US equity market resumed trading after the holiday break, but the volume remains low as many money managers and traders are still on vacation. Apple share price dropped 2.5% following a report of tepid iPhone X demand.

US equity market resumed trading after the holiday break, but the volume remains low as many money managers and traders are still on vacation. Apple share price dropped 2.5% following a report of tepid iPhone X demand.

This triggered broad sell-off in the Nasdaq, which closed 0.34% lower on Tuesday. Weakness in the technology sector was partially underpinned by the retail sector, which is expected to boost by a post-Christmas sales bounce.

Precious metal prices advanced further, with gold and silver prices approaching their one-month high at US$1,282 and US$16.60 respectively. Recent volatility in cryptocurrencies and risk-off sentiment in equity markets fuelled the demand for safety. Separately, North Korea’s rejection of UN sanction and hard stands on its nuclear power also led to escalation of geopolitical uncertainty.

Technically, both gold and silver prices are riding their short-term bull trends. The 10-Day SMA and SuperTrend (10.2) have both flipped upwards, indicating the bull side is dominating. Momentum indicator MACD continued to trend up but RSI is approaching overbought zone of 80%. Traders need to monitor the RSI carefully for early sign of correction.

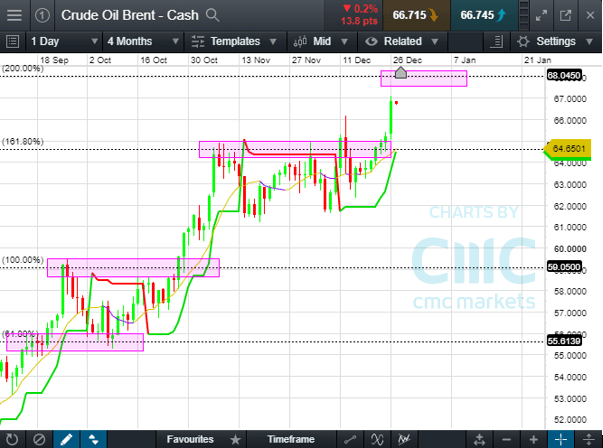

Libya pipeline blast sent crude oil prices to their two-and-half-year high of US$66.7 area. Brent oil has advanced to ‘higher high’ as indicated in the Fibonacci Extension below. Its price has broken out above 161.8% level of $64.4 and the next major resistance could be found at 200% level of 68.0 area.

Singapore’s Straits Times Index fell 0.22% on Tuesday as Keppel’s bribery penalty bill doomed market sentiment especially in the offshore & marine sector. The rebound in oil prices today is likely to alleviate that concern and bring a more positive outlook for this sector.

Crude Oil Brent – Cash