EURUSD remains under pressure and risk is still to the downside as prices continue to drift lower from the 3-year high of 1.2540. In the weekly timeframe, the world’s most traded currency snapped the seven winning sessions and posted a red candle. The short-term technical indicators seem to be in confusion as the price has been moving higher since today’s Asian session.

EURUSD remains under pressure and risk is still to the downside as prices continue to drift lower from the 3-year high of 1.2540. In the weekly timeframe, the world’s most traded currency snapped the seven winning sessions and posted a red candle. The short-term technical indicators seem to be in confusion as the price has been moving higher since today’s Asian session.

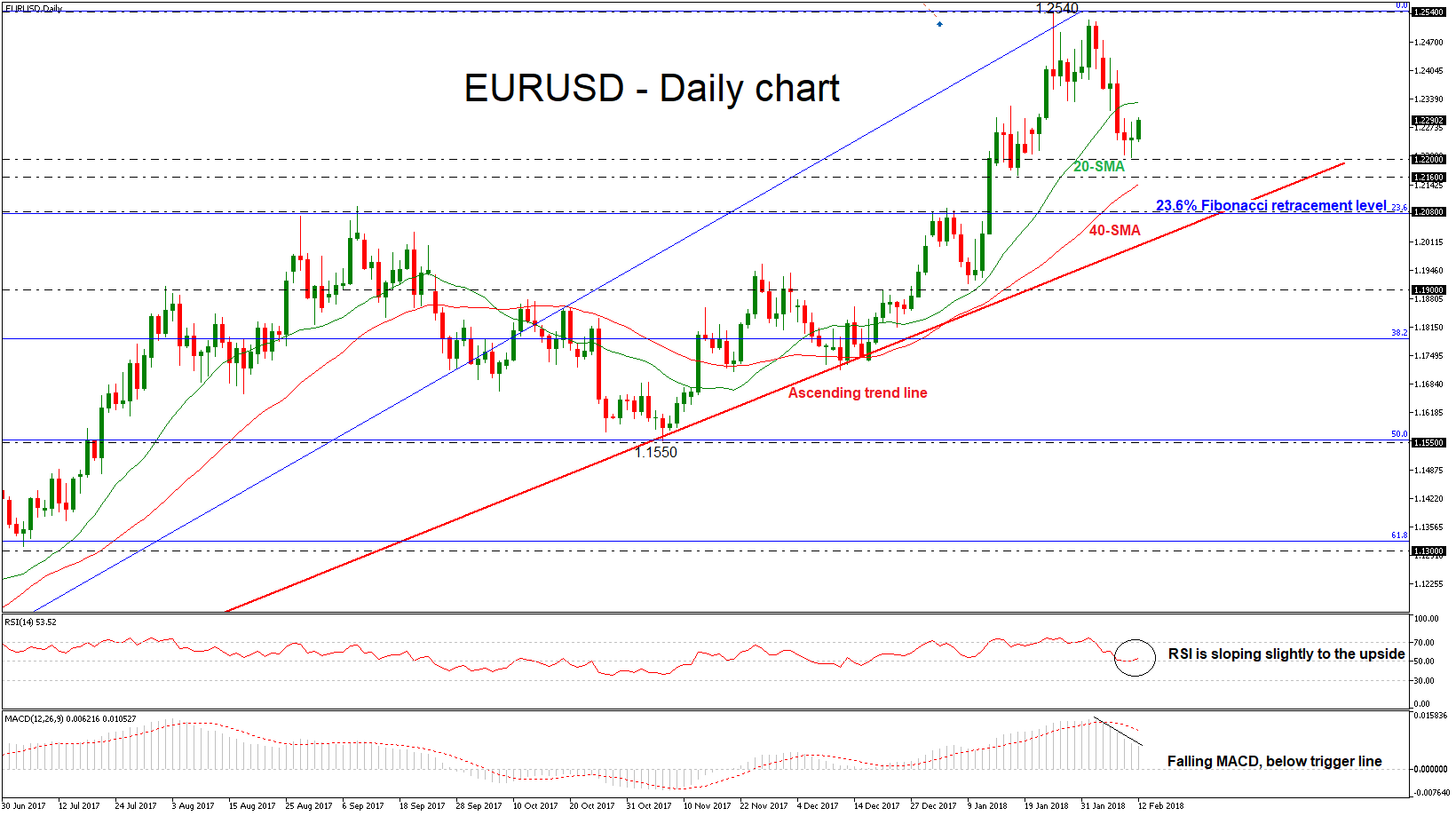

Looking at the daily timeframe, the Relative Strength Index (RSI) is sloping slightly to the upside near the 50 level, whilst the MACD oscillator is falling in the positive territory below its trigger line. As a side note, the price is being capped by the 20-day simple moving average, which is holding around 1.2330 at the time of writing.

If price action remains above the strong psychological level of 1.2200, there is scope to test 1.2540 resistance level. Clearing this key level could see additional gains towards the next immediate resistance of 1.2570. This is considered to be a strong resistance area which has been rejected a few times in the previous years.

If 1.2200 support fails, then the focus would shift to the downside towards the 1.2160 support, which is standing near the 40-day SMA. A drop below the latter level, could open the door for the 1.2080. This level is the 23.6% Fibonacci retracement level of the up-leg from 1.0560 to 1.2540 and thus is an important level, which if breached, would increase downside pressure and bring about a reversal of the trend as the ascending trend line would be penetrated.

Origin: XM