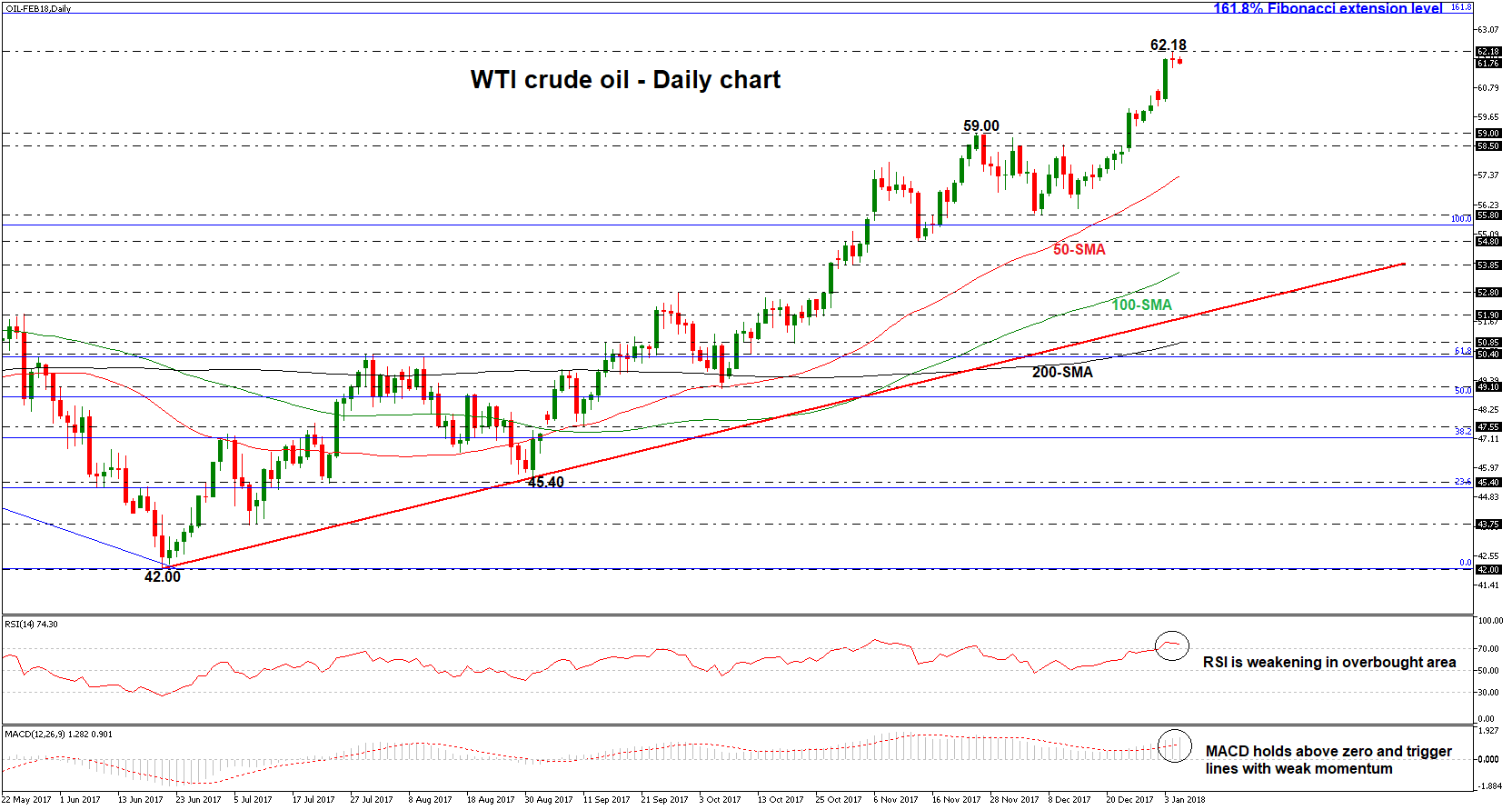

WTI crude oil’s bullish rally was eventually stopped during Thursday’s trading session, near the fresh high of 62.18 resistance level. The price structure in the short to medium-term time frame is higher peaks and higher troughs above the ascending trend line, drawn from the low of June 21.

WTI crude oil’s bullish rally was eventually stopped during Thursday’s trading session, near the fresh high of 62.18 resistance level. The price structure in the short to medium-term time frame is higher peaks and higher troughs above the ascending trend line, drawn from the low of June 21.

If buyers drive oil well above the 62.18 barrier, then the price could experience more upside extension, perhaps towards the 161.8% Fibonacci retracement level, of the last big down-leg move on the weekly chart, with the high at 55.39 and the low at 42.00, near 63.65. Having said that though, as the rally seems to be overextended, the likelihood is for the bears to take charge for a downward correction and push the price lower at 59.00.

The notion of a retracement is also supported by the oscillators in the near-term. The RSI indicator is still holding in the overbought zone; however, it lost its strong upside momentum and is flattening. In addition, the MACD oscillator stands above its trigger and zero lines with a weakening momentum.

It is worth mentioning that even if prices retreat for a while, as long as the market is developing above the uptrend line, the short to medium-term outlook remains to be positive. An expose below the 61.8% Fibonacci mark of 50.40 would hint a trend reversal.

Origin: XM