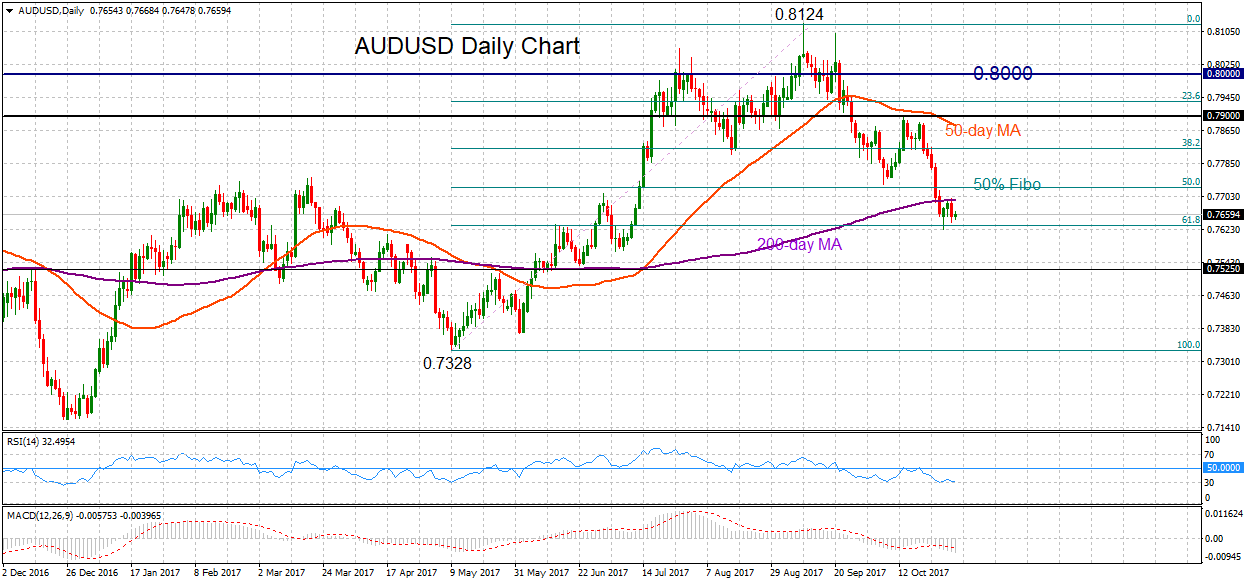

AUDUSD is under pressure below its 200-day moving average. The market has been reversing the May to September uptrend, retracing over half of this move. The drop below the 50% Fibonacci level of the 0.7328 to 0.8124 upleg last week has strengthened the short-term bearish bias.

AUDUSD is under pressure below its 200-day moving average. The market has been reversing the May to September uptrend, retracing over half of this move. The drop below the 50% Fibonacci level of the 0.7328 to 0.8124 upleg last week has strengthened the short-term bearish bias.

The market is now consolidating just above Friday’s low of 0.7624 and near the 61.8% Fibonacci level. This is expected to provide support in the near term, while prices are capped by the 200-day MA at 0.7691. The bounce on Friday failed to break above the 200-day MA resistance and left the AUDUSD pair neutral since the drop below it on October 26.

Downside momentum stalled as seen by RSI reaching oversold levels near 30, pointing to more sideways trading in the near term. A move above the 50% Fibonacci (0.7725) opens up AUDUSD for more gains to 0.7900. Only a rise above this key level would indicate that the short-term bearish phase has ended and increase the odds to break 0.8000 and re-test the 0.8124 peak.

The outlook for AUDUSD remains bearish below the 200-day MA and another leg lower towards 0.7525 and 0.7328 cannot be ruled out.

Origin: XM