Here are the latest developments in global markets:

Here are the latest developments in global markets:

FOREX: The dollar’s index against a basket of currencies was on its third straight day of advancing on Thursday – up by a bit less than 0.2% – after it was supported the previous day by the Federal Reserve’s positive assessment of the US economy.

STOCKS: The Dow Jones and the S&P 500 retreated by 0.3% and 0.1% respectively on Wednesday, as US-China trade tensions which were front and center weighed on sentiment. The Nasdaq Composite however advanced by 0.5%, as tech sentiment was bolstered by positive results by Apple; its stock gained 5.9% to close at a record high. Meanwhile, Asian equities declined on trade fears. The Japanese Nikkei 225 and Topix indices both fell by 1.0%, with Chinese stocks being deepest in losses. Hong Kong’s Hang Seng tumbled by 2.1%. Futures markets were projecting a lower open for major European indices, with contracts on the Dow, S&P and Nasdaq 100 also in the red at 0646 GMT.

COMMODITIES: WTI was up by 0.3% at $67.86 per barrel, after retreating to touch a two-week low of $67.31 on Wednesday on the back of a surprise build in US crude inventories that added fuel to supply considerations. Brent crude traded higher by 0.6% at $72.84 a barrel, after also losing considerable ground yesterday. In precious metals, gold was higher by 0.3% at $1,218.78 per ounce, though it was not far above its lows for the year at around $1,211.

The US currency was further distancing itself from last week’s three-week low of 94.084 against a basket of currencies. The Fed remaining on course to continue normalizing policy on the back of optimism about the economy, as well as a rise in Treasury yields, lifted the currency; ten-year Treasury notes exceeded 3% for the first time since June on Wednesday before retreating to marginally below that level on Thursday.

Sino-US trade tensions are back on the table, weighing on riskier assets such as equities and having implications for FX markets as well. The offshore yuan weakened versus the dollar, with USDCNH trading close to its highest since late June 2017 of 6.8566 hit last week. Developments will be eyed, with US officials saying on Wednesday that President Trump is proposing a 25% tariff on $200 billion worth of Chinese imports, instead of the initial 10%. The actions can be described as somewhat puzzling given that they come just as the two parties were testing the waters as regards reentering trade talks.

Despite the dollar index edging higher, the USD was slightly lower versus the yen which was elevated after 10-year Japanese government bond yields reached a fresh one-and-a-half-year high, following the Bank of Japan’s decision to allow yields to move more freely earlier in the week. Still, the Bank intervened in the markets to prevent yields from excessively rising.

The euro was down by 0.2% versus the dollar at $1.1631. In the meantime, pound/dollar was trading lower by 0.25%, below the 1.31 mark ahead of the conclusion of the Bank of England’s meeting on monetary policy (see below).

Australia’s trade surplus handily beating expectations did not help the currency, which was facing pressure due to a deteriorating outlook on global trade; AUDUSD was down by 0.25%, with the also commodity-linked kiwi lower by 0.2% against the greenback.

Elsewhere, the Turkish lira hit a fresh record low as the US implemented sanctions on Turkey over the imprisonment of an American pastor; USDTRY climbed above the 5 handle.

The Bank of England (BoE) will be deciding on monetary policy later today. Markets are expecting the Bank to raise benchmark rates by a quarter percentage point to 0.75% (1100 GMT) with the probability for such an action standing at around 91% according to UK OIS. Since a rate increase has been already mostly priced in, the focus will turn to the voting structure, with investors eagerly awaiting to see whether continuing Brexit and trade uncertainties, as well as some recent weakness in British wage growth, is pushing some policymakers to the dovish side in terms of the rate outlook.

In the previous meeting, six policymakers backed no change in interest rates, while the remaining three voted in favor of a rate rise. Expectations now are for a 7-2 rate hike vote and should this come surprisingly different, the pound could see some fluctuation. In other words, in case a larger number of MPC policymakers support that rates should remain steady, the pound is likely to move south and vice versa. Still, a “dovish” rate hike is not unlikely as the lack of clarity on the Brexit front and growing whispers of a no-Brexit deal not long before Britain’s exit from the EU bloc could turn policymakers cautious on future rate increases. Moreover, risks around the US trade policy which threatens the state of global trade could further complicate matters for policymakers. Commentary on Brexit and trade topics – especially the former – are expected by the BoE chief, Mark Carney, who will be holding a press conference at 1130 GMT. Investors will be also be carefully monitoring the Bank’s inflation forecast report delivered today alongside the rate announcement.

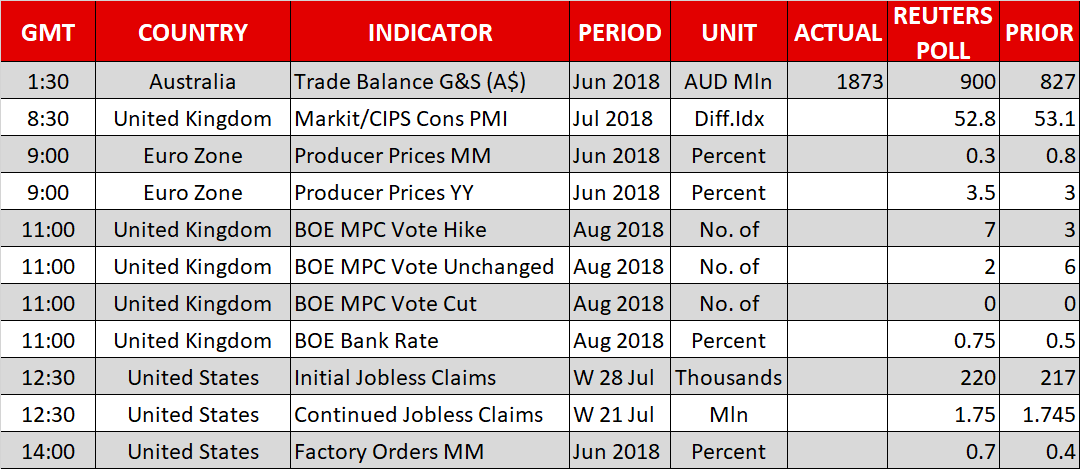

Earlier (at 0830 GMT), the UK’s construction PMI for July is anticipated to ease from 53.1 to 52.8.

Meanwhile in the US, the economic calendar will feature initial jobless claims for the week ending July 28 at 1230 GMT and June’s factory goods orders at 1400 GMT. The numbers are expected to show that initial jobless claims have increased to 220,000 in the aforementioned period compared to 217,000 seen in the previously tracked week, while new orders by manufacturers are projected to grow by 0.7% m/m, above May’s 0.4%. Meanwhile, updates on the US-China trade dispute during the day would be eyed.

Elsewhere, producer prices out of the eurozone are due at 0900 GMT and forecasts are for a 3.5% y/y expansion in the month of June, faster than the 3.0% rise recorded in May. On a monthly basis, though, the measure could lose steam, easing from 0.8% to 0.3%. Yet, the euro tends to be less sensitive to PPI figures, therefore the reaction in the forex markets could be soft.

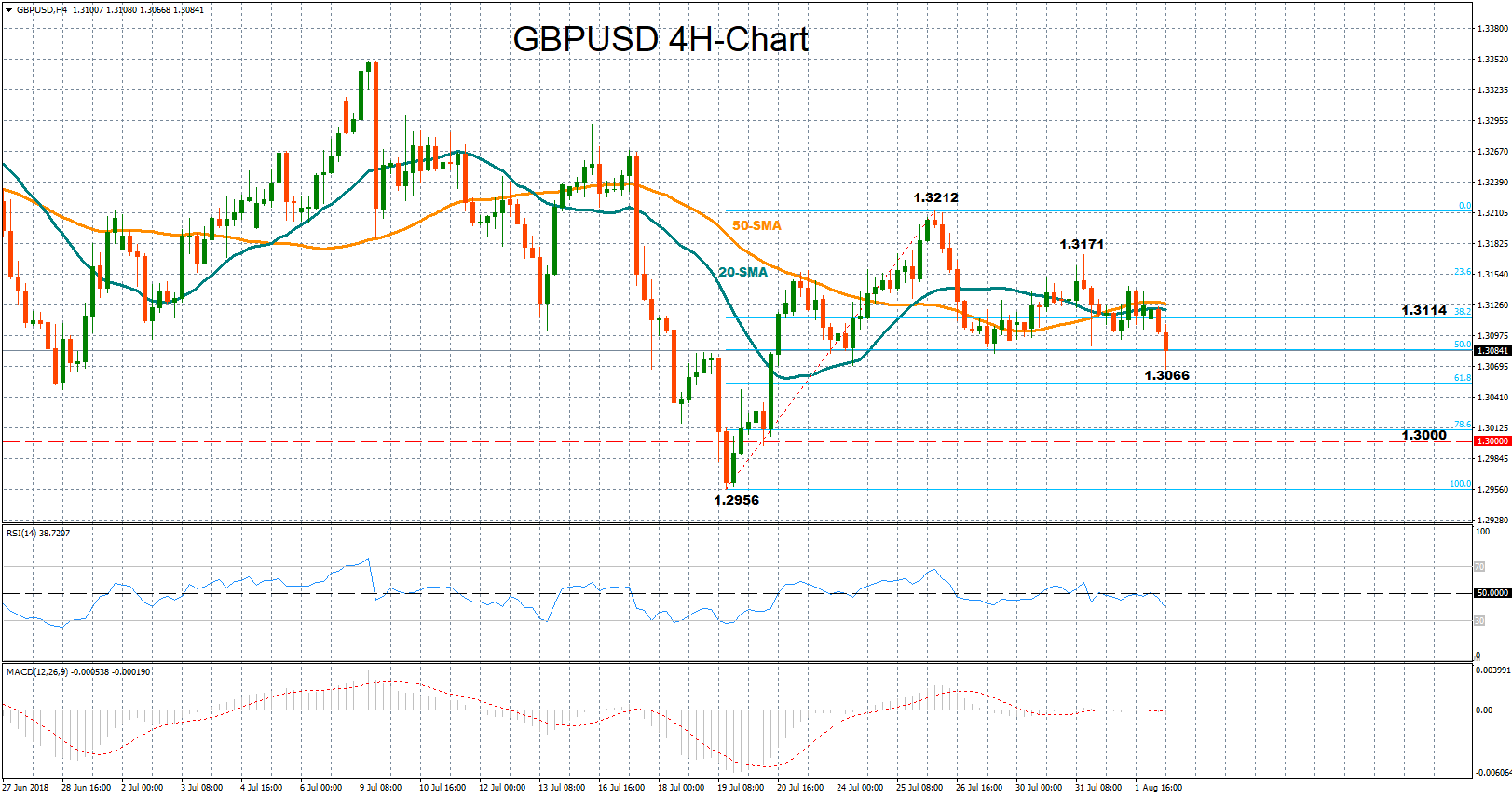

GBPUSD spiked below the 1.3100 key level earlier today to touch a two-week low of 1.3066. With the RSI falling below its neutral threshold of 50, further downside movement could take place. Still sideways moves should not be excluded either as the MACD remains attached around its red signal line near zero.

Should the Bank of England deliver a “dovish” rate hike today, the pair could revisit today’s low of 1.3066 (the 61.8% Fibonacci retracement level of the upleg from 1.2956 to 1.3212 is close to this point) before it tests the region around the 1.3000 psychological level. Steeper declines could also touch July’s trough of 1.2956.

Conversely, if the BoE uses a more hawkish tone, remaining optimistic on the economy and the path of interest rates, GBPUSD could rebound back above the 1.3100 level to test the 38.2% Fibonacci of 1.3114. Even higher, the market could try to break the 23.6% Fibonacci of 1.3151, while stronger bullish actions could find resistance at July’s 26 peak of 1.3212.

Origin: XM