Here are the latest developments in global markets:

Here are the latest developments in global markets:

FOREX: The US dollar index – which measures the greenback’s performance against a basket of six major currencies – is down by 0.12% on Tuesday, extending losses from the previous session. Sterling spiked higher once again, following encouraging comments from the EU’s chief Brexit negotiator that reaching a deal within 6-8 weeks is “realistic”. Meanwhile, the yen was on the retreat amid a recovery in risk sentiment, though that may not necessarily remain the case in an environment where trade tensions may escalate at any moment.

STOCKS: Wall Street closed mostly higher on Monday, with the Nasdaq Composite (+0.27%) and S&P 500 (+0.19%) managing to post some modest gains even despite market leaders like Apple underperforming (-1.34%). Meanwhile, the Dow Jones (-0.23%) was dragged lower by insurance firms UnitedHealth (-3.19%) and Travelers (-1.88%), which in turn were sold on worries around the potentially devastating impact of Hurricane Florence. Risk appetite seems to have lingered overall though, as futures tracking the Dow, S&P, and Nasdaq 100 are all pointing to a slightly higher open today. Asia was mixed on Tuesday. Whereas Japanese indices like the Nikkei 225 (+1.30%) and the Topix (+0.67%) advanced amid a softer yen brightening the outlook for exporters, the Hang Seng in Hong Kong fell by 0.39%. In Europe, all the major indices are set for a higher open today according to futures, besides the UK FTSE 100.

COMMODITIES: Oil prices traded higher on Tuesday, albeit only modestly so. WTI gained a mere 0.10% to touch $67.72 per barrel, while Brent crude gained 0.34% to trade at $77.81/barrel. The precious liquid may have been supported somewhat by remarks from Russia’s Energy Minister Alexander Novak that OPEC and other allied producers may sign a new long-term cooperation deal in December. In precious metals, dollar-denominated gold is up fractionally on Tuesday (+0.06%), continuing to trade in a very narrow range and showing little interest in any global developments besides movements in the US dollar.

The British pound surged once again on Monday, after the EU’s Michel Barnier said it’s “realistic” to expect a Brexit deal within the next 6-8 weeks. While in reality there was little new in his remarks – both sides have long aimed for a deal by October/November – Barnier’s conciliatory tone nevertheless played into the narrative that an accord may be inching closer, triggering a further unwinding of short bets on sterling. For an agreement to truly become feasible though, one of the two sides would need to present a new proposal for solving the Irish border issue, the main sticking point left. In terms of dates, reports suggest the EU will announce a special Brexit summit on November 13, implying that the weeks leading up to that period will likely be when a deal is wrapped up – if at all.

Euro/dollar interestingly rose after Barnier, as investors scaled back more of their prior sterling/dollar short positions and fewer of their long euro/sterling bets, implicitly signaling a preference towards the euro amid cheerful Brexit headlines. The same occurred back on August 29 when Barnier said the EU is prepared to offer a special partnership to Britain. Against this backdrop, further positive Brexit news in the coming weeks likely pose an upside risk for euro/dollar as well, and not just the pound.

Elsewhere, the Japanese yen underperformed on Monday and is also trading lower across the board on Tuesday, as a modest recovery in broader risk appetite curbed demand for the safe-haven currency. That being said, in the current environment where investors are holding their breath to see whether the US and China will actually exchange another salvo of tariffs soon, it may be premature to conclude that the selling interest on the yen will persist. In other words, any further escalation in trade tensions – which may happen at any moment and without much warning – could see funds rapidly rotated back into the Japanese currency.

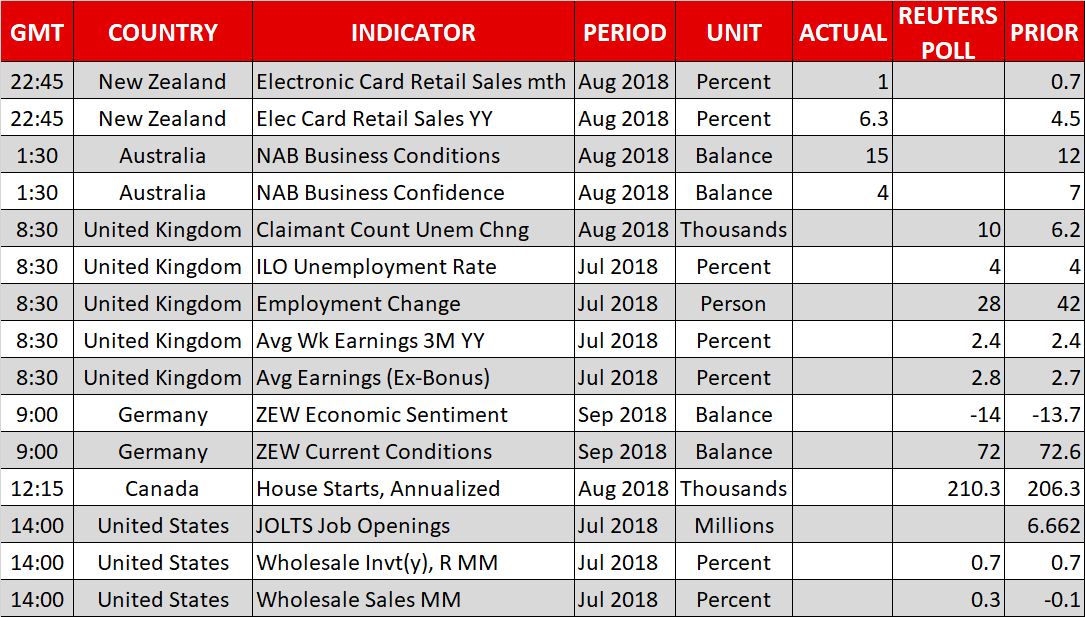

Tuesday’s releases include jobs data out of the UK, investor morale surveys out of Germany and job openings numbers out of the US. Any headlines on global trade and Brexit will also be monitored.

On trade, investor angst remains in the background, especially after President Trump’s threats to push forward with fresh tariffs on China.

On the data front, July’s employment figures out of the UK will be made public at 0830 GMT, with August’s unemployment claimant count also due at the same time. The nation’s unemployment rate is projected to have remained unchanged at the multi-decade low of 4.0% in July. Turning to wage growth, average weekly earnings (three-month average) are forecast to have grown by 2.4% y/y, the same as in June, while the measure of earnings that excludes bonuses is predicted to stand at 2.8% y/y, above June’s 2.7%. Wage inflation is important as it can stoke broader inflationary pressures, as well as boost the economy; ceteris paribus, higher wages translate into greater household spending power.

The labor market data can provide some near-term direction to sterling pairs, though again any Brexit headlines are anticipated to be the main driving force behind the currency’s movement.

ZEW’s surveys gauging investor sentiment in Germany, the eurozone’s largest economy, are due at 0900 GMT. Both the economic sentiment and current conditions indices are expected to deteriorate a bit in September relative to July; at 72.0, the latter is predicted to touch its lowest since December 2016. Trump’s tariff threats have been keeping German investors on edge.

Canadian housing stars for August will be released at 1215 GMT, though yet again the main driver for potential movements in the loonie are expected to be any updates on deliberations for a new North American trade deal taking place today.

JOLTS job openings data for July out of the US are slated for release at 1400 GMT. The measure has remained at robust levels so far in 2018, hitting an all-time high earlier in the year. Meanwhile, the numbers on July’s wholesale inventories will be released at the same time.

British Finance Minister Philip Hammond and his junior ministers will be taking part in a Q&A session in the UK parliament at 1030 GMT. Riksbank Governor Ingves will be discussing the Swedish central bank’s current monetary policy at 1245 GMT. Meanwhile, a meeting between Russian President Vladimir Putin and his Chinese counterpart Xi Jinping is of interest.

In geopolitics, any updates on North Korea’s Kim Jong-un requesting a new meeting with Trump will be closely watched.

In energy markets, weekly API data on US crude stocks are due at 2030 GMT.

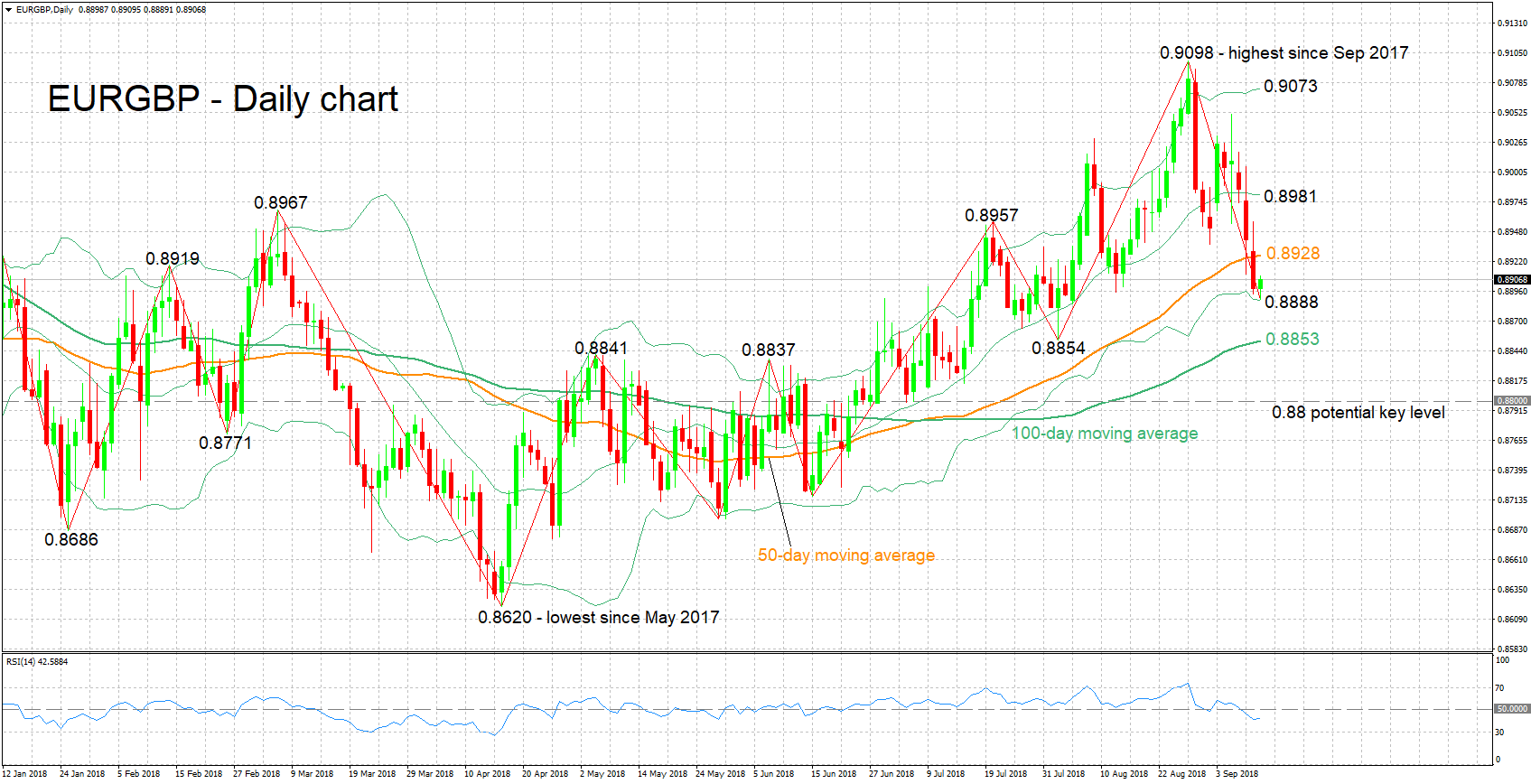

EURGBP has lost around 200 pips after rising to its highest since September 2017 in late August. Earlier in the day, it hit a one-month low of 0.8889. The RSI has been declining overall in recent days in support of a bearish short-term picture. However, it seems to be attempting a move higher at the moment; this may be an early sign of changing momentum.

Strong UK employment numbers, especially on earnings growth, or further indications for a UK-EU deal on Brexit are expected to push the pair further down. Immediate support seems to be taking place around the lower Bollinger band at 0.8888, including the earlier touched bottom of 0.8889. Not far below lies the current level of the 100-day moving average at 0.8853, while additional support in case of steeper declines may come around 0.88; the zone around this was congested between late April and late June.

Disappointing UK data or negative Brexit-momentum are likely to boost the pair. Resistance could occur around the 50-day MA at 0.8928. Not far above is the middle Bollinger line – a 20-day moving average line – at 0.8981 (the 0.90 round figure is part of the area around this), while stronger gains would bring the upper Bollinger band at 0.9073 into scope.

Origin: XM