US equities continued to range bound at their record highs and volume remained low as money managers were away for year-end holiday break.

In Asia, the Shanghai Composite – a gauge of China A share performance – fell 0.95% with blue chips suffering from heavy sell-off. Negative sentiment has spread over to the Hong Kong market, which managed to close marginally higher after resuming trading on Wednesday.

In Singapore, the SGX securities market trading volume was only half of its normal daily average, suggesting lack of trading activities during holiday season. This phenomenon may continue until early next week when most of market participants are back to the trading ground. The Straits Times Index rebounded 13.5 points or 0.4% to 3,391 area due to surging crude oil prices. Its immediate resistance and support level at 3,450 and 3,350 area respectively. Lack of fresh catalyst, the index may continue to sideway within this narrow range in the days to come.

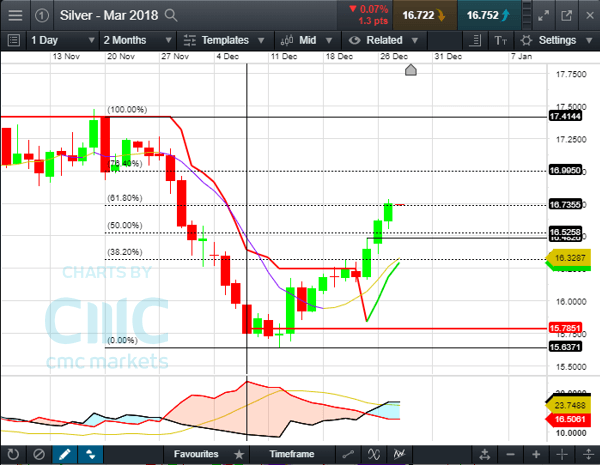

The US dollar index fell against all of its G10 peers to a four-week low of 92.6. EUR/USD is attempting to breakout a key Fibonacci resistance level of 1.190 with upward momentum. Clearing this level will open room for further upsides towards the next resistance at 1.195 area. Soft dollar gave precious metal prices a boost, with gold and silver prices moving to higher highs. Silver price has surged to a key 61.8% Fibonacci retracement level of US $16.7 area and may face some technical resistance here. Gold is riding a smooth uptrend towards the next key resistance level at US$ 1,297 area (38.2% retracement).

Technically, both gold and silver prices are riding their short-term bull trends. The 10-Day SMA and SuperTrend (10.2) have both flipped upwards, indicating the bull side is dominating. Momentum indicator MACD continued to trend up but RSI is approaching overbought zone of 80%. Traders need to monitor the RSI carefully for early sign of correction.

Crude oil prices retraced from two-and-a-half year high as Libya is expected to repair its broken pipelines within a week, and therefore the market impact is significantly lowered. The immediate support and resistance levels for Brent crude oil could be found at US$64.9 and US$68.0 respectively.

Silver – Mar 2018