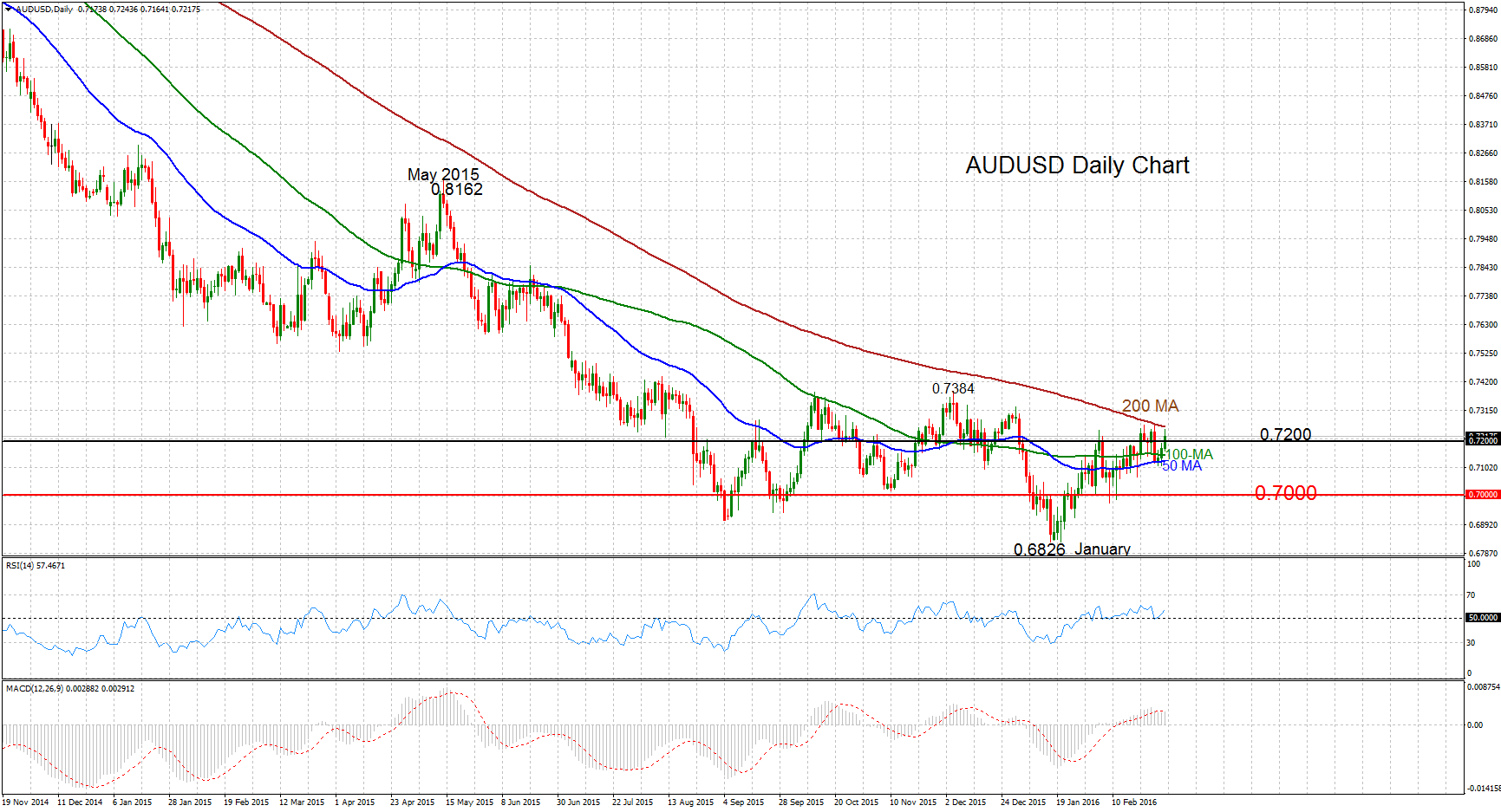

AUDUSD retains a neutral long term outlook as the pair pivots around the key 0.7200 level. After declining sharply from the May 2015 high of 0.8162, the market has stalled and traded sideways since September. The range is defined by the January low of 0.6826 and the December high of 0.7384. The 50 and 100-day moving averages have levelled off which also highlights the lack of direction in the market for now.

Looking at the short term, AUDUSD staged quite a rally from 0.6826 to rise above 0.7200. MACD indicated this bullish momentum as it has risen above zero. RSI is in bullish territory above 50 although the momentum is not strong. Resistance lies at the 200-day moving average around 0.7255 while immediate support is provided by the 50 MA at 0.7127.

Only a decisive break above the top of the range at 0.7384 would shift the outlook from neutral to more bullish. Alternatively a break below 0.6826 would bring a resumption of the downleg from May.

Source: XM Broker