Here are the latest developments in global markets:

Here are the latest developments in global markets:

FOREX: The US dollar is marginally lower (-0.07%) against a basket of six major currencies on Thursday, extending the losses it posted in the previous session. The British pound was in focus yesterday, having a volatile session that saw sizeable movements in both directions following some conflicting headlines on Brexit. Elsewhere, the Bank of Canada struck a slightly more cautious tone yesterday, as it kept its policy unchanged.

STOCKS: Wall Street had a mixed session on Wednesday, with tech-weakness being the name of the game amid concerns that regulation in the sector is looming. This followed a Senate hearing attended by the CEO of Twitter (-6.06%) and the COO of Facebook (-2.33%), where lawmakers raised the prospect of increased regulation. The tech-heavy Nasdaq Composite (-1.19%) led the charge lower, while the S&P 500 fell only modestly (-0.28%). The Dow Jones, which is less exposed to tech, managed to climb by 0.09%. Futures tracking the Dow, S&P, and Nasdaq 100 are also pointing to a lower open today. Asia was mostly in the red on Thursday too, with Japan’s Nikkei 225 and the Topix edging down by 0.41% and 0.74% respectively. In Hong Kong, the Hang Seng fell 1.30%. In Europe, all the major benchmarks were set to open lower today, futures suggest.

COMMODITIES: Oil prices are lower modestly on Thursday, with WTI and Brent being down by 0.20% and 0.11% respectively, both extending the notable losses recorded yesterday. Sentiment surrounding the energy sector has turned sour, after a storm did not ultimately disrupt US oil production as was expected. On the demand side, a looming escalation in the Sino-American trade conflict, combined with the clouded prospects for EM economies are also weighing on prices. In precious metals, gold is higher by a marginal 0.07% today, trading just a couple of dollars below the $1200/ounce handle. Given the metal’s striking indifference to any political, geopolitical, or trade-related news in recent months, one would expect it to continue mirroring the US dollar’s movements. Namely, to move in the opposite direction of the dollar, as the two are inversely correlated.

The spotlight fell on the British pound on Wednesday, following some Brexit headlines that left investors scratching their heads. Sterling/dollar surged initially, rallying more than 150 pips within minutes, after Bloomberg reported Germany is ready to accept a less detailed agreement on the future trading relationship for now – instead striking a deal on all other issues first to ensure a smooth exit. However, sentiment soon turned around after Reuters cited a German government spokesman saying his nation’s stance on Brexit hasn’t changed. The pound came back down, with euro/sterling finishing the day flat, while sterling/dollar still managed to close higher amid some dollar-softness. Overall, despite some sterling-shorts being liquidated, nothing drastic appears to have changed in the broader Brexit narrative for now, with the pound likely to remain ultra-sensitive to any fresh developments.

The Bank of Canada (BoC) kept interest rates yesterday, sending mixed policy signals. On the bright side, officials appeared more upbeat on the economy, noting that recent data “reinforce” their view that higher rates will be warranted. However, policymakers also indicated they are “monitoring closely the course of NAFTA negotiations” – the first time such a reference was included in a statement. On the margin, investors interpreted these signals as being mildly dovish, paring back their bets for a rate hike at the next meeting in October. The market-implied probability for such an action fell to 60% from 78% previously, according to Canada’s overnight index swaps. The loonie fell modestly on the decision, but ended the day higher against the dollar as the US currency retreated in general. Now, all eyes turn back to the NAFTA talks, which resumed yesterday.

Elsewhere, news flow was relatively light. Aussie/dollar underperformed, down by nearly 0.25% on Thursday even despite a weak greenback, following news that more Australian commercial banks have raised the mortgage rates they offer to consumers. Effectively, this has similar effects to an RBA rate hike and hence, should be a worrisome development for policymakers. Namely, it squeezes the income of households, weighing on spending.

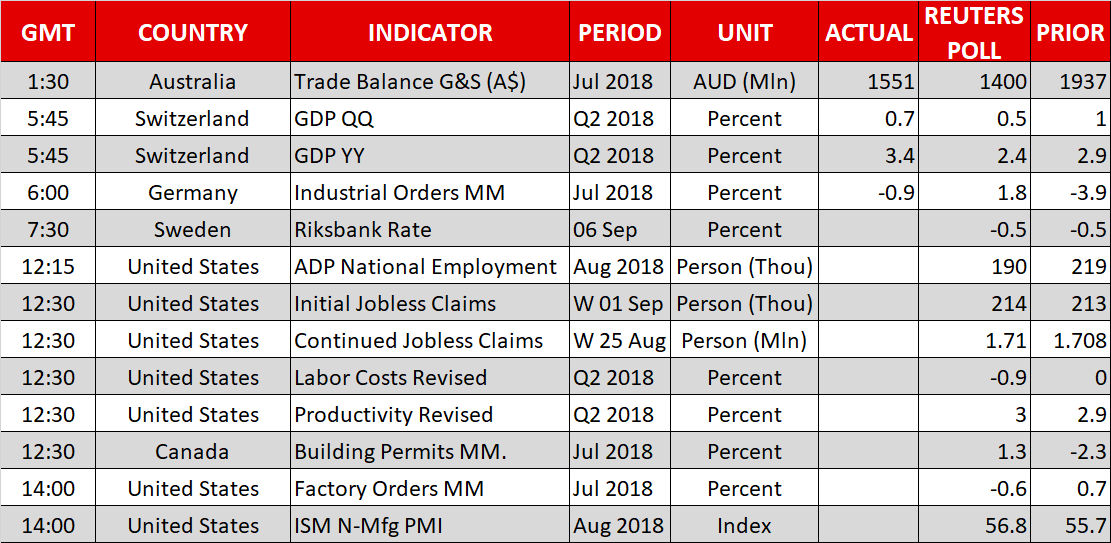

Some notable data prints out of Thursday’s calendar are employment figures out of the US private sector, as well as the ISM services PMI. Meanwhile, trade and Brexit developments will again be closely monitored.

Krona pairs will come to the fore as the Riksbank’s decision on monetary policy is made public at 0730 GMT. No change in rates is expected, with the focus falling on the Swedish central bank’s rate guidance. The Bank signaled in the past that it would deliver a rate increase before the end of the year. Should the timing for a hike be pushed later in time then the krona is likely to come under pressure. A press conference featuring the Bank’s governor will follow at 0900 GMT.

The ADP’s national employment report for positions added to the US economy by the private sector will be released at 1215 GMT. An addition of 190k positions is projected, below July’s 219k but nevertheless a health figure. The ADP data are seen by some as giving insights on the nonfarm payrolls report (due on Friday) which is broader in nature as it covers both the public and private sectors. It bears mention though that the two reports are not as closely correlated lately.

Also out of the US, weekly jobless claims data will be hitting the markets at 1230 GMT, alongside the figures on Q2 productivity and labor costs. Later (1400 GMT), July’s factory orders and the ISM’s services PMI for August are slated for release. Orders are forecast to contract by 0.6% m/m, after rising by 0.7% in June, while the services PMI is expected to rise to 56.8 from 55.7 in July. It remains to be seen whether the latter will maintain the positive momentum from earlier in the week when a surprisingly strong ISM manufacturing PMI for August came in at its highest in 14 years.

Canadian building permits for July are due at 1230 GMT. Of more importance for the loonie though are ongoing talks for a new North American trade deal.

Remaining on trade, the public comment period for proposed US levies on an additional $200 billion of Chinese imports expires today. President Trump signaled that once this period is over his administration is ready to push forward with new tariffs; a fresh escalation in the Sino-US trade dispute may thus be imminent.

Elsewhere, Brexit updates will be closely followed, after Germany and the UK appeared to be finding common ground for a deal.

ECB member Sabine Lautenschlager will be giving a speech at 1145 GMT, while New York Fed President John Williams, who holds permanent voting rights within the FOMC, will be participating in a chat at 1400 GMT. Moreover, Bank of Canada Senior Deputy Governor Carolyn Wilkins will be talking at 1845 GMT. Also of interest may be a meeting between French President Emmanuel Macron and the Prime Minister of Luxembourg Xavier Bettel on the future of the EU at 1500 GMT.

In energy markets, weekly EIA data on US crude stocks are due at 1500 GMT.

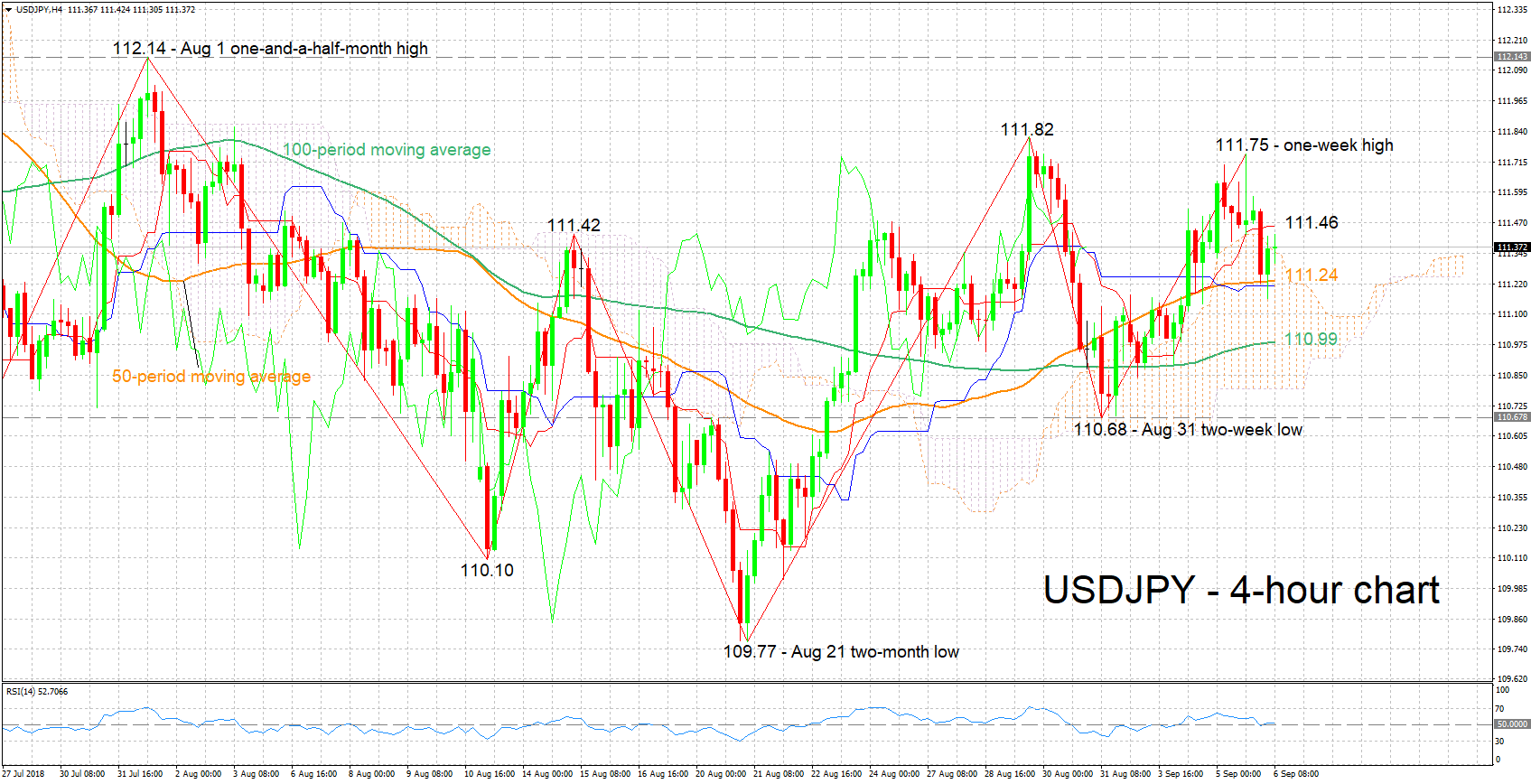

USDJPY lost some ground after climbing to a one-week high of 111.75 on Wednesday. The Tenkan- and Kijun-sen lines are positively aligned though they both have eased (the latter is flat), overall projecting a mostly neutral picture in the short-term. The RSI, which is largely moving sideways close to its 50 neutral level, is also supporting this view.

Overall positive data out of the US are likely to boost the pair. A move above the Tenkan-sen at 111.46 would turn the focus to yesterday’s one-week high of 111.75; the area around this includes another peak from the recent past. Not far above lies the August 1 one-and-a-half-month high of 112.14 which may also act as a barrier to price gains.

Downbeat US releases may push USDJPY lower. Support may come around the current level of the 50-period MA at 111.24; the zone around this includes the Ichimoku cloud top (111.35) and the Kijun-sen (111.21). Not far below lies the 100-period MA at 110.99, with the 111 round figure and the Ichimoku cloud bottom (110.79) being part of the area around it. Lower still, the two-week low of 110.68 from late August would be eyed.

Trade developments also have the capacity to move the pair.

Origin: XM