Here are the latest developments in global markets:

Here are the latest developments in global markets:

FOREX: The dollar index is down fractionally on Tuesday (-0.08%), extending the notable losses it posted in the previous session, unable to attract safe-haven inflows even despite a fresh escalation in the US-China trade standoff. The pound gained ground on Monday alongside the euro as investors positioned for an EU summit that commences tomorrow, with expectations for a Brexit breakthrough riding high.

STOCKS: US markets closed in the red on Monday, weighed down by a fresh escalation in the Sino-American trade skirmish, with the tech sector leading the way lower. The tech-heavy Nasdaq Composite (-1.43%) underperformed as major names like Apple (-2.66%), Amazon (-3.16%), Netflix (-3.90%) and Twitter (-4.18%) got slammed. Outside of tech though, losses were rather contained, with the benchmark S&P 500 (-0.56%) and the Dow Jones (-0.35%) not feeling as much heat. Turning to Asia, most indices surprisingly ended well in the green on Tuesday, perhaps due to the size of the announced US tariffs being smaller than previously touted. Japan’s Nikkei 225 (+1.41%) and Topix (+1.81%) climbed on their first day back from a holiday, while in Hong Kong the Hang Seng rose by 0.49%. Markets in China and South Korea were also higher. In Europe, most benchmarks were set to open lower today, futures suggest.

COMMODITIES: Oil is lower on Tuesday, as trade tensions between the world’s two largest economies returned to the forefront, casting a long shadow on the outlook for future crude consumption. WTI is down by 0.33% at $68.81 per barrel, while Brent shed 0.47% of its value, trading at $77.76/barrel. Crude prices could remain sensitive to any updates in the trade skirmish, particularly in case China “strikes back” soon. In precious metals, gold is lower by a marginal 0.06% at $1197 per troy ounce today, continuing to exhibit no interest in any developments on the trade front, and remaining in a narrow range between $1189 and $1214.

As had been broadly expected, the Trump administration announced yesterday that it will impose a 10% tariff on $200bn worth of Chinese goods, effective from September 24. From 2019 onwards, these tariffs will be raised to 25%. The delay is apparently aimed at giving US businesses some precious time to reconfigure and adjust their supply chains, before the increased costs really “start to bite”. Interestingly, the inclusion of this new timeframe suggests the US expects this to be a drawn out and prolonged trade skirmish, pouring cold water on expectations for a swift, diplomatic resolution.

Characteristically, Trump also warned that if China retaliates – which the Asian nation has stressed it will – then his administration will pursue new tariffs on another $267bn Chinese products. All in all, Trump seems set to ramp up the pressure to the maximum ahead of the US midterm elections, and with Beijing almost certain to strike back given it does not want to be “bullied around” by the US, tensions may be set to escalate further in the coming weeks. Now, the ball is in China’s court. It will be crucial to see what method and size of retaliation Chinese officials deem appropriate to utilize, and whether the previously-planned talks with the US are now dead in the water.

In terms of market reaction, the magnitude of the moves was not as big as one would have expected following such an escalation – perhaps because the move was well telegraphed in advance, or due to the tariffs being smaller than the expected 25%. US stock markets closed lower, albeit not massively, while safe-haven currencies like the yen were broadly weak, failing to attract substantial inflows. The dollar was the biggest underperformer, ending the day lower across the board even despite growing trade risks, which until recently had been supporting the currency.

The biggest outperformers in Monday’s session were actually the pound and euro, in that order. Both currencies climbed as investors seem to be positioning for a favorable outcome at this week’s EU summit, which is likely to set the stage for what to expect from the Brexit negotiations through the fall. Some even suggest this event could be the “turning point” for the talks, though to be fair, until a realistic solution to the Irish border issue is presented such optimism may be unfounded.

Elsewhere, aussie/dollar is higher by nearly 0.50% today, after the RBA struck a somewhat optimistic tone in the minutes of its latest meeting released overnight, reiterating that the next moves in interest rates is likely to be upward.

Following the tariff announcement by the US president late on Monday, who triggered an additional 10% tariff against Chinese imports worth approximately $200 billion, eyes will now turn to China. Investors are waiting eagerly to see whether Beijing will continue the already-inflamed trade dispute by taking countermeasures as well, and what would be the size of a potential retaliation. However, based on latest stats, Chinese orders for US products total around $130 billion, less than a third of what the US purchase from China, generating a question of whether Beijing will simply decide to increase its already-existing tariffs on US imports. Besides that, traders now have bigger concerns that the US could turn even more punitive if Beijing fights back, with the US president warning yesterday that in this case, he would activate further tariffs on $267 billion Chinese goods, including on Apple products. Note that the new 10% import tariff will take effect on September 24, while from January 1 2019, the weigh will increase to 25%. Yet, questions remain on whether China will agree to restart or cancel trade talks with the US.

Brexit will remain under the spotlight as well this week as the UK Prime Minister prepares to meet EU officials in an informal summit in Salzburg, Austria on September 20, where UK’s withdrawal plan will be a highlight in the agenda. While recent headlines support that the EU prefers to avoid a no-deal Brexit, other sources suggest that the EU has not softened its stance. At Thursday’s summit markets could get fresh clues on where the EU stands, six months before UK’s official exit from the trading bloc. Note that yesterday, a report by The Times newspaper raised hopes on the Brexit progress, stating that the EU Brexit negotiator Michel Barnier is working on plans to limit physical checks on the Irish border, a key issue in the Brexit talks.

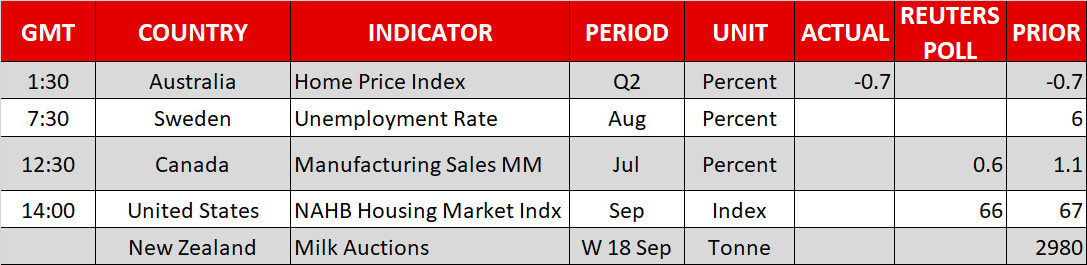

Turning to data releases, Tuesday’s calendar will feature Canadian Manufacturing sales for the month of July at 1230 GMT, while at 1400 GMT, the National Association of Home Builders in the US will publish its Housing Market index which tracks the relative level of current and future home sales. In New Zealand, the outcome of the bi-weekly dairy auction is due at a tentative time.

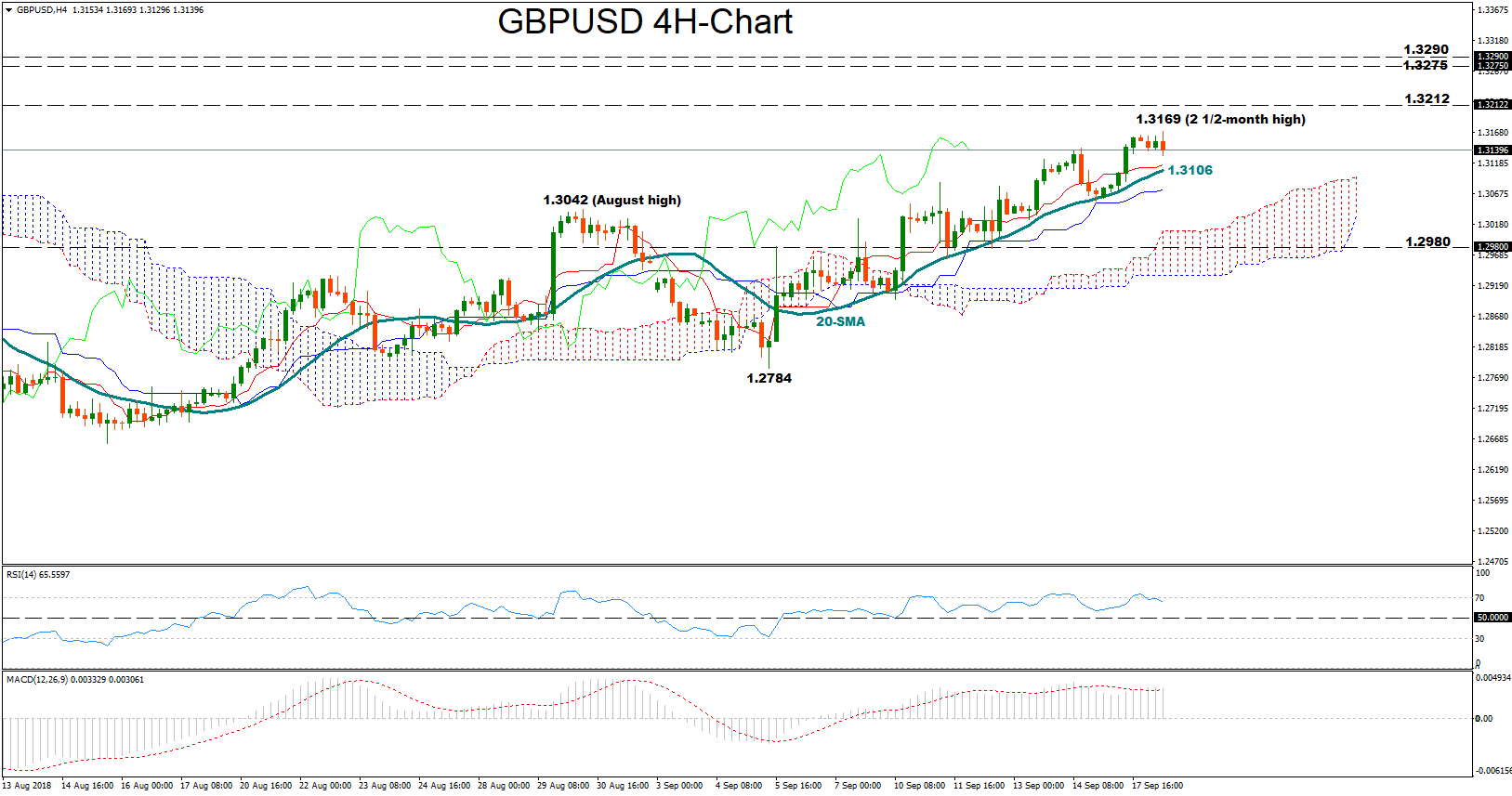

GBPUSD rallied significantly after its drop to 1.2784 on September 5, the lowest level reached since August 20, rising back above the Ichimoku cloud in the 4-hour chart to reach 2 ½ -month highs at 1.3169 today. In the short-term, upside risks are likely to hold as long as the red Tenkan-Sen line continues to fluctuate above the blue Kijun-Sen line and the RSI trends above its 50 neutral mark.

On the upside, the price could retest today’s peak of 1.3169 which acted as a resistance on July 30 as well. Even higher, the bulls may try to break above the 1.3212 where the market paused on July 26, while steeper increases could meet a wall between 1.3275 and 1.3290.

In the alternative scenario, if bearish forces dominate, the price could decline until it meets the 20-period simple moving average currently at 1.3106 which has been restricting downside movements over the past two weeks. A close below that line, however, and specifically a fall below the August peak of 1.3042, could trigger further bearish actions, probably towards the area around 1.2980.

Origin: XM