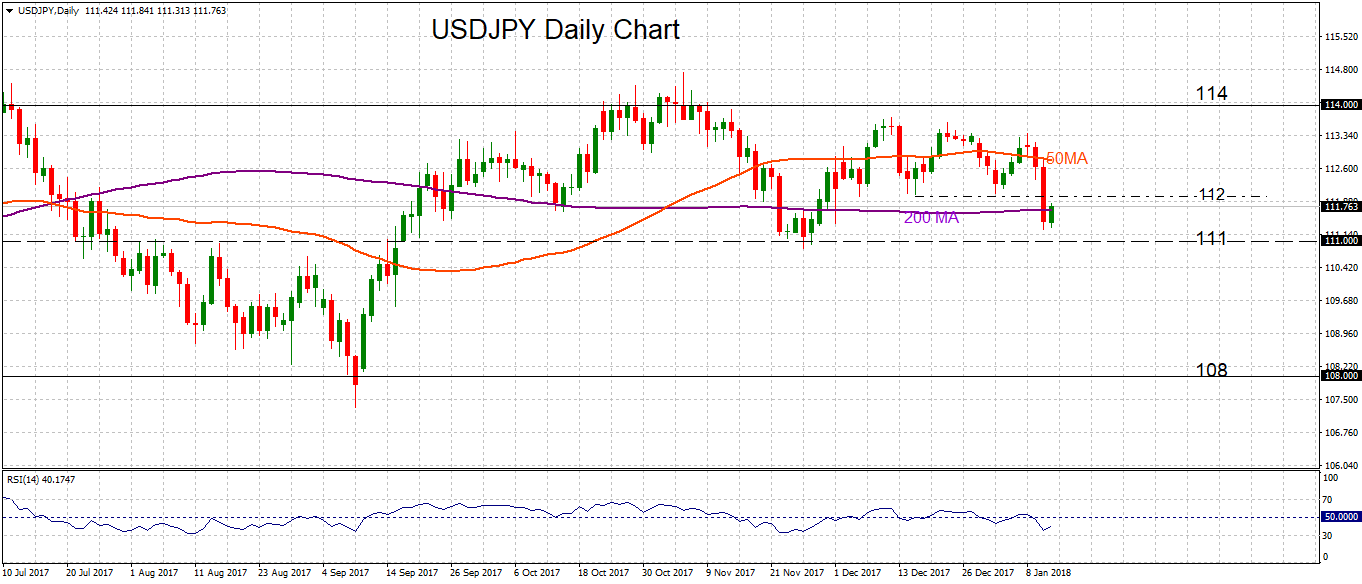

USDJPY has turned more bearish in the near term after the break below the key 112 level and 200-day moving average yesterday to reach its lowest level in six weeks. Momentum is weak and the daily RSI is indicating a bearish bias after dipping below 50. Risk remains skewed to the downside until prices make a sustained move back above 112.

USDJPY has turned more bearish in the near term after the break below the key 112 level and 200-day moving average yesterday to reach its lowest level in six weeks. Momentum is weak and the daily RSI is indicating a bearish bias after dipping below 50. Risk remains skewed to the downside until prices make a sustained move back above 112.

USDJPY is making a modest bounce in early trading today but there is scope for further weakness if there is a rejection at the 112 level, which is now seen as firm resistance. However, further downside may be limited as long as support holds at the key 111 level. A deeper decline would see prices target 108.

Since late September the pair has been trading in a range mostly between 111 and 114. In the bigger picture, the market does not have any clear direction and this lack of trend is indicated by the horizontal 50-day and 200-day moving averages. This could change if USDJPY breaks below 111 in the next few sessions.

Origin: XM