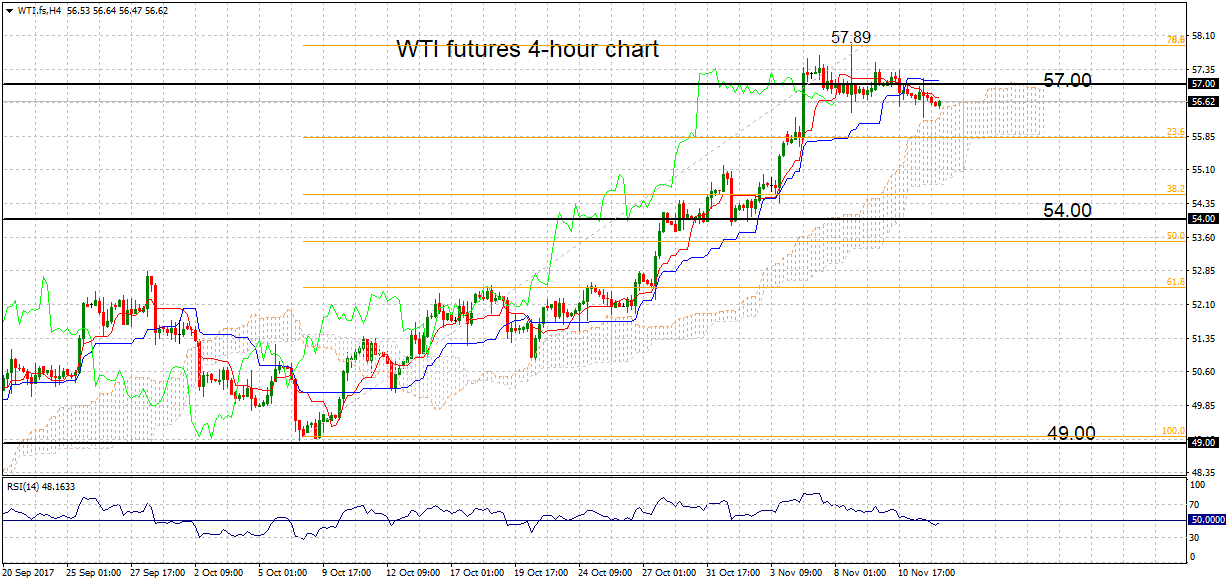

WTI oil futures have paused after a strong rally from 49.07 to 57.89. The market reached overbought levels on the 4-hour chart, as indicated by RSI rising above 70, and consequently, prices corrected lower and fell below the key 57.00 level.

WTI oil futures have paused after a strong rally from 49.07 to 57.89. The market reached overbought levels on the 4-hour chart, as indicated by RSI rising above 70, and consequently, prices corrected lower and fell below the key 57.00 level.

A falling RSI is tilting immediate risk to the downside. A dip in the market would target the 23.6% Fibonacci retracement level (55.81) of the rise from 49.07 to 57.89.

If prices can remain above yesterday’s low of 56.28 during the next few sessions then the risk of a deeper pullback will diminish. Staying above dynamic support provided by the 50-period moving average would help stabilize the market.

The market needs to rise above key resistance at 57.00 to push momentum back to the upside to see a re-test of 57.89 and clearing this would confirm the uptrend. A move back below the 50% Fibonacci (53.47) would end the broader uptrend.

The neutral bias is expected to hold in the near-term and prices are likely to consolidate around the key 57.00 level. Overall, the three moving averages (50, 100 and 200-period) are positively aligned and rising, which is keeping the bigger picture bullish.

Origin: XM