EURUSD maintains a neutral bias in the short term and has not changed much since entering a range two weeks ago. The market is showing signs of stabilization as the sell-off has slowed somewhat over the past couple of weeks.

EURUSD maintains a neutral bias in the short term and has not changed much since entering a range two weeks ago. The market is showing signs of stabilization as the sell-off has slowed somewhat over the past couple of weeks.

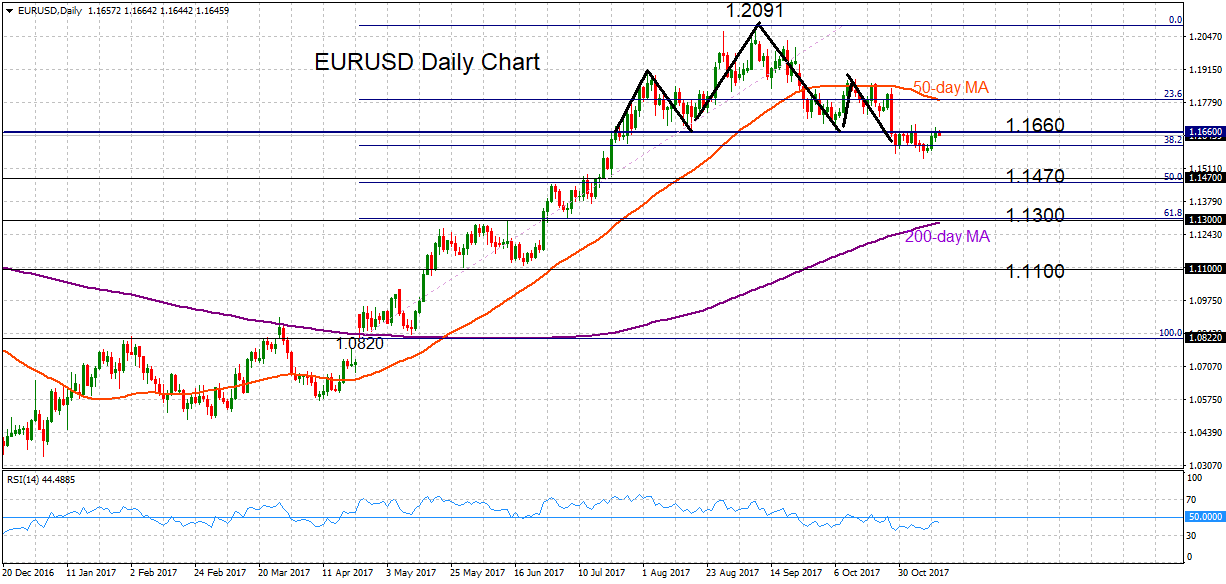

There has been a lack of a trend following a break below the neckline (1.1600) of the head and shoulders pattern on the daily chart. EURUSD did not sustain losses below 1.1553 but has been unable to re-test the range high at 1.1690 that was hit on November 3, resulting in a consolidation phase.

A decisive break above 1.1600 should see EURUSD gain momentum quickly towards the upper 1.1700 area. The 50-day moving average is expected to act as dynamic resistance. Prices would need to rise above 1.1875 in order for the bearish phase from the 1.2091 peak to weaken and to shift the market’s focus back to the upside.

A drop below 1.1553 would increase downside pressure and open the way to 1.1470. This level is roughly the mid-point of the upleg from 1.0820 to 1.2091. A deeper decline would target 1.1300, which is the 61.8% Fibonacci retracement level.

The bias is expected to remain neutral in the short term. This view is supported by the RSI which is lacking clear direction. In the bigger picture, the upside trajectory of EURUSD has lost traction but as long as the market remains above its 200-day MA, a reversal of the longer-term uptrend doesn’t look that likely.

Origin: XM