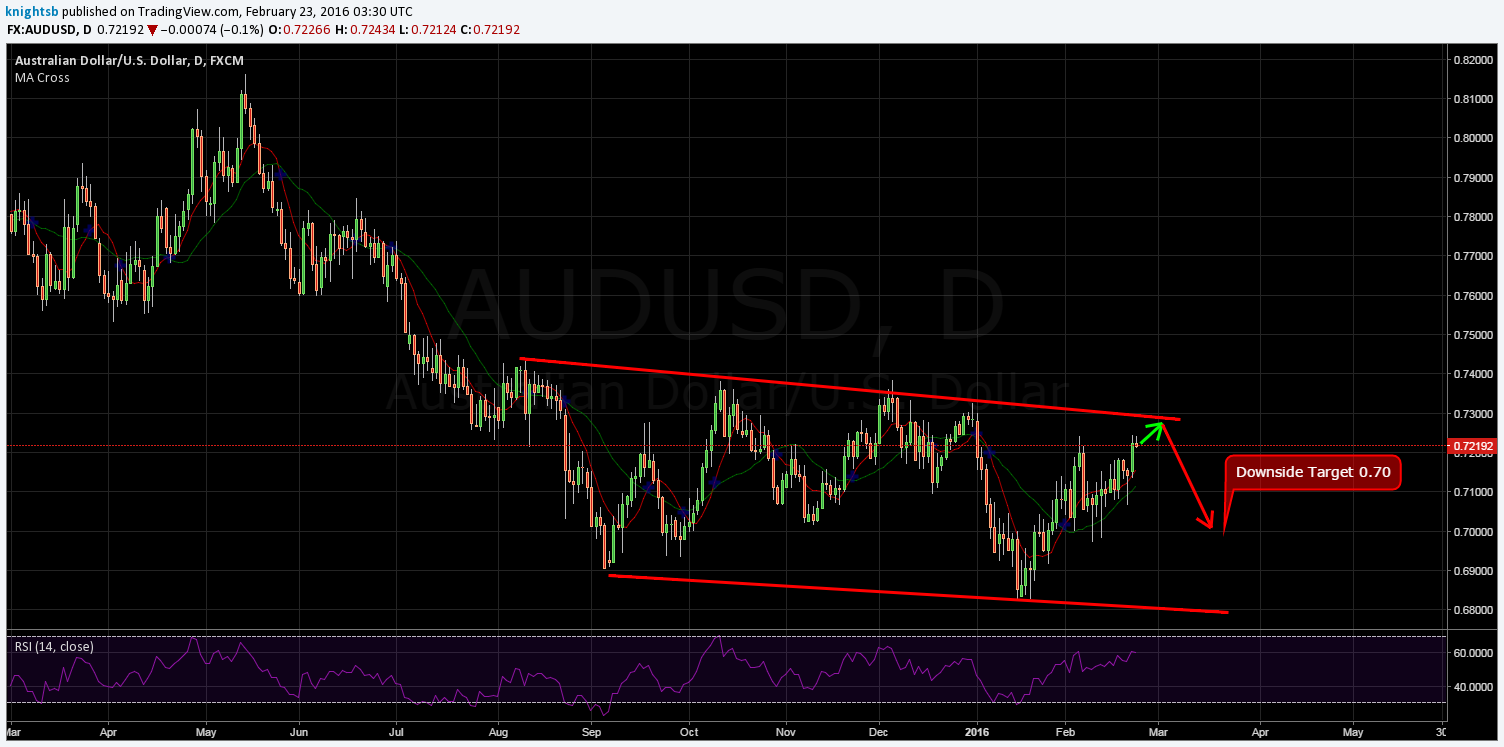

Over the past few weeks the Australian dollar has seen a rollercoaster of reversals as price action has been largely contained within a slowly descending channel. Subsequently, there have been plenty of options for trades as price action bounces between the two extremes. The question remains as price again nears the top of the channel, will we indeed see a breakout or the return to a short play?

Over the past few weeks the Australian dollar has seen a rollercoaster of reversals as price action has been largely contained within a slowly descending channel. Subsequently, there have been plenty of options for trades as price action bounces between the two extremes. The question remains as price again nears the top of the channel, will we indeed see a breakout or the return to a short play?

The week ahead is likely to be interesting for technical traders as the Aussie dollar is providing some signals that suggest a retreat back towards the central tendency is the likely move ahead. Currently, price action is nearing a key level of resistance around the top of the channel at 0.7250. In addition, the RSI oscillator, although still trending strongly higher, is now nearing the over-bought area.

Subsequently, if price again fails to breach the top of the channel at 0.7295, a sharp correction back towards the 70-cent handle is highly likely. Although price currently remains above the 100-Day MA, the moving average has provided little in the way of support over the past six months and any subsequent retracement will therefore be swift.

Chart AUD/USD

In addition, the fundamental stability of the Australian economy is certainly up for debate considering the current slump in global commodity prices. China’s current sliding domestic demand has been largely to blame for the price rout given Australia’s reliance upon the export revenues for GDP growth. Subsequently, the next two weeks will likely be relatively negative for the Australian dollar given the pending Chinese Manufacturing PMI figures. The fundamental view subsequently supports the technical view of a significant pull back from the 0.7250 mark.

Ultimately, regardless of your current bias, the upside potential for the AUD is relatively limited given the general bullish sentiment of the USD. Subsequently, look for the pair to stage a small rally towards the 0.7250 mark before pulling back towards the 70-cent handle over the week ahead. Stops should be set above the current channel located at 0.7295.

Origin: Investing.com