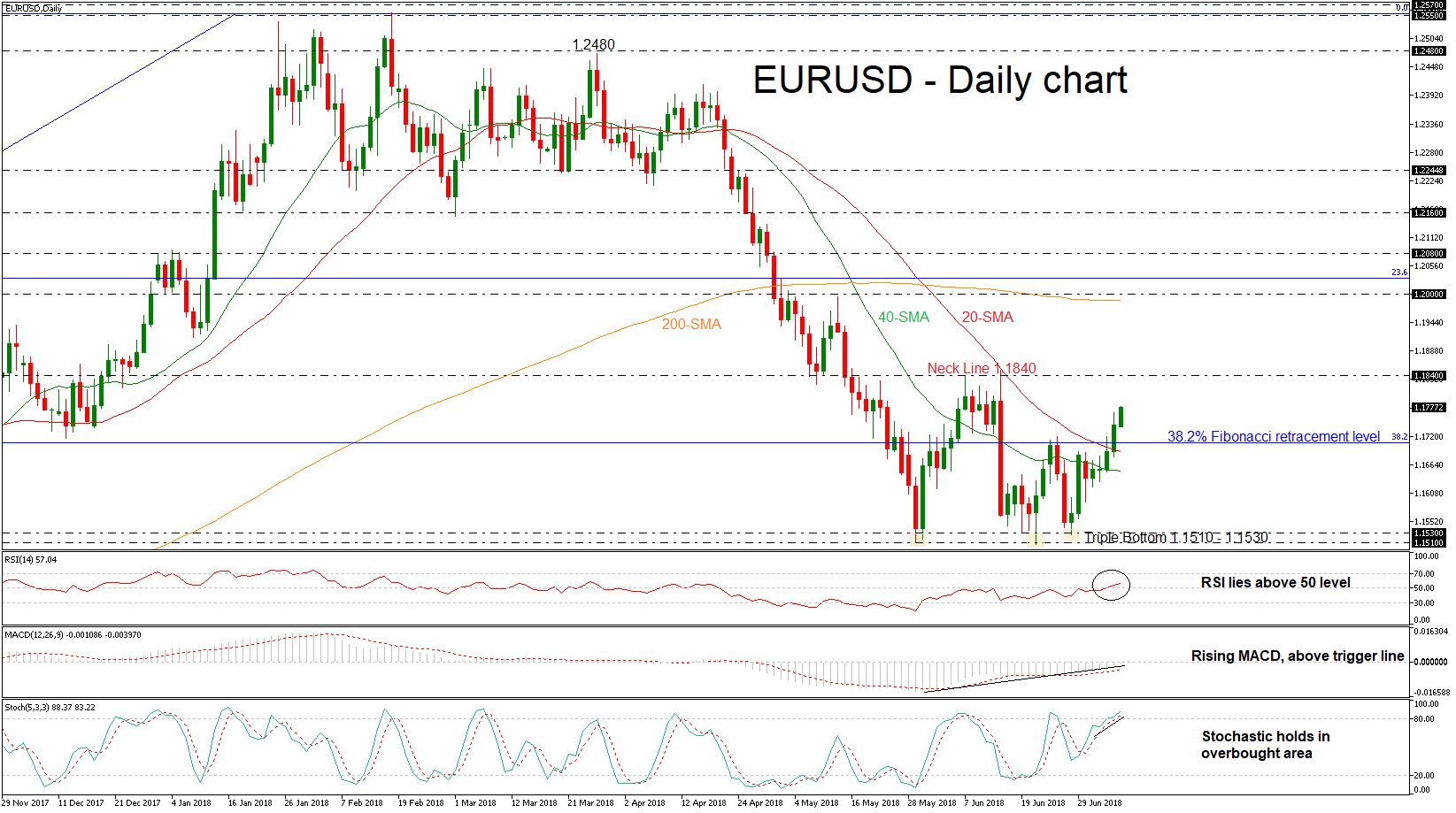

EURUSD has been outperforming over the last three weeks, following the touch on the 1.1510 support level on June 21. Also, during Friday’s session, the common currency successfully surpassed the 38.2% Fibonacci retracement level of the upleg from 1.0340 to 1.2550, around 1.1707. The short-term technical indicators are bullish and point to more strength in the market.

EURUSD has been outperforming over the last three weeks, following the touch on the 1.1510 support level on June 21. Also, during Friday’s session, the common currency successfully surpassed the 38.2% Fibonacci retracement level of the upleg from 1.0340 to 1.2550, around 1.1707. The short-term technical indicators are bullish and point to more strength in the market.

The positive bias in the near term is supported by the deterioration in the momentum indicators. The %K line of the stochastic oscillator has risen sharply into overbought levels. Moreover, the RSI is holding above the 50 level and is moving north, while the MACD oscillator is approaching the bullish territory and lies above its red-trigger line.

In the wake of positive pressures, the market could meet resistance at the 1.1840 barrier, which is the neckline of the triple bottom formation. The significant troughs stand within the 1.1510 – 1.1530 zone. A jump above this key level could challenge the 1.2000 psychological barrier, which stands near the 200-day simple moving average (SMA).

Conversely, a move to the downside, below the 38.2% Fibonacci and the 20- and 40-SMAs could see immediate support at the 1.1510 – 1.1530 area. Further losses could drive the price towards the 50.0% Fibonacci of 1.1450, forcing the continuation of the negative outlook in the medium term.

Overall, the world’s most traded currency has been developing within a reversal pattern (triple bottom). Near-term weakness is expected to remain as long as price action takes place above 1.1530 and below the neckline (1.1840).

Origin: XM