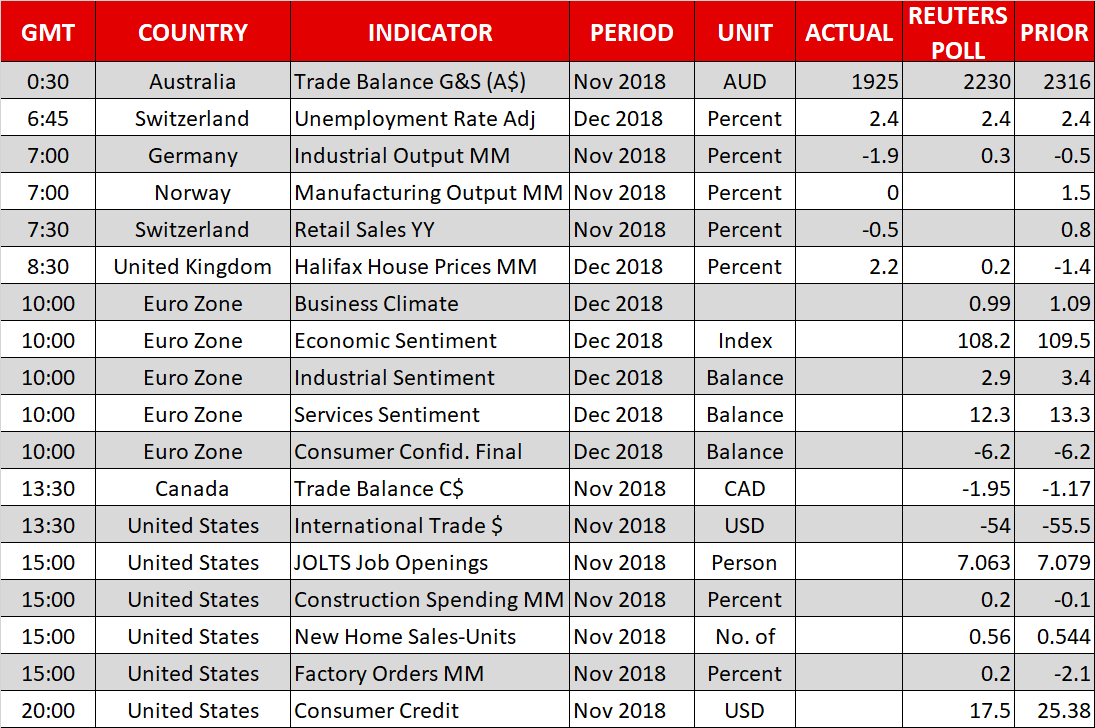

In FX markets, the dollar was on the recovery on Tuesday against six major currencies, with dollar/yen crawling up to 109 after almost a week. The antipodeans, though, which had a respectful rally the previous two days, reversed to the downside despite optimistic trade headlines. The kiwi declined by 0.25% while the fall in the aussie was double that percentage probably due to missing concrete proof of progress in the trade talks. Weaker-than-expected trade stats out of Australia probably weighed on sentiment as well. The data showed that the Australian trade surplus narrowed for the second consecutive month in November, while October’s number was revised downwards.

Besides trade, investors will be also watching political developments in the US as fears over a government shutdown persisted for the 17th day on Monday, with public services operating partially as many federal workers could miss their paycheck this week. President Trump and Democrats did little to resolve their budget differences mainly due to Democrats’ strong opposition on the funding of the border wall. Specifically, the US President is asking for $5.6 billion, while Democrats are only willing to accept $1.3 billion for border security but nothing for a wall.

The debate is expected to continue later in the day, with Trump’s TV address at 9 p.m. on Tuesday (0200 GMT Wednesday ) eagerly awaited.

Brexit keeps pressuring buying interest in Europe; Eurozone economic sentiment index pending

Turning to Europe, market confidence remained weak as the Brexit issue kept investors cautious, with the pound and the euro paring yesterday’s gains against the greenback. While questions remain about whether May will manage to achieve more concessions from the EU, the Daily Telegraph reported that EU and British Officials are discussing the possibility of postponing the exit date amid concerns that the British Parliament will not approve it by March 29. According to the BBC, the Brexit vote in Parliament is expected to take place on January 15.

Monetary policy is another puzzle in Europe. The BoE is not willing to raise interest rates until it gets more clarity on Brexit, while the ECB, which terminated its asset purchase program in December, has promised that a rate hike would only come after the summer of 2019. Yet markets are not certain if the latter will stay on course as policymakers failed to drive core inflation towards the 2.0% price target in 2018. Earlier today, data showed that German industrial output posted its biggest decline in two years in November, while later in the day the focus will shift to the Economic sentiment index due at 1000 GMT. Yesterday the Sentix investor confidence index for the month of January indicated that pessimism among investors increased but by less than analysts predicted.

Origin: XM